Stocks Tumble, Dollar Climbs With Traders on Edge

This article from Bloomberg may be of interest. Here is a section:

“Investors are beginning to realize that a ‘higher for longer’ interest rate environment is a likely outcome and are slowly adjusting to the ‘new normal,’” Paul Nolte, a senior wealth manager at Murphy & Sylvest Wealth Management, wrote in a note. “Higher-for-longer has been the mantra of the Fed for a few months. It is only recently that the markets have been taking them at their word.”

On days when the stock, bond and commodity markets decline but the Dollar goes up, the only clear conclusion is cash is being raised and stuffed into money market funds.

That pattern of behaviour is putting downward pressure on the very short-end of the curve while the long-end is still trending higher. The net result is the 10-year – 3-month yield curve spread is now recovering from deeply inverted territory.

The belief in a soft landing is predicated on rates coming down soon and liquidity remaining supportive indefinitely. The more people believe and act in as if that is reality, the less likely a soft landing is.

The next inflation figures will be released on Friday and the one to watch will be Core Services Less Housing. It has been stubbornly high, and I don’t see any particular reason it will decline significantly on this reading. That will only further support the argument for keeping rates higher for longer.

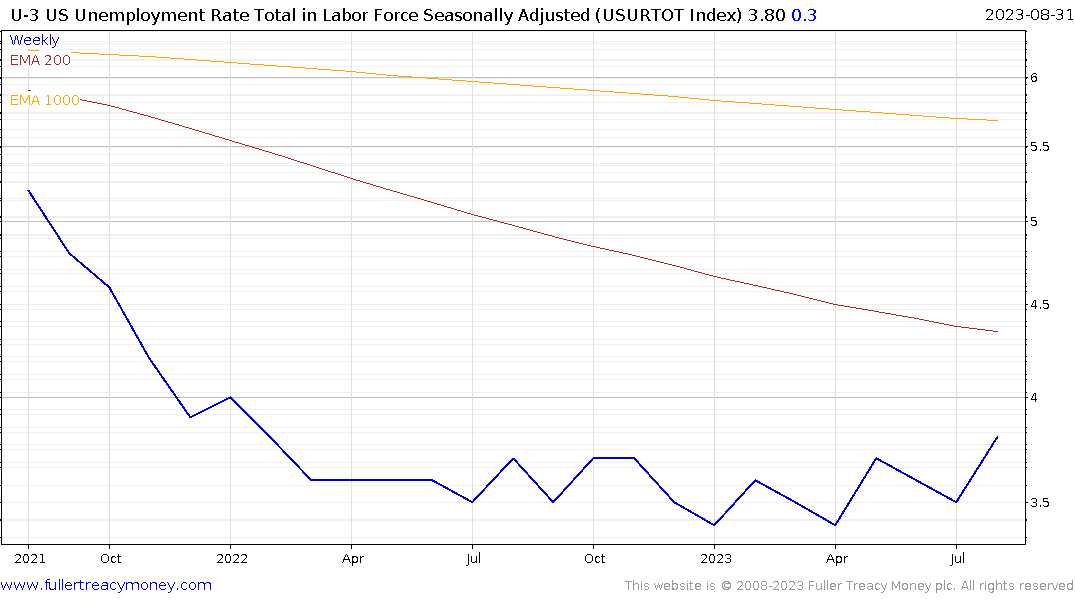

Meanwhile unemployment has made a new recover high. It is still below 4% but the trend is now moving higher. Rising unemployment and high inflation is a nasty stagflationary recipe which is unlikely to be beneficial for stock prices.

Meanwhile unemployment has made a new recover high. It is still below 4% but the trend is now moving higher. Rising unemployment and high inflation is a nasty stagflationary recipe which is unlikely to be beneficial for stock prices.

The Nasdaq-100 made a new reaction low today as it continues to unwind the short-term overextension relative to the 200-day MA. I believe the most likely scenario is a deeper process of consolidation as the ability of consumers to sustain their pandemic lifestyles comes under additional pressure.