Tesco Sales Decline Most in Two Decades as Plight Worsens

This article by Gabi Thesing for Bloomberg may be of interest to subscribers. Here is a section:

Kantar’s figures also showed that budget chains Aldi and Lidl are continuing to gain at expense of the traditional U.K. supermarkets. Wal-Mart Stores Inc.’s Asda was the only one of the country’s four main grocers to boost sales in the 12-week period, with J Sainsbury Plc and Wm Morrison Supermarkets Plc both losing revenue and market share, Kantar said.

?Aldi’s sales surged 29 percent in the 12-week period, with Lidl revenue gaining 18 percent. The two discounters command a combined 8.3 percent share of the market, up from 6.7 percent a year ago. More than half of all British households now shop at the budget stores, the researcher said last month.

Sainsbury’s 12-week sales fell 1.8 percent, worse than Morrison’s 1.3 percent decline, Kantar said. Sainsbury is due to report second-quarter sales Oct. 1. The shares fell as much as 4.2 percent to 267.1 pence, the lowest since September 2011.

The entry of no frills discount supermarkets that concentrate on their in-house brands has shaken up the grocery sector in the UK and Ireland over the last decade. Privately owned Aldi and Lidl in particular are responsible for this transition and the credit crisis could not have happened at a better time for them. Wal-Mart’s ASDA has also benefitted for many of the same reasons. Consumers are inherently conservative but the prospect of saving upwards of 30% on a weekly shopping trip, often for better quality fruit and veg, has meant that slow to evolve chains have given up market share.

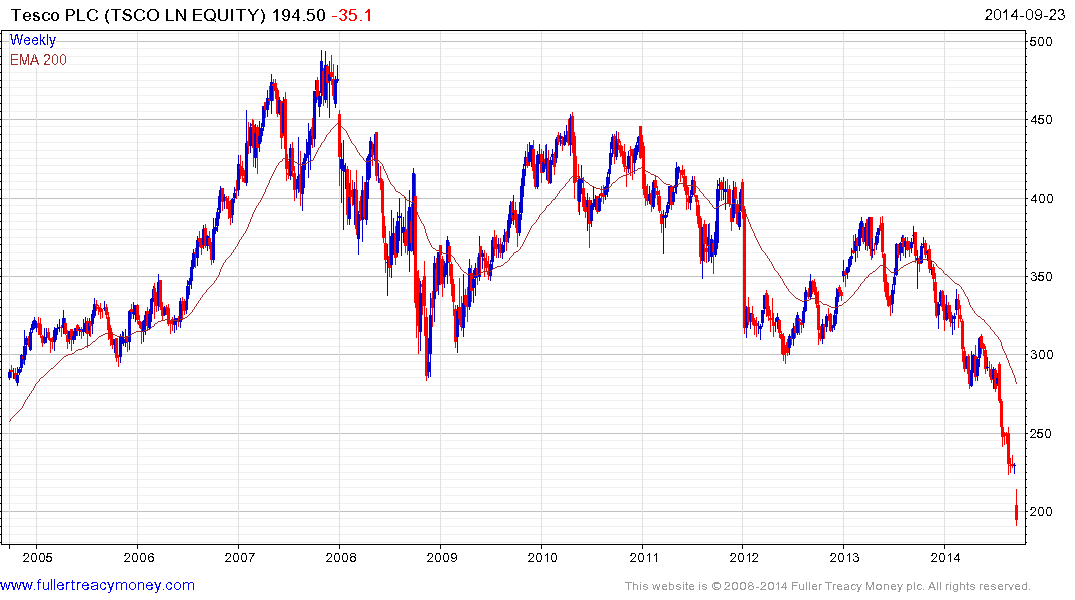

Despite its high profile foreign expansion, the UK still represents 67.7% of revenues for Tesco (Est P/E 10.57, DY 6.45%), down from 80% in 2005. The share has halved in little more than a year and while the company’s dominance of the UK market is being shaken, it is now trading on a Price/Book of 1.07 suggesting a great deal of bad news is already in the price. A deep oversold condition is now evident but a clear upward dynamic will be required to pressure shorts and to trigger stops.

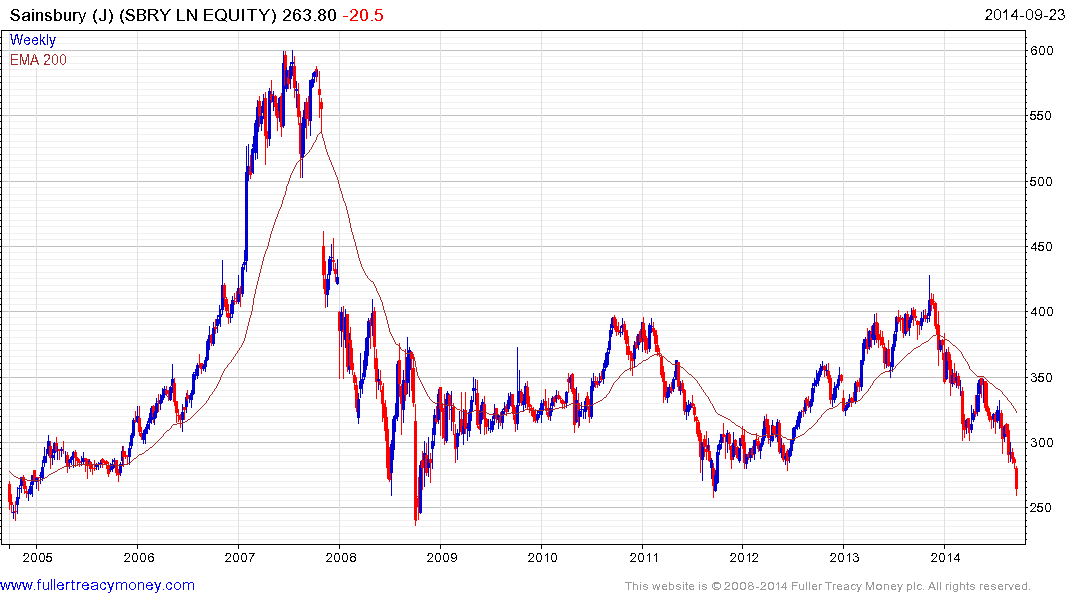

Sainsbury (Est P/E 9, DY 7.29% P/B 0.84) has returned to test the region of the 2011 and 2008 lows following a clear acceleration over the last month. The 250p area represents a potential area of support but a clear upward dynamic will be required to check downward momentum.

Morrison’s (Est P/E 14.2, DY 8.39% P/B 0.87) found at least short-term support in the region of 160p from August and will need to hold that level on the current pullback if medium-term potential for additional mean reversion is to remain credible.

Ocado (Est P/E 148.21, DY N/A. P/B 7.62) in partnership with Morrison’s and Waitrose operates an online store for non-perishables. The share accelerated to its February peak near 600p before experiencing a sharp reversal. It has encountered resistance in the region of the 200-day MA twice since June and a sustained move above the trend mean, currently near 360p will be required to question medium-term supply dominance.

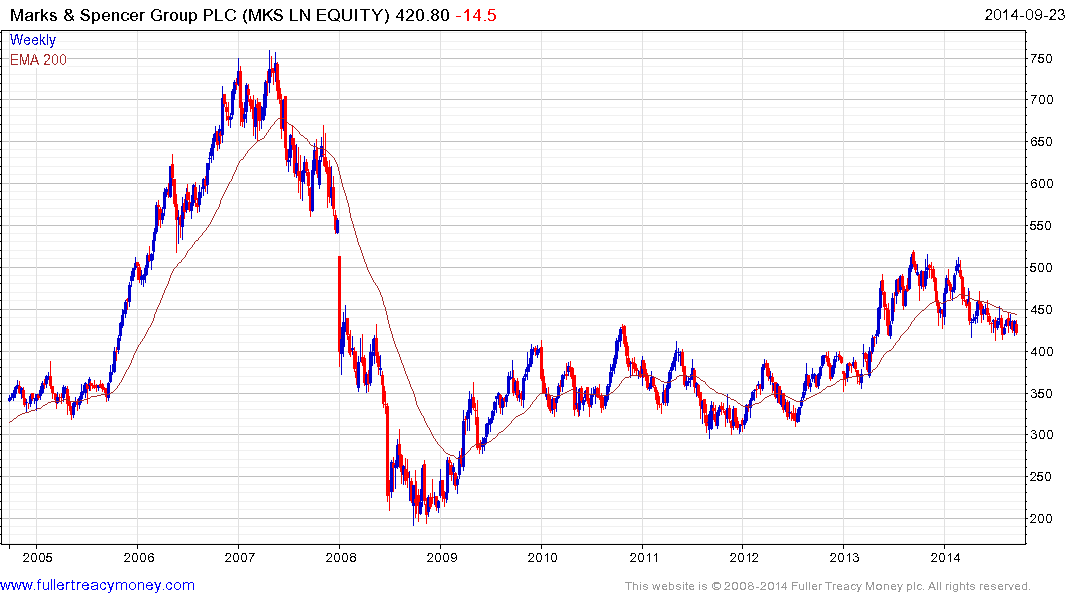

By concentrating on the shopping experience rather than price, Marks & Spencer (Est P/E 12.6, DY 4.49%, P/B 2.54) has been spared the accelerated declines experienced by the above retailers. The share has returned to test the upper side of the 2009-2013 range and a sustained move below that level would be required to question medium-term scope for additional higher to lateral ranging.

.png)

The downward accelerations in a number of the above shares reminds me of the plight Home Retail Group experienced in 2012 when its Argos and Homebase stores were under pressure. Since then a new management team have successfully implemented a rationalisation and the share tripled from its lows before losing consistency recently.

With a new CEO and discounters encroaching on its market share what is to stop Tesco or one of the other larger retailers from making a more concerted push into online retail where their mature supply chains would represent an advantage as well as appealing to price conscious people by improving its own brand offerings?

Back to top