Ericsson profit smashes forecasts as 5G buzz grows

This article by Dominic Chopping for MarketWatch may be of interest to subscribers. Here it is in full:

Ericsson AB's ERIC, +5.15% third-quarter net profit exceeded estimates by a significant margin as the telecommunications equipment company continued to keep a tight rein on costs while seeing strong demand from operators racing to launch new fifth-generation networks.

Ericsson's quarterly net profit ballooned to 2.75 billion Swedish kronor ($307.7 million) from a loss of SEK3.56 billion as sales rose 8.9% to SEK53.81 billion.Analysts polled by FactSet had expected a net profit of SEK630 million on sales of SEK50.28 billion.

The gross margin rose to 36.5% from 26.9% while the operating margin grew to 6.0% from a negative margin of 7.4%.

"We continue to invest in our competitive 5G-ready portfolio to enable our customers to efficiently migrate to 5G," said Chief Executive Borje Ekholm. "Strong sales were mainly driven by a continued high activity level primarily in North America."

Amid the furore about new technology there are some that we should pay particular attention to because of their enabling characteristics which can boost personal productivity. These are 5G, batteries, cancer therapy, automation and artificial intelligence.

5G is the foundation for the promise of the internet of things. We are going to need a lot more bandwidth to accommodate having internet connected sensors everywhere and that requires an infrastructure build.

Ericsson gave up on phones a long time ago and now concentrates on networks. The share held a progression of higher reaction lows since September and a sustained move below the trend mean will be required to question medium-term scope for continued upside.

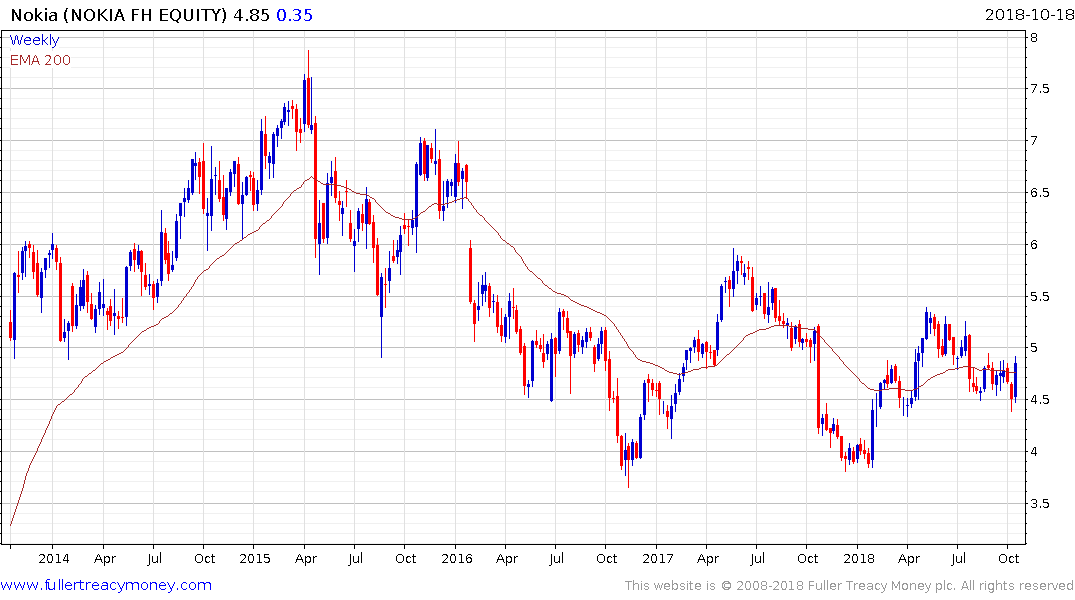

Nokia has been holding above €4 since 2016 and is currently firming. A sustained move above the May high near €5.40 would break the three-year progression of lower rally highs and signal a return to demand dominance beyond the short term.

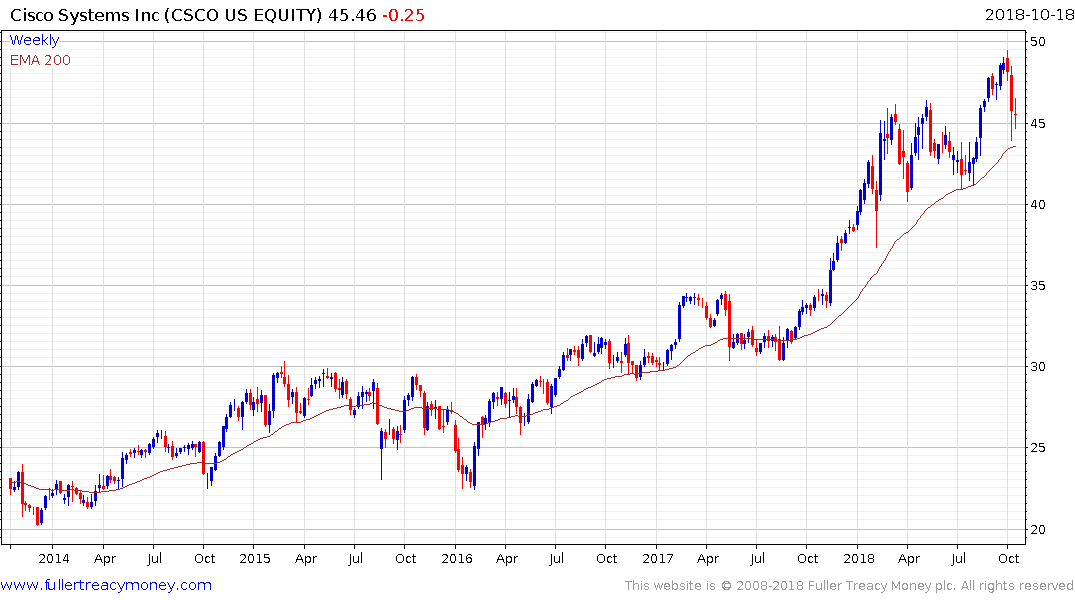

Cisco Systems retested the region of the trend mean last week and has firmed this week. This is a key area of potential support if the medium-term trend is to remain consistent.

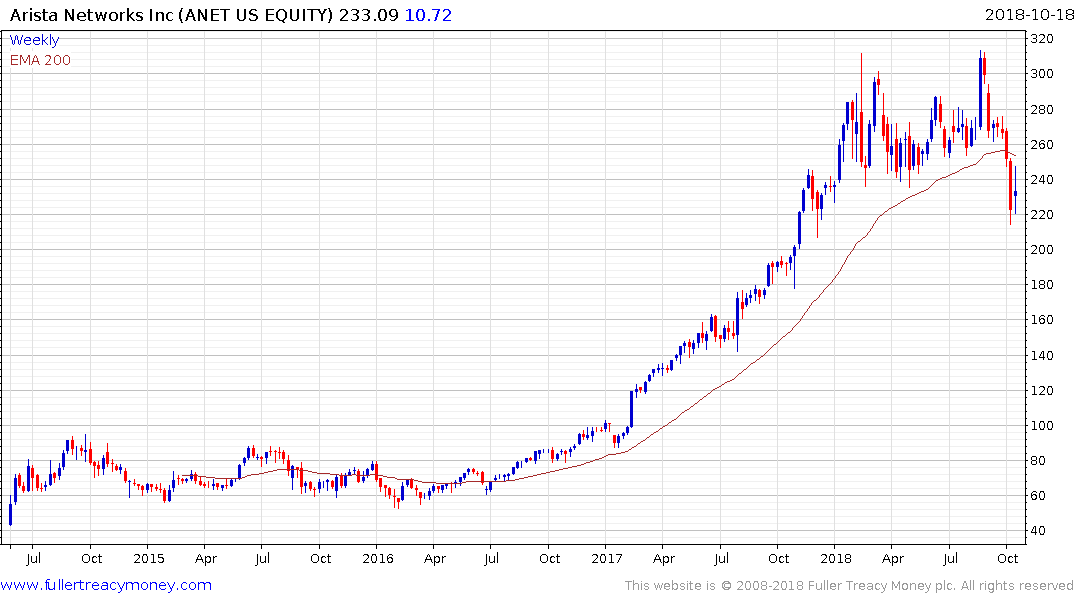

Arista Networks has type-2 top formation characteristics and will need to sustain a move back above the $250 area to question supply dominance.

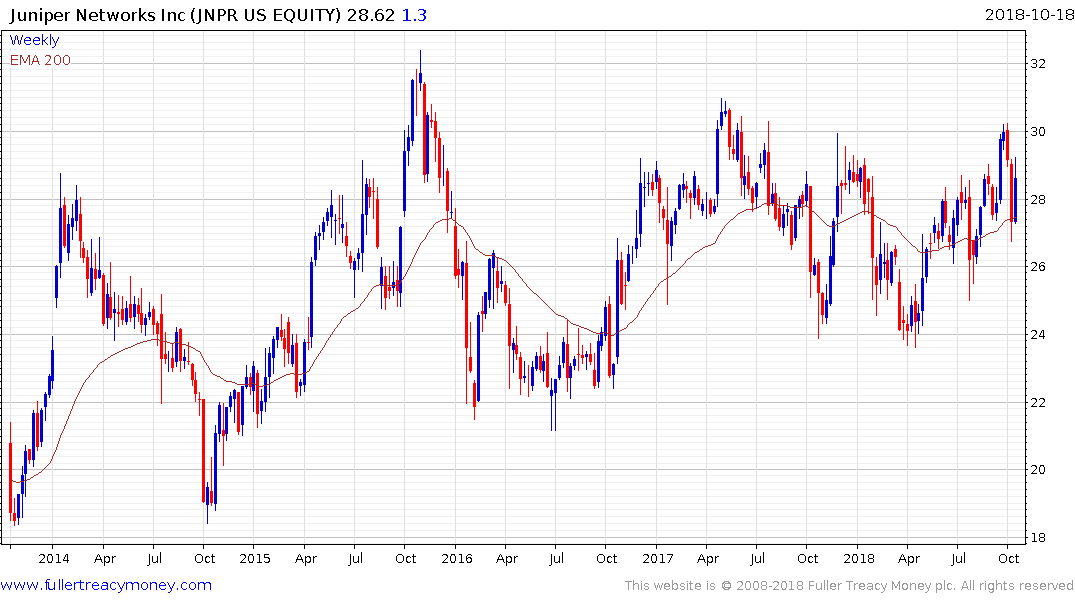

Juniper Networks has been ranging mostly below $30 since 2015 and is currently firming from the region of the trend mean.