China to tolerate weaker yuan, wary of trade partners' reaction

This article from Reuters may be of interest to subscribers. Here is a section:

China's central bank would tolerate a fall in the yuan to as low as 6.8 per dollar in 2016 to support the economy, which would mean the currency matching last year's record decline of 4.5 percent, policy sources said.

The yuan is already trading at its lowest level in more than five years, so the central bank would ensure any decline is gradual for fear of triggering capital outflows and criticism from trading partners such as the United States, said government economists and advisers involved in regular policy discussions.

Presumptive U.S. Republican Presidential nominee Donald Trump already has China in his sights, saying on Wednesday he would label China a currency manipulator if elected in November.

The economists and advisers are not directly briefed on policy by the People's Bank of China (PBOC), but they have regular meetings and interactions with central bank officials and they provide policy recommendations. They said the central bank would tolerate a further weakening of the yuan this year to between 6.7-6.8 per dollar.

"The central bank is willing to see yuan depreciation, as long as depreciation expectations are under control," said a government economist, who requested anonymity due to the sensitivity of the matter.

China is engaged in a massive rationalisation of the basic resources sector with cement, steel, coal, aluminium all subject to challenges. With millions of jobs at stake the country needs a weaker currency to take some pressure off the manufacturing sector so it may be able to absorb some displaced workers.

The last thing the Party wants is a sharply depreciating currency because that would challenge confidence in their ability to shepherd the economy to a more prosperous future. That suggests a gradual depreciation, similar to what we have seen over the last two years, is their objective. Provided they can continue to control the capital account they are likely to get their wish.

The CSI300 continues to firm from the psychological 3000 level and a sustained move below it would be required to question support building.

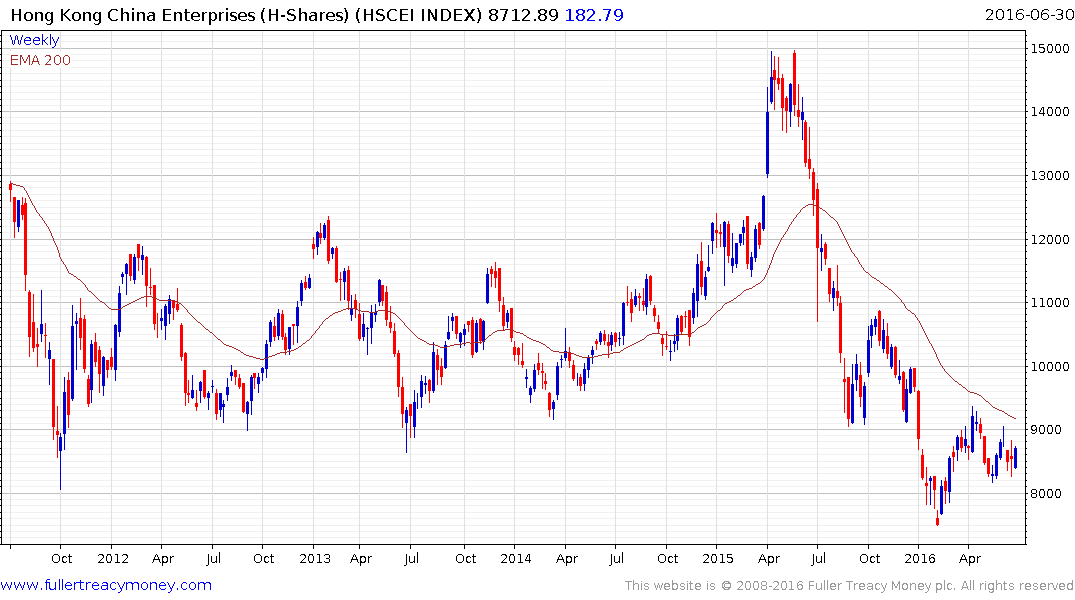

The China Enterprises Index (H-Shares) continues to respond favourably to the reduced risk of Fed rate hikes and a sustained move below 8000 would be required to question medium-term scope for additional upside.