Dollar Strength

The Dollar has broken its downtrend against a host of currencies. The weakness of the Euro and Yen have attractive the most attention but the relative weakness of commodity and Asian currencies is also noteworthy.

Against this background the sustainability of US based international companies’ earnings is coming into focus. Some have estimated that foreign operations account for 40% of S&P500 earnings. With the Dollar rallying, at least some of these companies will see their competitiveness eroded. They will have to work particularly hard to maintain market share abroad and garner additional revenue in the resurgent but competitive domestic economy.

The Russell 2000’s recent return to form might be viewed in this context. Generally speaking small caps respond to a reviving domestic economy and don’t have the reach to have expanded overseas. As a result they are leveraged to a revival of the US economy and do not have the currency exposure of large companies.

The Index failed to hold the break below 1100 in October and has rebounded to test the upper side of the range. A sustained move below 1150 would now be required to question medium-term scope for a successful upward break.

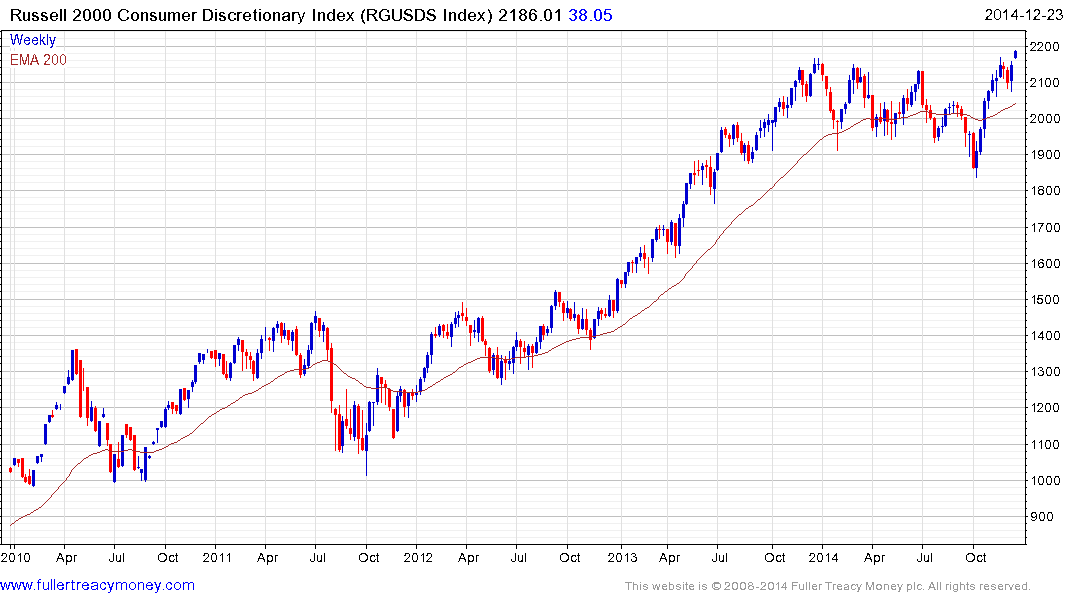

The Russell is being led higher by the Consumer Discretionary sector which moved to a new all-time high this week.

Back to top