Copper miners

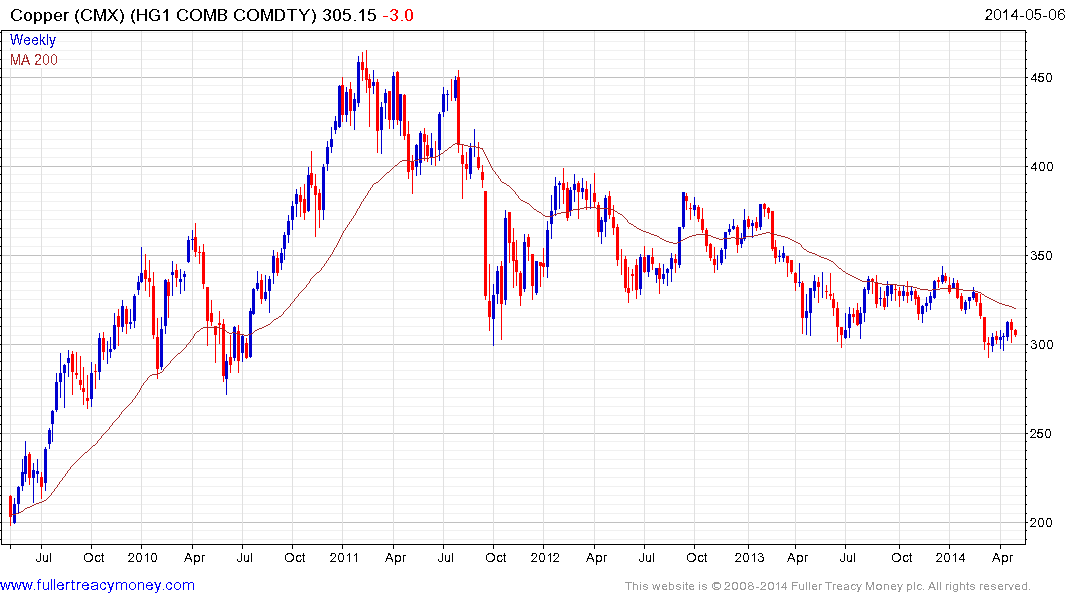

Despite the fact that copper prices have been dribbling lower for nearly three years they are still more than 200% above their 2009 lows. This is a significant position of relative strength versus the other industrial metals and speaks to the tightness of the copper market. Prices failed to sustain the March drop to new lows and a break in the short-term progression of higher reaction lows would be required to question potential for additional higher to lateral ranging.

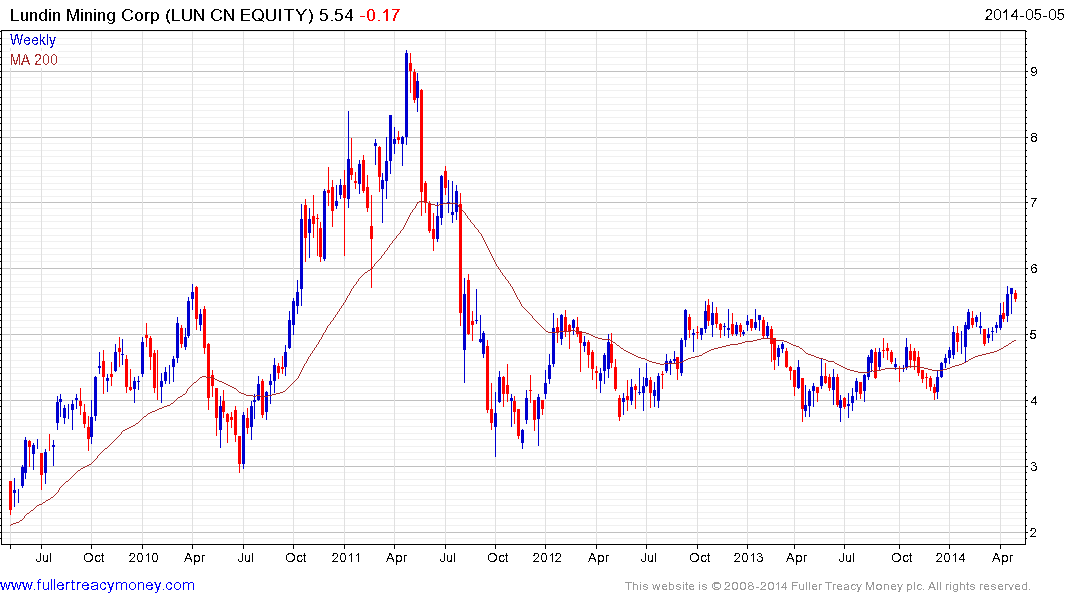

Copper miners have for the most part retested their range lows over the last couple of months. The most common chart pattern is Type-3 base formation development and some that may be beginning to bottom. We do yet have evidence of base formation completion for the majority of shares but they are worth watching for signs of increased investor interest nonetheless.

Canadian Lundin Mining (Est P/E 22.9, DY N/A) produces copper (54.7%), zinc (21.7%), nickel (10.6%) and lead (8.6%). The share moved to a new three-year high last week and while somewhat overbought in the short term, a sustained move below C$5 would be required to question medium-term scope for additional upside.