Stocks Climb With Bonds, Gold on Policy Bets After Brexit Storm

This article by Inyoung Hwang and Bailey Lipschultz for Bloomberg may be of interest to subscribers. Here is a section:

Statements from the European Central Bank and the Bank of England that they stand ready to loosen policy to deal with the aftermath of Brexit helped halt a two-day rout in markets. Odds that the Federal Reserve will raise borrowing costs this year as planned have fallen to less than 10 percent. Data today showed U.S. factory activity expanded in June at the fastest clip in more than a year, underscoring optimism in the strength of the world’s largest economy as investors look to data for clues on the trajectory of interest rates.

“Central banks coming out and reinforcing that they were a backstop gave investors the confidence that they would have enough support to keep making moves,” said Walter Todd, who oversees about $1.1 billion as chief investment officer for Greenwood Capital Associates LLC in South Carolina. “That and the timing of the quarter-end played into it and helped the rally start and the market really rebound.”And

“As bad as things have gotten, central banks have talked about new types of easing -- that’s going to keep a bid under equities,” said Andrew Brenner, head of international fixed income at National Alliance Capital Markets in New York. “The worse things get, the more potential there is for quantitative easing and the better that is for equity markets.”

UK Gilt yields touched a new multi-decade low this week. US 10-year Treasury yields also hit a new multi-decade low yesterday. More than half of all sovereign bonds globally have negative yields. With central banks talking seriously about employing fresh extraordinary measures to stimulate asset prices there is little potential for policy to tighten. The question then is how likely is it that UK yields will turn negative amid BoE stimulus and at what level US Treasury yields are likely to stabilise.

UK Gilt yields had been ranging mostly above 1.3% until mid-June when they began to price-in an unruly outcome to the Brexit referendum. The move so far has been swift and an overbought condition is evident, but the reality is that BoE measures to support the economy are expected and they want neither a strong currency nor a weak bond market if they are going to achieve their goals. Therefore a sustained move above the MA would be required to question potential for additional yield compression in Gilts.

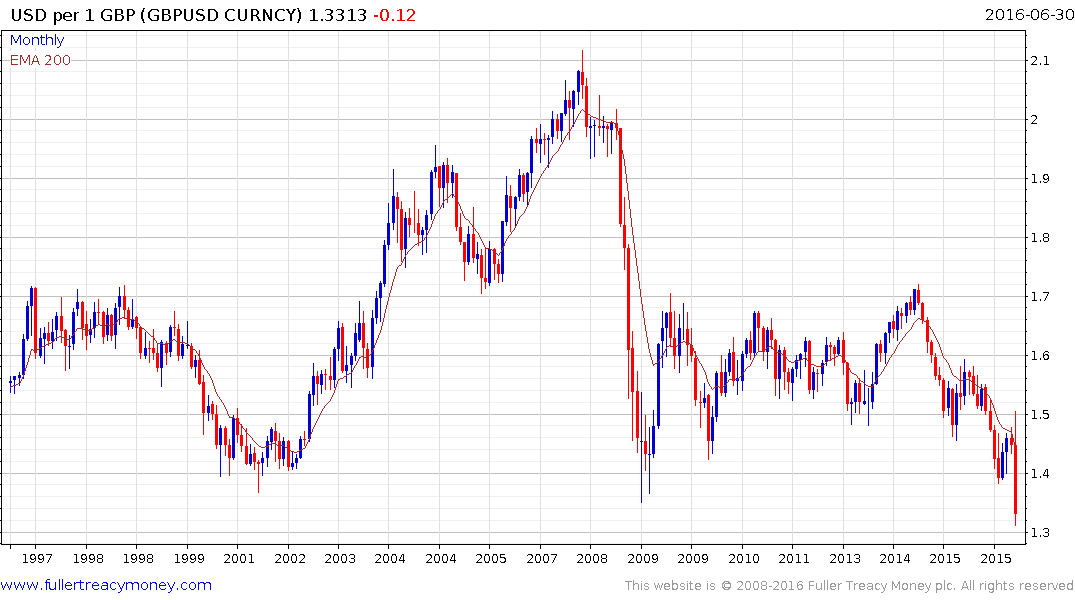

The Pound has stabilised somewhat near $1.32 but will need to hold that level if potential for support building is to be given the benefit of the doubt.

That leaves yield hungry investors in a quandary. They can have pay for the apparent security of bonds or will need to participate in the equity market if they are to achieve the income they require.

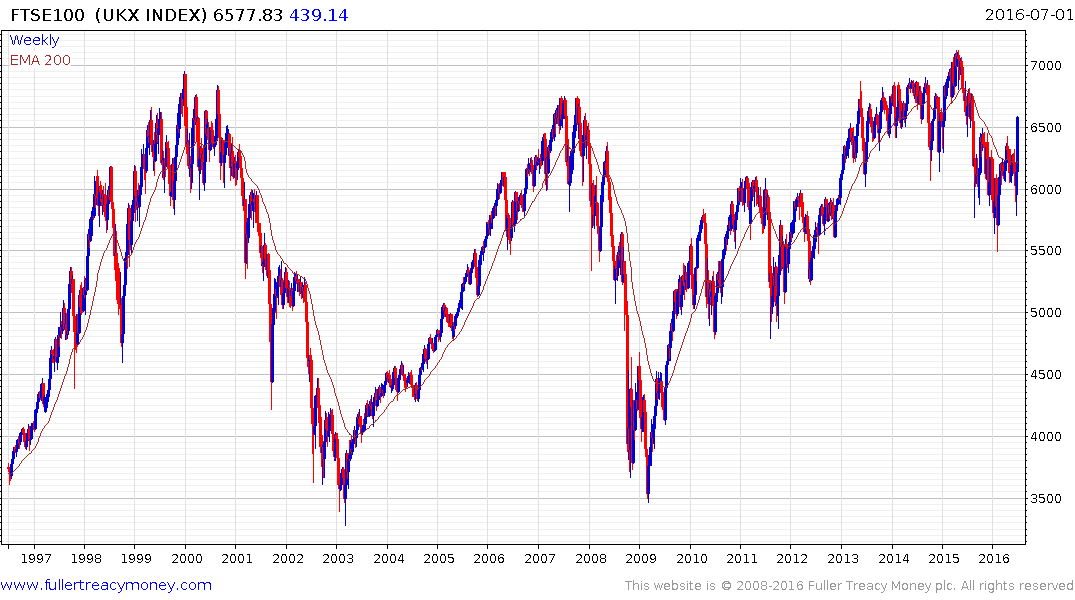

The FTSE-100 has been ranging mostly below 7000 since 2000. Considering how long the congestion area has been the eventual upward break is likely to take many by surprise regardless of whether it might only be rallying in nominal terms.

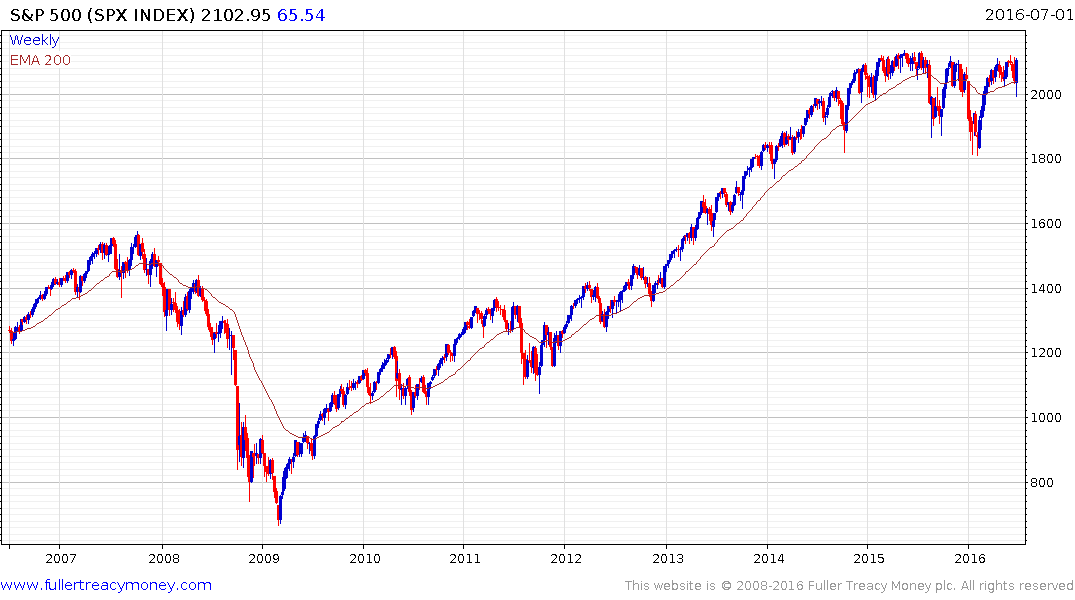

The S&P 500 have been confined to range since the end of new QE in 2014. If we are moving into another phase of synchronised global monetary expansion, that should have an inflationary effect on asset prices and not least stocks.

The precious metals, particularly silver, are responding favourably to the fact that supply cannot simply be loaned into existence. Silver is somewhat overbought following a particularly strong rally this week so some consolidation in the region of the psychological $20 is possible. However, a sustained move below the trend mean would be required to question medium-term recovery potential.

If major stock markets break higher because of monetary expansion and negative yields rather than margin expansion and corporate profits we can expect valuations to move from slightly expensive to very overvalued and that would represent the third psychological perception stage of the bull market; mania or euphoria.

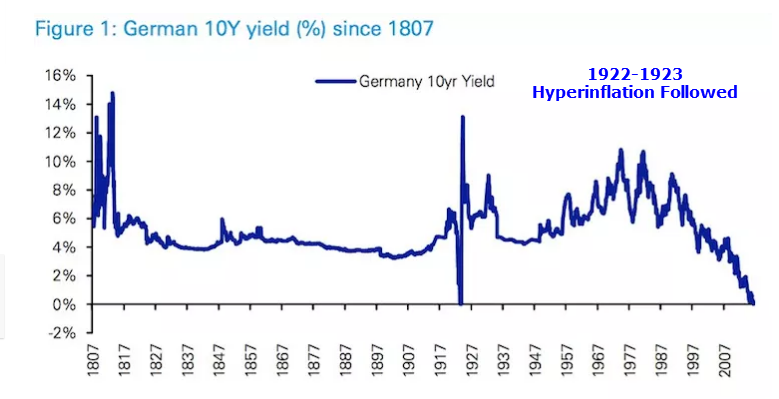

This chart of German Bond yields over more than a century, kindly forwarded by a subscriber highlights what happened after the last time yields were negative. We don’t have hyperinflation right now but neither is it sensible to expect that everyone can borrow as much as they like and never expect to have to pay any of it back. That’s about as irrational as anyone can imagine and yet it is as true today as when Keynes mentioned it. “the market can stay irrational longer than you can stay solvent”. The more appropriate way to play the market is to be long while watching for signs the contradiction that is supporting prices might be changing.