Tech's Big Day Tarnished as Microsoft, Google, TI Disappoint

This article from Bloomberg may be of interest to subscribers. Here is a section:

The demand outlook was particularly dire in the semiconductor industry, which had been one of the hottest sectors during the pandemic. Texas Instruments, whose chips go into everything from home appliances to missiles, saw shares tumble after its weak forecast signaled that the chip slump is spreading beyond computing and phones into other businesses. The stock lost 5%, while Analog Devices Inc., ON Semiconductor Corp., and Marvell Technology Inc. also dipped.

South Korean chipmaker SK Hynix Inc. reported a 60% decline in profit and said it would cut capital expenditures by more than half. It warned of “an unprecedented deterioration in market conditions.” Hynix is joining fellow memory makers Micron Technology Inc. and Kioxia Holdings Corp. in slashing production plans as chip prices tumble.

The silver lining for investors is that the eventual pullback in supply may ultimately prove beneficial for profits -- and stock prices. Hynix shares, which have lost 28% this year, were up as much as 2.1%. Samsung Electronics Co. climbed 3%, while Taiwan Semiconductor Manufacturing Co. added 1.4%.

“Inventory will decrease accordingly and demand will rise again,” said Greg Roh, head of technology research at HMC Investment & Securities.

At the NAAIM conference yesterday the manager of a commodity ETF quoted the statistic that there have been more backwardations in commodities this year than ever before. The point I think most people are missing is the monetary and fiscal response boosted demand for everything. New homes, stocks, bonds, commodities, semiconductors, toilet paper and a host of other products saw demand balloon between April 2020 and early 2022.

It was very tempting to think the pandemic ushered in a new era of permanently higher demand. It’s just not true. It much more likely that the liquidity fuelled demand pulled forward earnings from years in the future, much like the Y2K mania did in the late 1990s.

Some companies are limiting their commitments to massive capital expenditure in the semiconductor sector but ASML posted another record quarter for pre-sales. That suggests national security concerns trump profit potential at present. The outlook still points to a swell of new supply hitting the market from 2024 onwards. ASML is unwinding its oversold condition relative to the 200-day MA but will need to sustain a move above it to confirm a return to medium-term demand dominance.

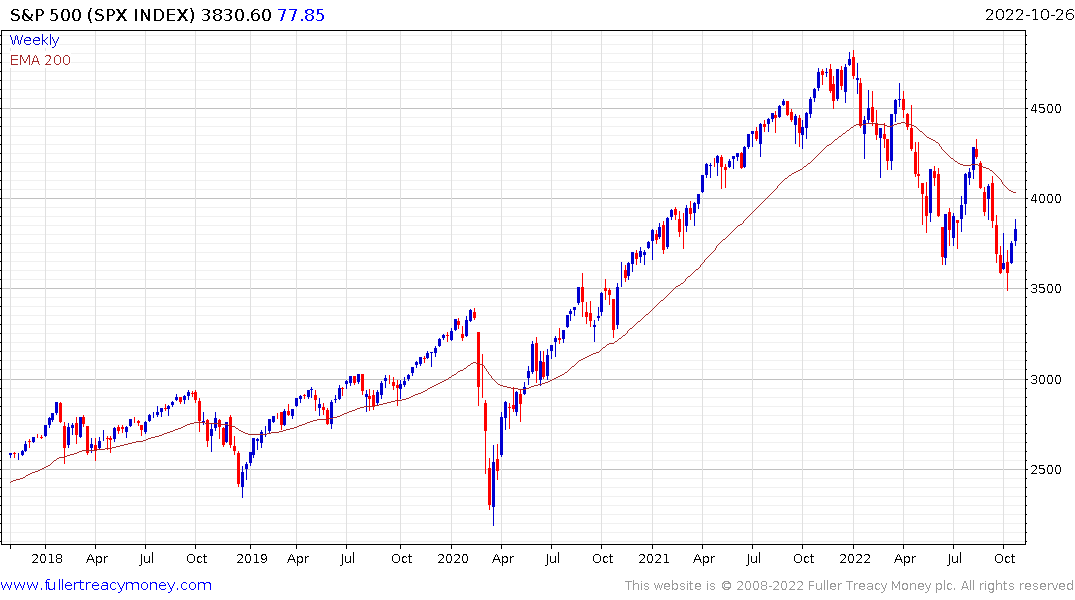

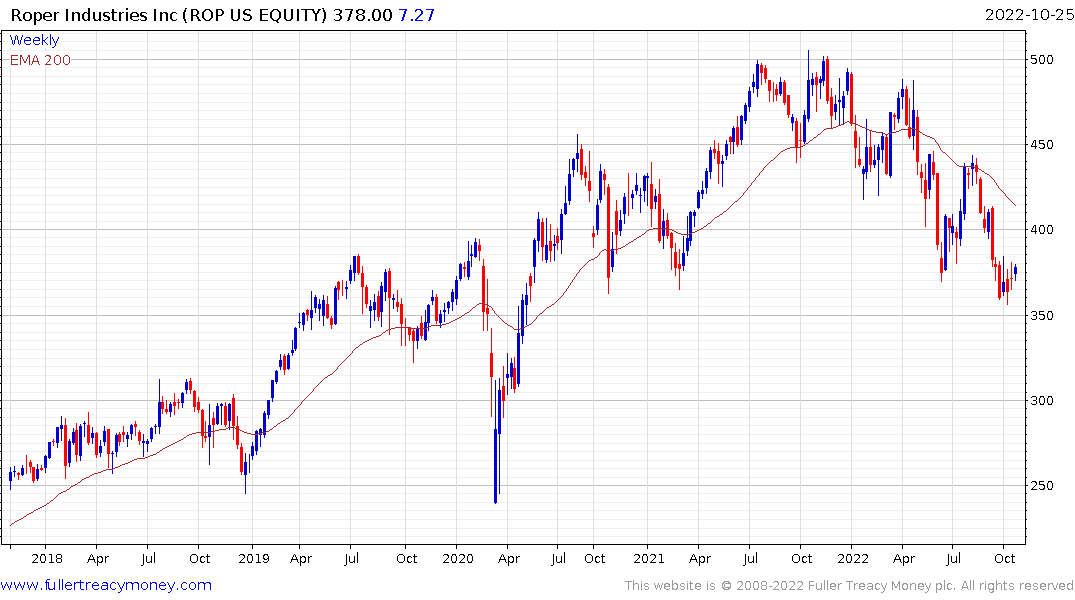

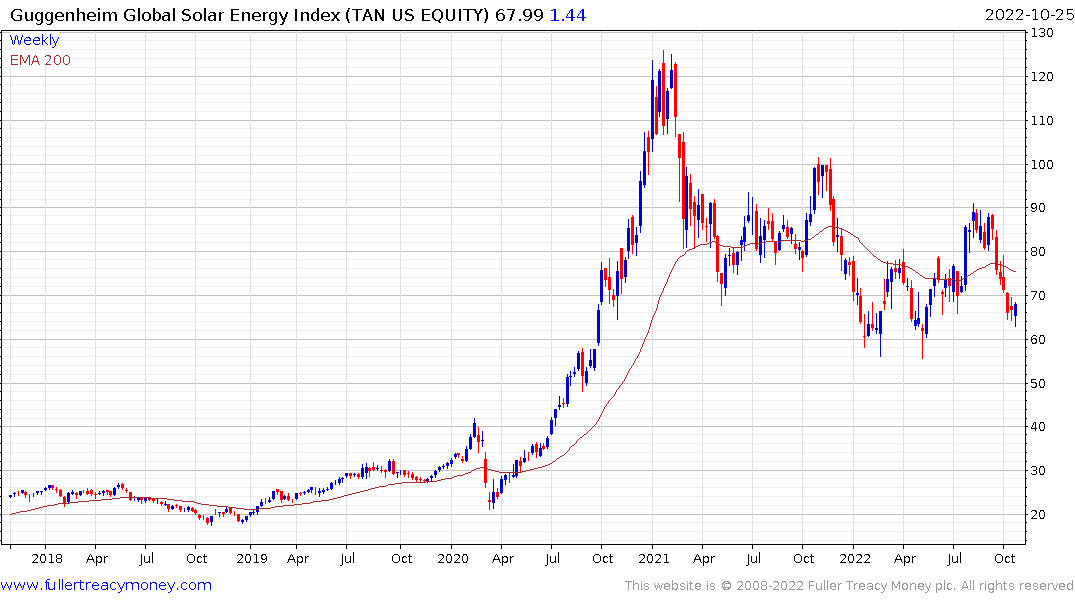

The S&P500 continues to unwind the short-term overextension relative to the 200-day MA. However, there is evidence of a change of leadership. High dividend growth companies like Roper Technologies and Visa are rebounding emphatically. The Solar ETF is in the process of posting an upside weekly key reversal led by inverter manufacturers like SolarEdge.

The S&P500 continues to unwind the short-term overextension relative to the 200-day MA. However, there is evidence of a change of leadership. High dividend growth companies like Roper Technologies and Visa are rebounding emphatically. The Solar ETF is in the process of posting an upside weekly key reversal led by inverter manufacturers like SolarEdge.

Meanwhile, the soft earnings and negative guidance of Microsoft and Alphabet are warnings that cloud and subscription services are struggling. I remain of the view Apple is a highly cyclical company and will not be able to meet rosy expectations for sales growth.

The next Fed meeting is on November 2nd and a 75 basis point hike has already been priced in. Enthusiasm today was fuelled by the Bank of Canada only raising by 50 basis points. Investors displayed a willingness to bet the Fed is going to slow the pace of tightening too.

I do wonder how long that will last. Canada has much the same issue as the UK and Australia with high property prices and a dependence on floating rate mortgages to fuel speculative activity. The Fed is unlikely to take its cue from the Bank of Canada. It’s more productive at this stage to pay attention to relative strength leaders. They will be the companies to lead on the upside when this tightening cycle does in fact end.

Back to top