Stocks Tumble, Treasuries Surge as Concerns Mount

This article by Randall Jensen and Vildana Hajric for Bloomberg may be of interest to subscribers. Here is a section:

Earnings remain in focus though the depth of the sell-off overshadowed most major reports. Weak results from Germany’s SAP and Taiwan Semiconductor dragged American tech indexes lower.

Earnings misses from several U.S. industrial firms and a Bank of America downgrade of the housing sector fueled worries that higher interest rates and the trade war are hitting profits.

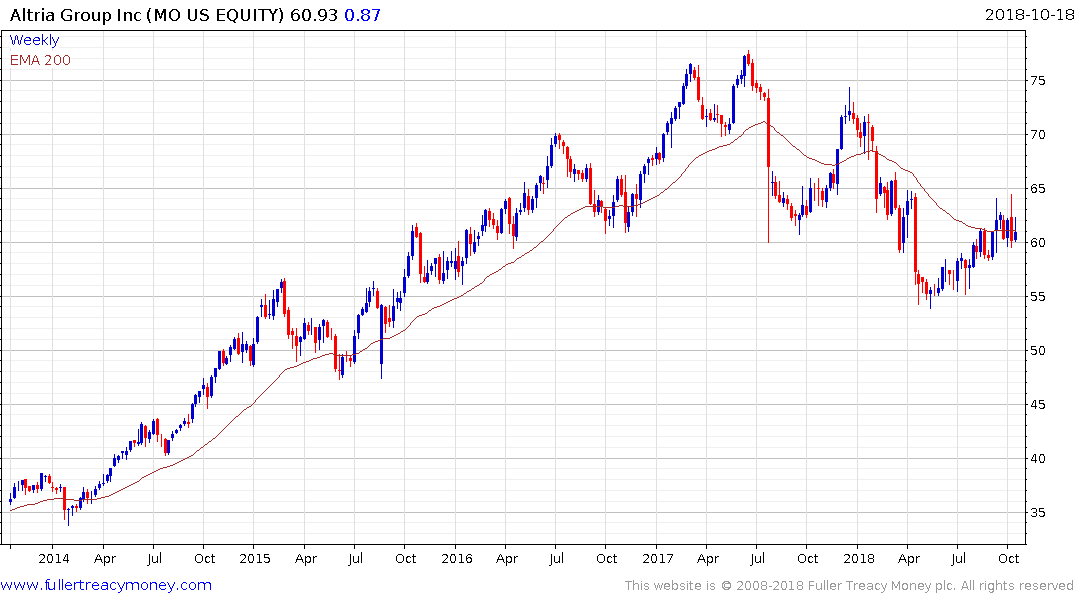

Philip Morris surged on strong demand, buoying consumer shares. Elsewhere, emerging-market assets also fell after declines in Europe and Asia. The Japanese yen gained the most in a week and gold traded near three-month highs.

I’ve been clicking through a lot of charts over the last couple of days and there are some very clear conclusions that jump out. The most important of these is that a major rotation is underway. The big momentum trades than really animated markets in the early part of the year are underperforming whereas a good many that have been out in the wilderness for the last couple of years are increasing showing signs of activity.

It’s very easy to focus on news flow, such the evolving trade war with China, the outlook for an Italian downgrade to junk and the Fed’s continued desire to raise interest rates. The major Wall Street indices are still trading above their respective trend means but the interest rates sensitive midcaps sector is exhibiting relative weakness, on a global scale, which is a cause for concern.

![]()

Meanwhile the Philadelphia Semiconductors Index has Type-2 top formation characteristics and a sustained move above the trend mean will be required to question that conclusion.

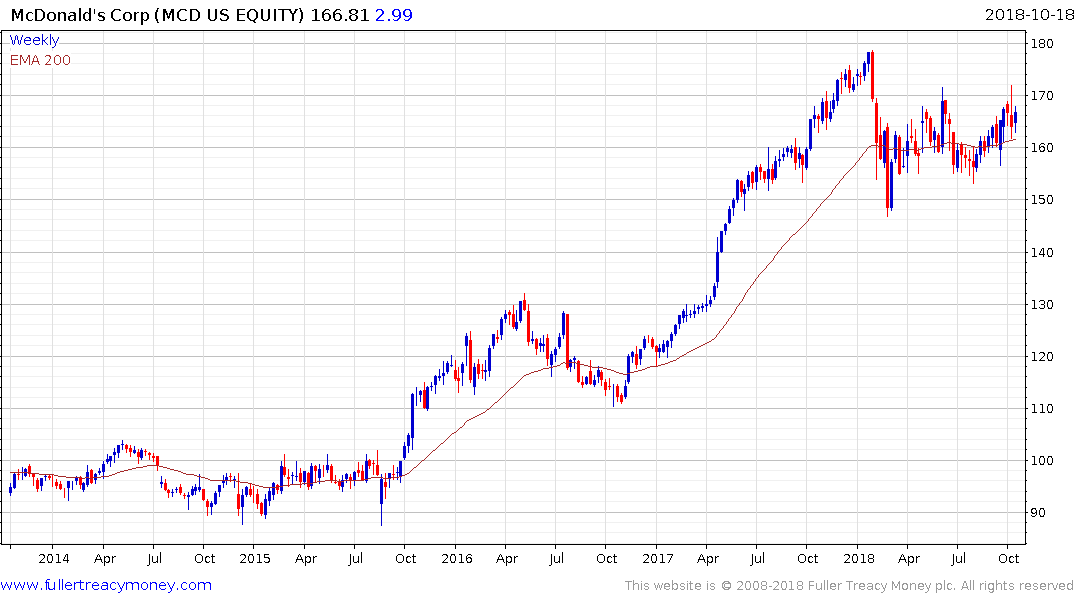

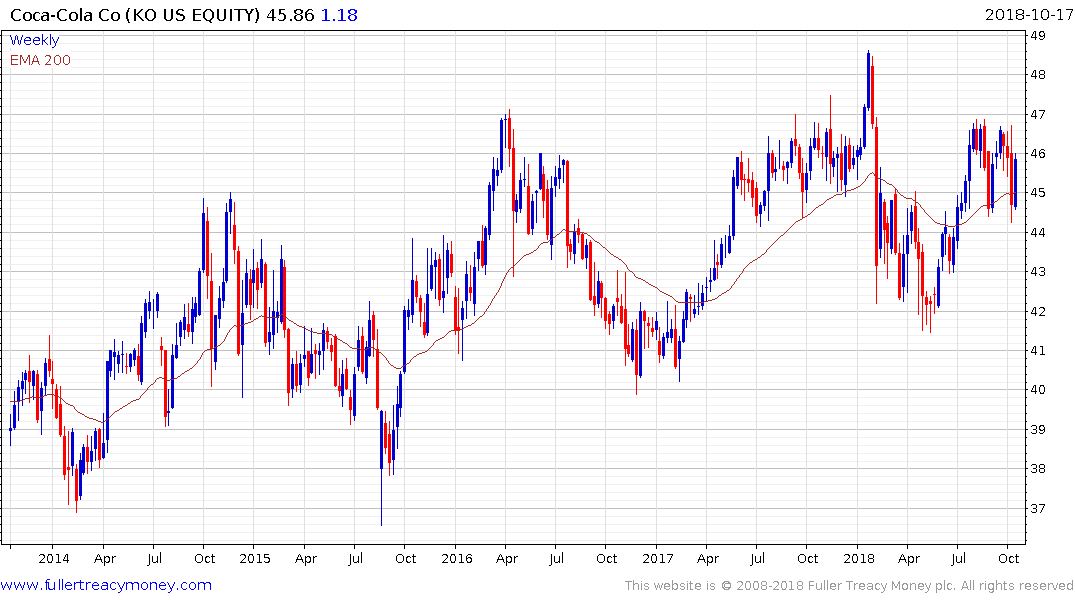

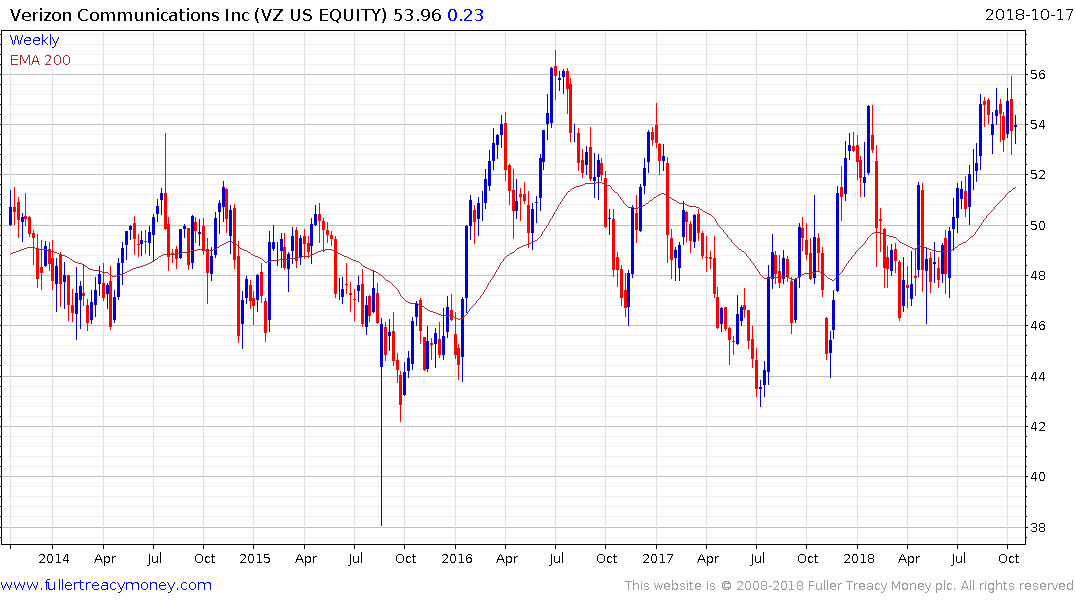

Concurrently, shares with defensive characteristics like McDonalds, Coca Cola, Walt Disney, Verizon tobacco and utilities are exhibiting relative strength. That is a classic late stage development since investors tend to crave strong cashflow when they are uncertain about the future.

The big question therefore is to what extent the rotation now underway will undermine the unrelenting buying of ETFs which has helped support momentum moves in the major market cap weighted indices over the last couple of years.