South-east Asia stocks poised for bull market as global funds pile in

This article from The Straits Times may be of interest to subscribers. Here is a section:

South-east Asian markets are rebounding as accelerating economic growth and calmer currencies attract investors seeking refuge from the volatility rocking markets in China and Japan this year. That is a reversal of fortunes from 2015 when the region's equity gauge plunged 21 per cent as prospects for higher US rates spurred capital outflows.

"The risk-on trade is back on. This is a short term rebound after a tumultuous fourth quarter," said Mr Geoffrey Ng, director at Fortress Capital Asset Management Sdn in Kuala Lumpur, which oversees about US$238 million (S$322 million). "This is fueled partly by greater certainties of the path of US interest rates."

South-east Asian assets have stabilised after Federal Reserve Chair Janet Yellen signaled in early February policy makers will not rush to raise rates amid turbulence in global markets. The Fed earlier this week scaled back expectations for interest-rate increases this year.

A point made repeatedly by this service is that when a currency has been falling for years, competitiveness improves and all foreign investors are waiting for is a sign that the central bank is willing to stem the slide for them to begin bargain hunting.

The Indonesian central bank intervened to support the Rupiah in October and other central banks have followed suit over the last six months. The effect currency devaluation has had on stock indices is relatively minimal in nominal terms so I thought it might be instructive to review some US Dollar denominated funds for greater clarity.

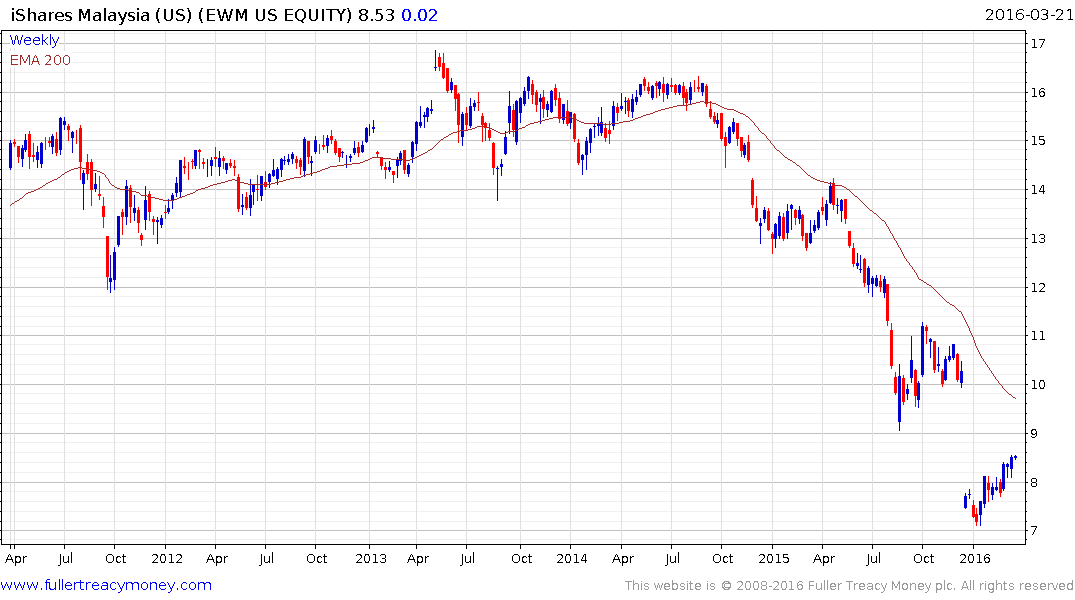

The iShares MSCI Malaysia ETF yields 8.13% and paid a special dividend of over 30% in December. It has been ranging for much of the last six months and pushed back above the 200-day MA for the first time in 15 months last week.

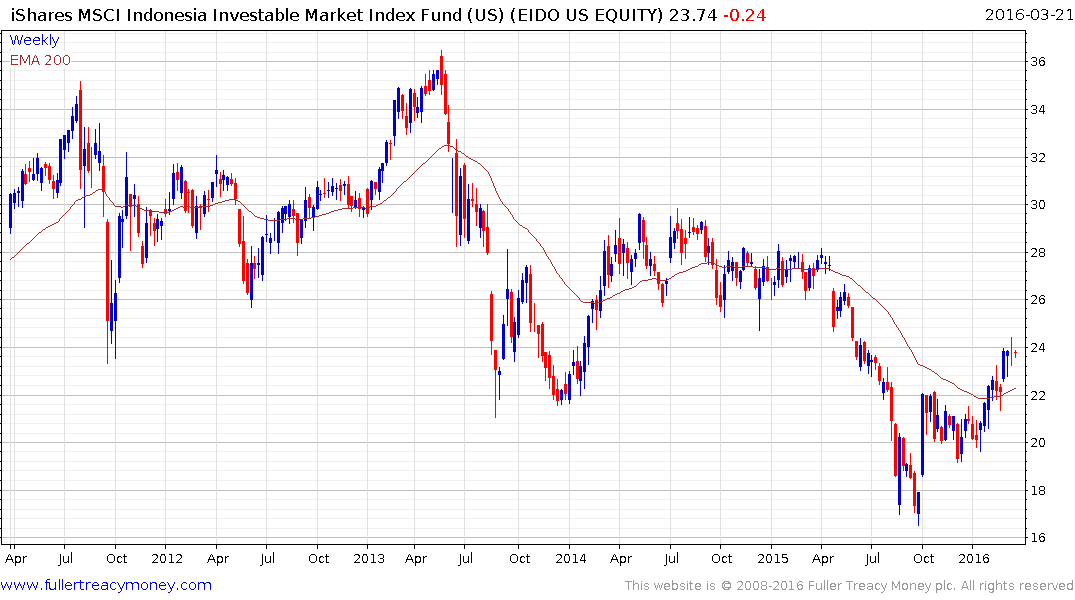

The iShares MSCI Indonesia ETF accelerated to a low near $16.50 but rebounded emphatically with the currency and has held a progression of higher reaction lows since.

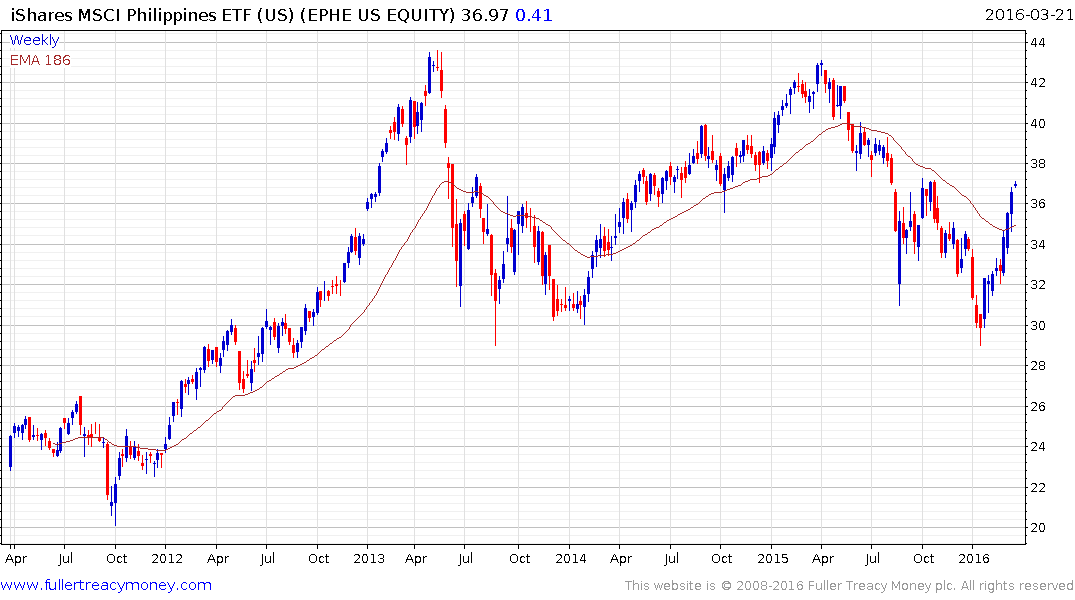

The iShares MSCI Philippines ETF found support in January in the region of the 2013/14 lows and continues to rebound. It pushed back above the trend mean two weeks ago and a sustained move below $35 would be required to question recovery potential.

The iShares MSCI Singapore ETF yields approximately 4% and rallied last week to break back above the 200-day MA. It will need to find support above the January low near $9 to confirm a return to demand dominance beyond short covering.

From the above charts we can see that this is the strongest rally any of these ETFs has seen in quite some time. Provided their respective currencies hold their lows on any pullback the competiveness these countries have gained will stabilise and foreign investors will be more likely to support their stock markets.

Back to top