Merkel's conservatives warn of Trump effect in Germany

This article from Reuters may be of interest to subscribers. Here is a section:

"Things are getting simplified, black or white, good or bad, right or wrong. You can asked simple questions, but one should not give simple answers," Oettinger told Deutschlandfunk radio.

He said politicians and media should better explain complicated things with facts, but they should also embrace social media to reach younger voters in the new digital world.

The AfD, polling at around 13 percent, on Wednesday welcomed Trump's victory as the disempowerment of political elites.

INSA chief Hermann Binkert told Bild politicians had not taken on board the warning signs and a growing number of people had rejected the established parties and turned to the AfD.

However, polls show a majority of Germans still reject rabble rousing slogans. A Politbarometer poll for broadcaster ZDF showed some 82 percent of Germans think it is bad or very bad that Trump became president.

Experts also argue that Germany's political system, established after World War Two to avoid the rise of another dictator after Hitler, makes the rise of individual politicians like Trump or even a single party difficult.

When considering where the hydra of populism is most likely to sprout next Germany is not the most likely candidate. Its federal political system, high barrier to entry into the Bundestag and the simple fact that, despite discontent among the so called Wutbürger class of disaffected citizens, Germany was perhaps the least affected of any European country by the credit / sovereign debt crises.

That of course does not mean Angele Merkel will be the next chancellor. Helmut Kohl held the office for 16 years and Merkel has already been in office for 11 years to date. Therefore we can conclude that conservative led German governments tend to have long lives but nevertheless they do end and the rise of right wing populism represents a significant threat by siphoning off votes; and by extension, potentially strengthening adversaries.

France’s presidential election on the other hand is much more dynamic. The greater influence of the town/city divide, increasingly audacious terrorist attacks, a large unintegrated migrant population, the continued importance of France’s cultural exceptionalism and disaffection with the solutions proffered by incumbent parties suggest the National Front under Marine LePen has a fighting chance at success.

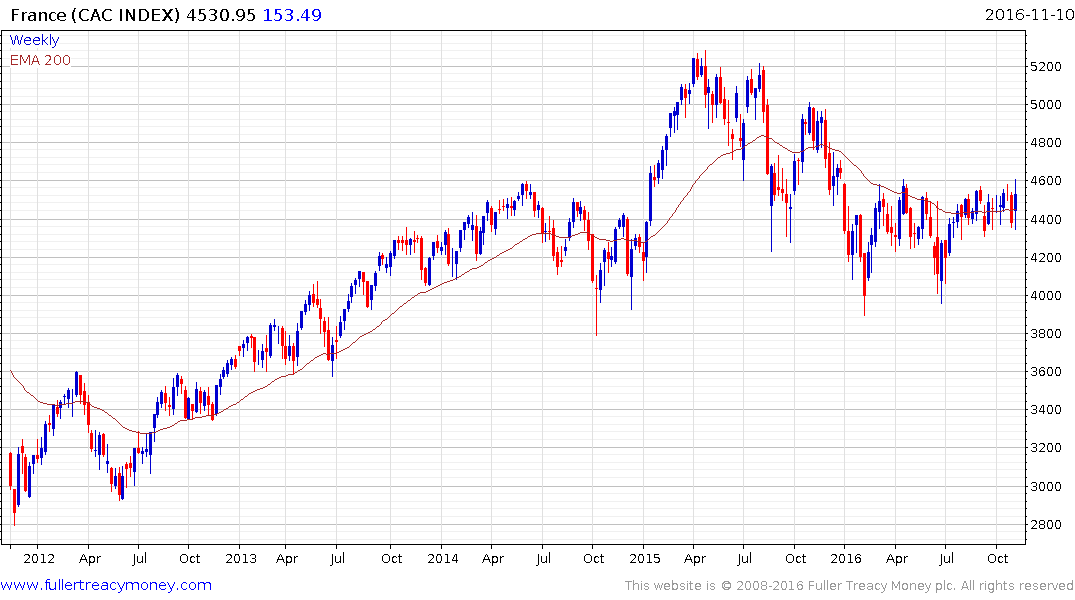

The French stock market is dominated by internationally oriented businesses which could benefit from any weakness in the Euro such an event would engender. The Euro has headwinds in the form of both continued stimulus by the ECB, rising political threats in both Italy (December) and France (April/May 2017) and outsized growth in the US spurred by fiscal stimulus. The progression of lower rally highs within the two-year range remains intact and a sustained move above $1.13 will be required to question potential for a further test of underlying trading.