Tech hardware and supply chain, Ten themes to watch in 2015

Thanks to a subscriber for this detailed report from Deutsche Bank, dated December 8th, but no less relevant today. Here is a section:

The technology sector is in a constant state of flux, such is the rapid pace of innovation across its various subsectors. However some clear themes are evident such as mobility, connectivity, the accelerating output of data points from every part of our lives, increasingly intelligent machines capable of self diagnostics and rapid prototyping. All of these innovations are not occurring in isolation but are collaborative, so that developments in one area are quickly co-opted to accelerate growth elsewhere. While big data uses might be most apparent in social media and advertising, its application to the industrial, energy and healthcare complexes is even more important.

Here is a link to the full report.

The technology sector is in a constant state of flux, such is the rapid pace of innovation across its various subsectors. However some clear themes are evident such as mobility, connectivity, the accelerating output of data points from every part of our lives, increasingly intelligent machines capable of self diagnostics and rapid prototyping. All of these innovations are not occurring in isolation but are collaborative, so that developments in one area are quickly co-opted to accelerate growth elsewhere. While big data uses might be most apparent in social media and advertising, its application to the industrial, energy and healthcare complexes is even more important.

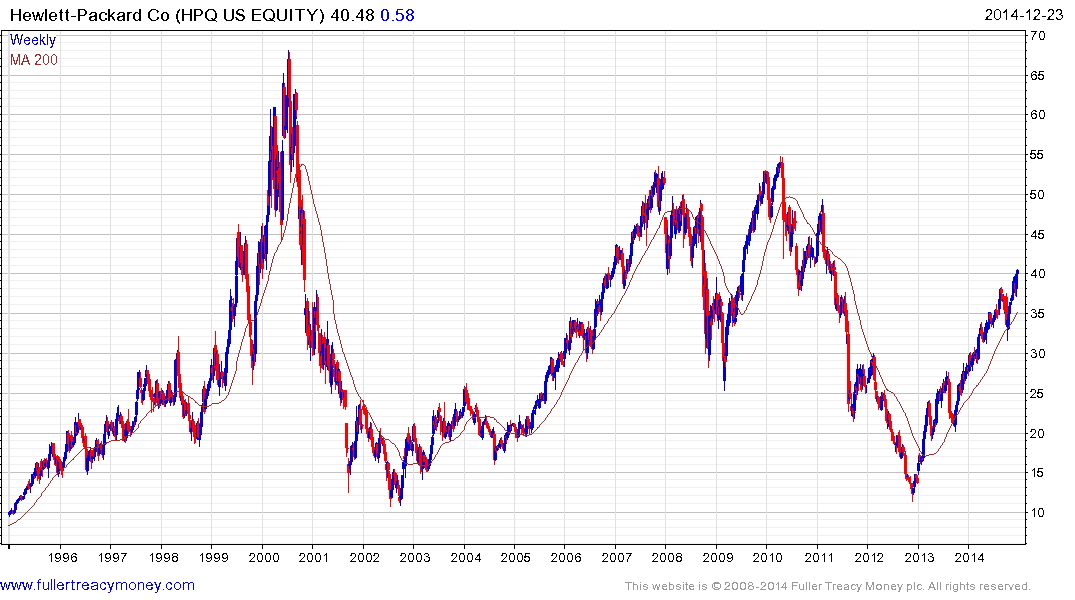

Hewlett Packard (Est P/E 10.24, DY 1.58%) has made great efforts to reinvent itself for this this new environment and the share has been trending consistently higher since bottoming near the 2002 low in late 2012. A sustained move below the 200-day MA would be required to question medium-term upside potential.

EMC Corp (Est P/E 16.08, 1.51%) is also worthy of mention. The share has been ranging with a mild upward bias since 2011 in a lengthy first step above its base. The share now appears to be in the process of breaking out and a sustained move below the trend mean would be required to question medium-term recovery potential.

There is a reasonably high degree of commonality in the Electronics Manufacturing Sector (EMS) with NetApp, Plexus, Jabil Circuit sharing similar patterns. Of these Plexus (Est P/E 13.39) has the more consistent price action and it currently rallying towards the upper side of its first step above the base.

Both Intel (Est P/E 16.78, DY 2.55%) and Texas Instruments (Est P/E 21.86, DY 2.48%) offer relative recent examples of impressive breakouts from lengthy base formations. What the above shares demonstrate is that despite the fact that the Nasdaq is within striking distance of its all-time high, it still offers a rich seam of base formations that are increasingly being completed.