Tech Defanged as Stocks From Amazon to Netflix Left Out of Rally

This article by Lu Wang and Rebecca Spalding for Bloomberg may be of interest to subscribers. Here is a section:

Losses among computer and software makers mushroomed Thursday and were pronounced in the FANG block of Facebook Inc., Amazon.com Inc., Netflix Inc. and Google parent Alphabet Inc., each of which fell at least 3.6 percent. The Nasdaq 100 Index slumped 2.3 percent as of 10:58 a.m. in New York, the biggest retreat since Sept. 9.

While opinions vary about what’s going on, one possibility was concern about the impact of Trump’s policies on trade overseas, where U.S. technology companies thrive. Others saw a rational retreat for a group that through Election Day had surged 11 percent in 2016, or even the potential for retaliation by the president-elect against an industry that didn’t exactly cozy up to him during the campaign.

“Amazon is not worth $42 less than it was yesterday. It’s just that there’s been these violent moves as investors try to sort out what the election means,” said Terry Morris, manager director of equities at BB&T Institutional Investment Advisors in Wyomissing, Pennsylvania. “These exaggerated moves are just that, and I think we’re going to come back to more reasonable valuations.”

Facebook slid as much as 6.4 percent to $115.27. Amazon was down 4.7 percent to $735.66 after falling as much as 7 percent earlier. Netflix declined 5.4 percent to $115.57 in its biggest slide since July. Alphabet lost 3.8 percent to $774.77.

Trump’s presidency leaves the U.S. tech industry in an uncomfortably uncertain position. Total contributions to Hillary Clinton’s campaign from the internet industry came in at 114 times the level they did for Trump, according to statistics compiled by the Center for Responsive Politics. Facebook CEO Mark Zuckerberg gave a strongly worded rebuke to Trump’s views on immigration at the company’s developers conference in April, although he never called him out by name.

Quite apart from the election highflying mega-cap technology shares were due a reversion towards the mean and pre-election jitters provided the catalyst for some profit taking, but the result has what has so far been a subpar rebound.

However it is worth considering whether a Trump presidency is in fact negative for technology shares? It certainly would be if other countries retaliate against proposed trade restrictions by imposing penalties on large US multinational corporations. On the other hand proposals, to reduce corporate tax rates and encourage companies to repatriate foreign profits could be highly beneficial for large companies with substantial US businesses in addition to their overseas operations.

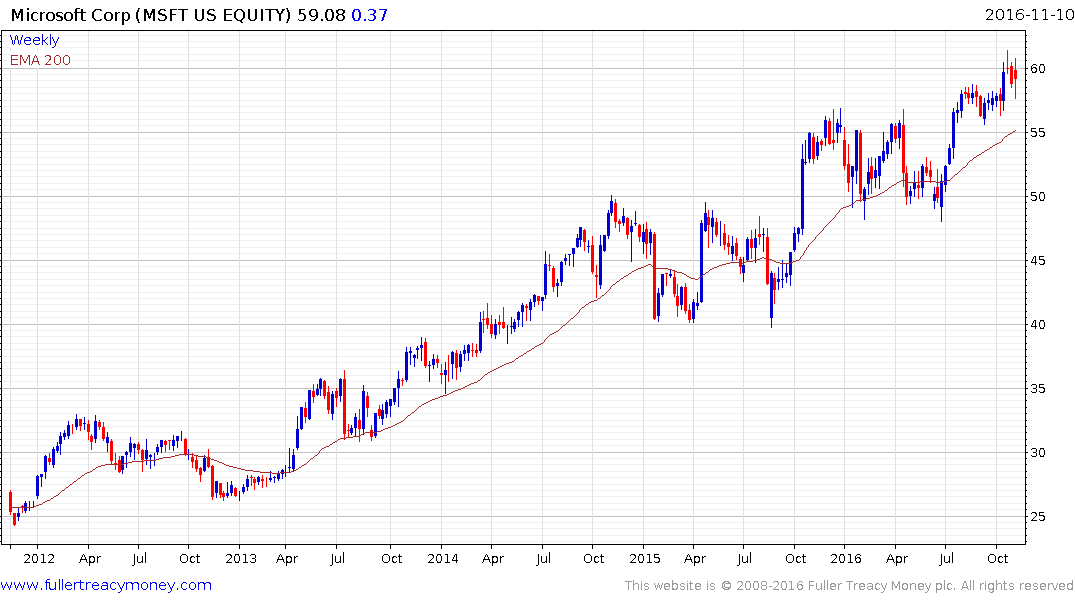

Apple, Facebook, Alphabet, Amazon and Microsoft are all now trading in the region of their respective trend means and will need to demonstrate support in these areas if medium-term scope for continued upside is to be given the benefit of the doubt.

Meanwhile the best performing shares over the last five days have been infrastructure related. For example United Rentals has bounced emphatically from the region of the trend mean on the assumption that plant rentals will prosper during an infrastructure boom.

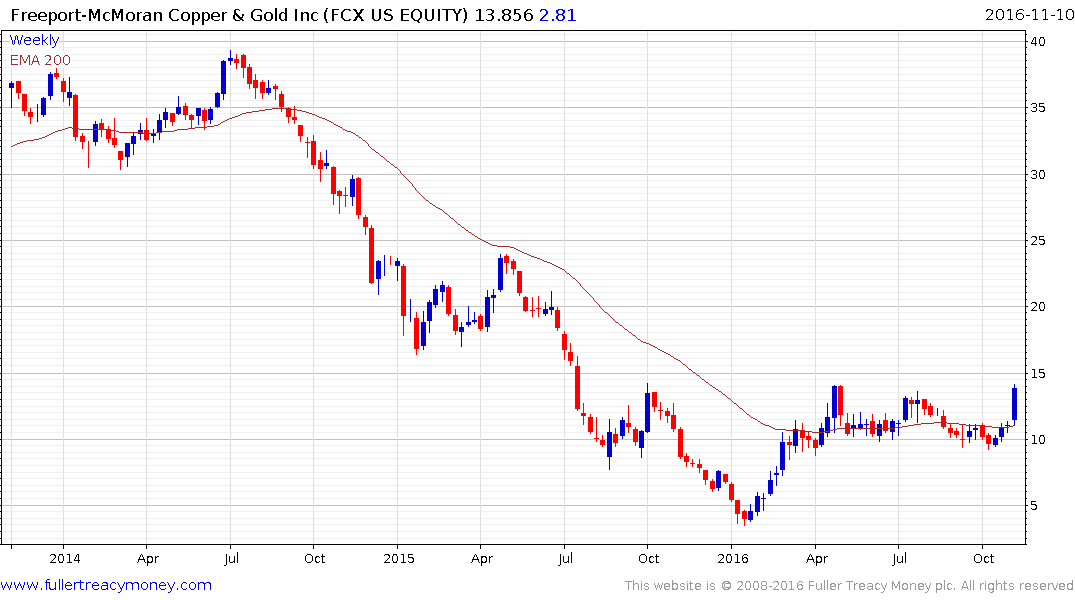

Freeport McMoRan bounced impressively from the lower side of a developing first step above the Type-2 bottom and a clear downward dynamic will be required to question recovery potential. There is also a high degree of commonality within the copper mining sector.

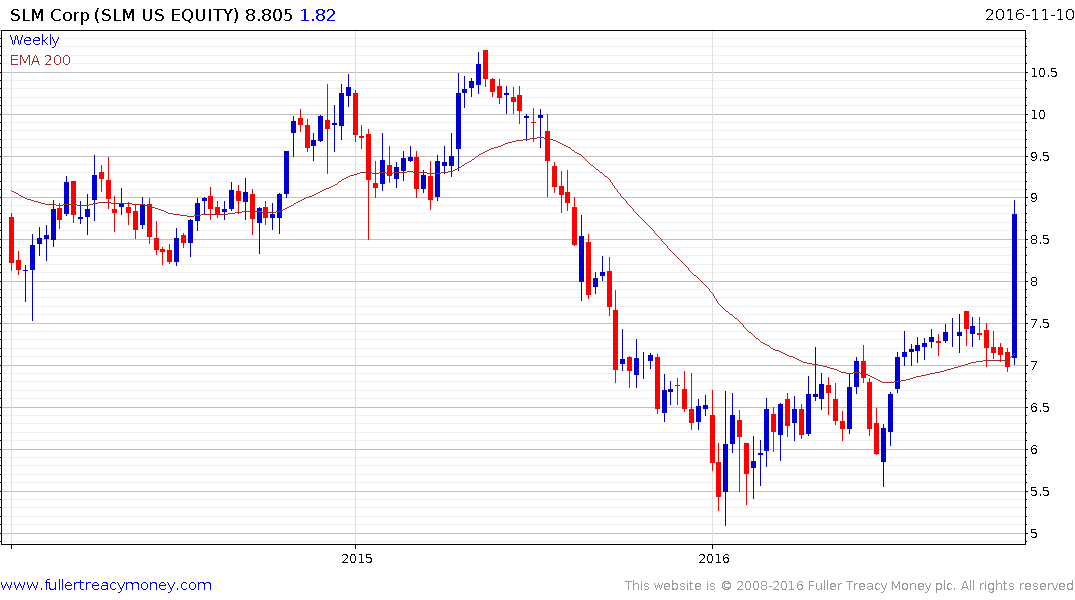

Both Sallie Mae (publicly funded education loans) and Navient Corp (private education loans) surged following the election.