China economic restructuring cuts demand for iron ore

This article quoting Fortescue Metals may be of interest to subscribers. Here is a section:

Power said that while a slump in iron ore prices has pushed out some high-cost producers from the market, supply was "not being cut back fast enough to reduce the overhang in the market".

"The response by high-cost producers ... has been much slower than certainly what I thought and what most in the industry thought," he said.

"But inevitably that needs to happen ... so the iron ore price will be low for long enough for that supply to exit the market. That's an economic reality."

While stockpiles at China's ports remain high, Power said steel mills were running with relatively low stockpiles.

Power said Fortescue's delivered cost into China is less than $50 a tonne.

?"Our focus is on making sure that our production is as efficient and low cost as possible," he said.

The iron-ore oligarchy of Vale, BHP Billiton and Rio Tinto have been boosting supply even as prices have been declining. You don’t do that if you wish to sustain high prices. Rather they are attempting to drive high cost producers out of business in an effort to maintain market share and future pricing power.

Iron ore prices dropped below $80 yesterday for the first time since 2009 and a break in this year’s progression of lower rally highs will be required to signal a return to demand dominance beyond potential for some short term steadying.

Vale (Est P/E 7.33, DY 7.17%) broke down from a yearlong range yesterday to extend its medium-term decline. Following nine consecutive weeks to the downside a short-term oversold condition is evident but a clear upward dynamic will be required to pressure shorts and signal a reversionary rally is underway.

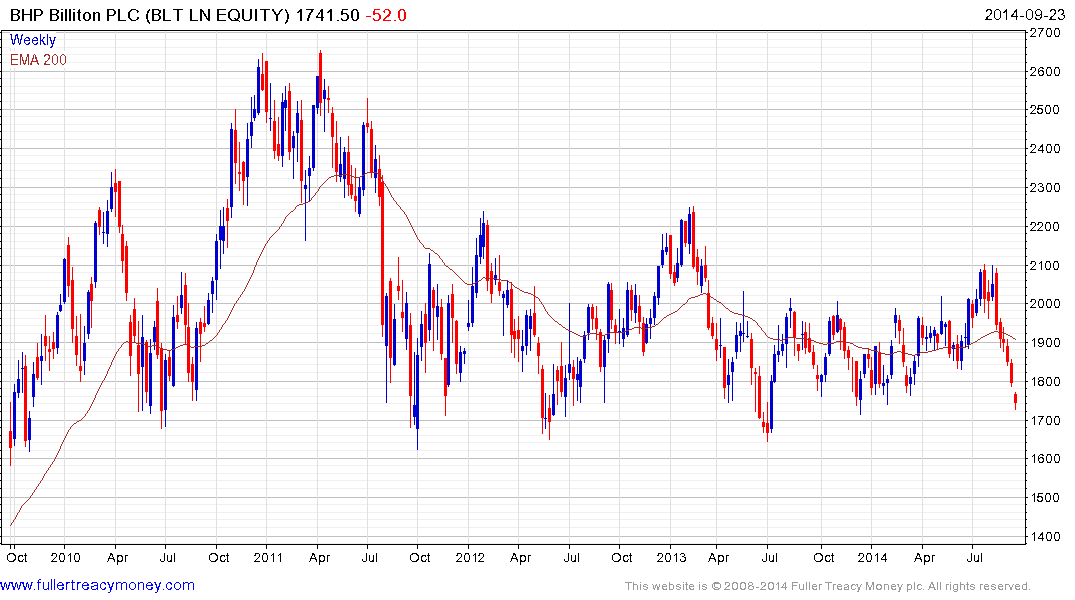

BHP Billiton (Est P/E 11.70, DY 4.65%) has fallen for six consecutive weeks and is now testing the lower side of a three-year range.

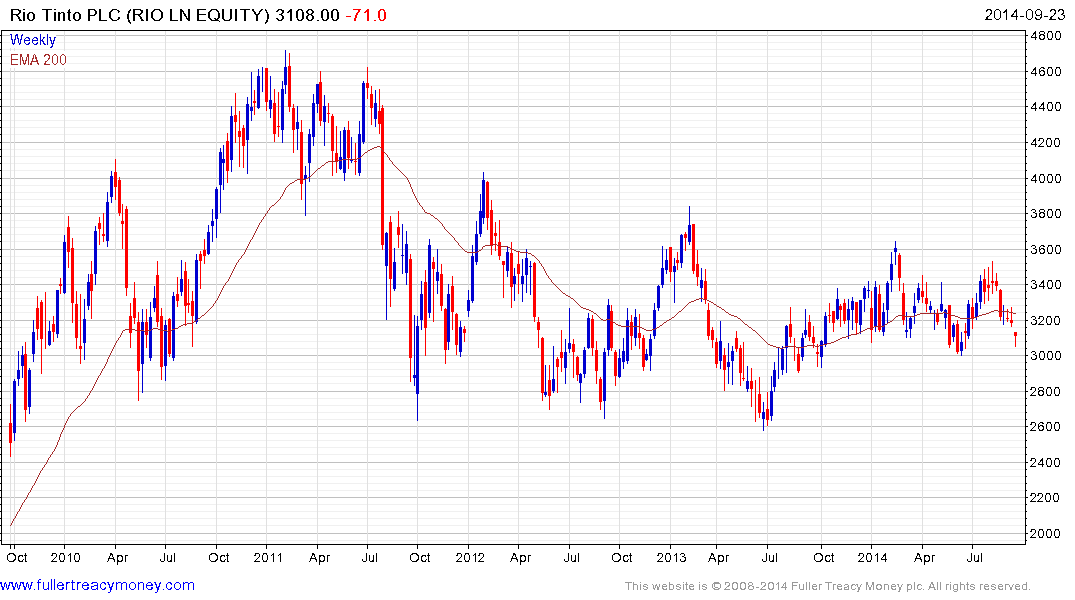

Rio Tinto (Est P/E 9.71, DY 4.39%) has fallen less than the others and is currently trading in the region of the June lows near 300p. It will need to at least hold that level if its relative outperformance is to be sustained.

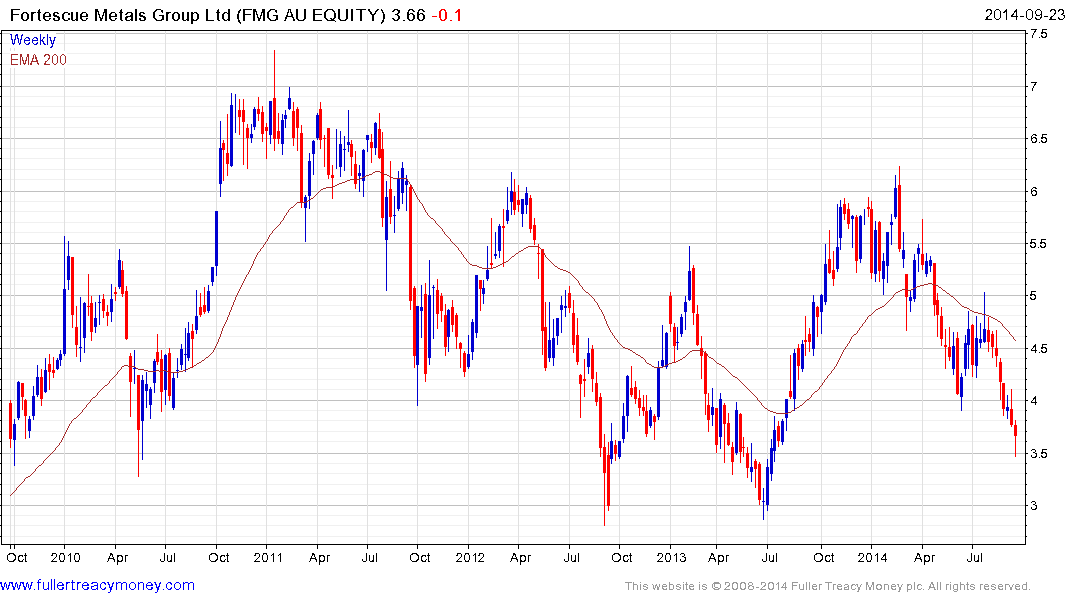

Fortescue Metals (Est P/E 5.86, DY 7.81%) found at least short-term support today in the region of A$3.50. Some upside follow through tomorrow would increase potential for a reversionary rally back up towards the mean.

Back to top