Some FOMC Members Saw December Rate Rise as 'Close Call'

This article by Christopher Condon and Craig Torres for Bloomberg may be of interest to subscribers. Here is a section:

Earlier Wednesday, Fed Vice Chairman Stanley Fischer said policy makers’ median forecast predicting four interest-rate increases in 2016 were “in the ballpark,” though China’s slowing economy and other sources of uncertainty make it difficult to predict the path of policy.

Financial markets expect only two quarter-point increases this year, according to pricing in federal funds futures, a view Fischer called “too low.”

“We make our own analysis and our analysis says that the market is under-estimating where we’re going to be,” he said in an interview on CNBC.

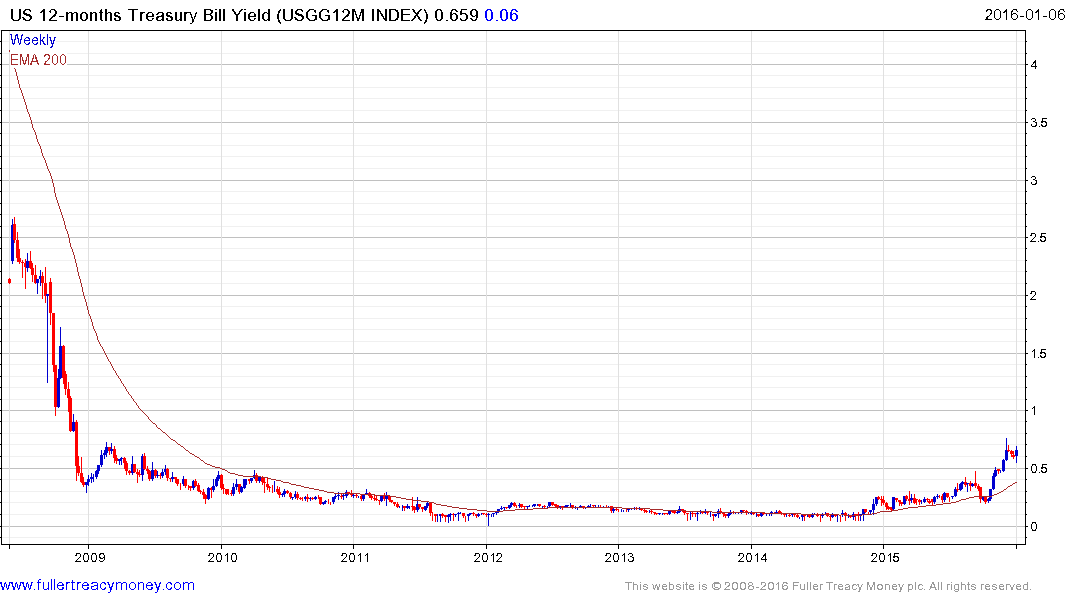

On first blush the fact the Vice Chairman of the Fed believes the economy is resilient enough to tolerate four interest rates hikes this year should be positive. However because the bond market is not so sanguine, with 12-month bills trading at 65.9 basis points, some revisions of expectations is seeing yields on the short end of the curve rising sharply.

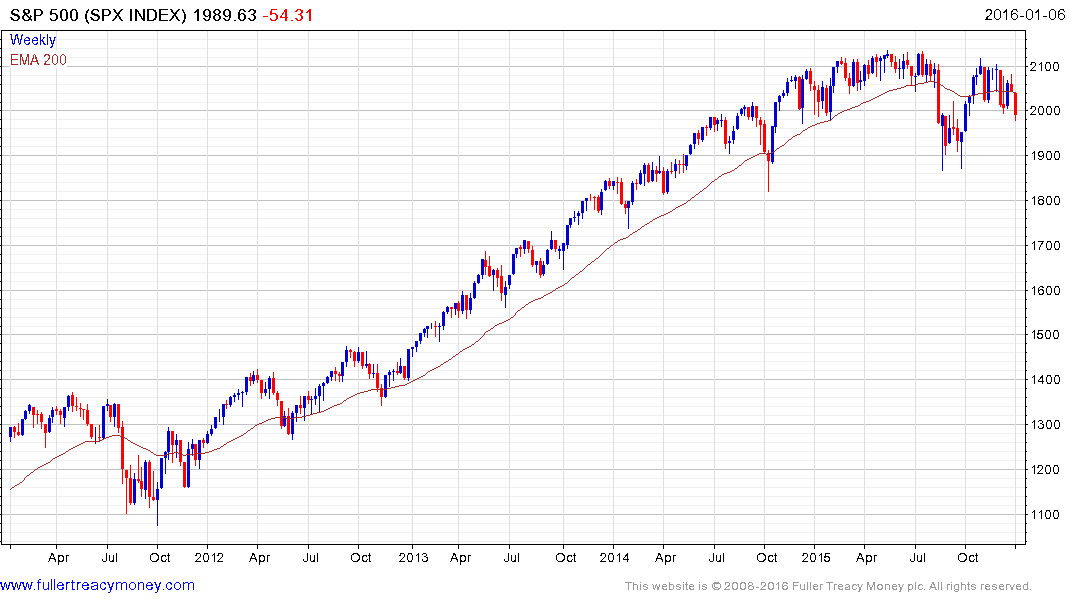

Ultra-low interest rates have been a major enabler for the stock market over the last six years not least because they made leverage relatively cheap to take on. However every interest rate hike makes it more expensive and forces leveraged strategies to reduce the size of their positions.

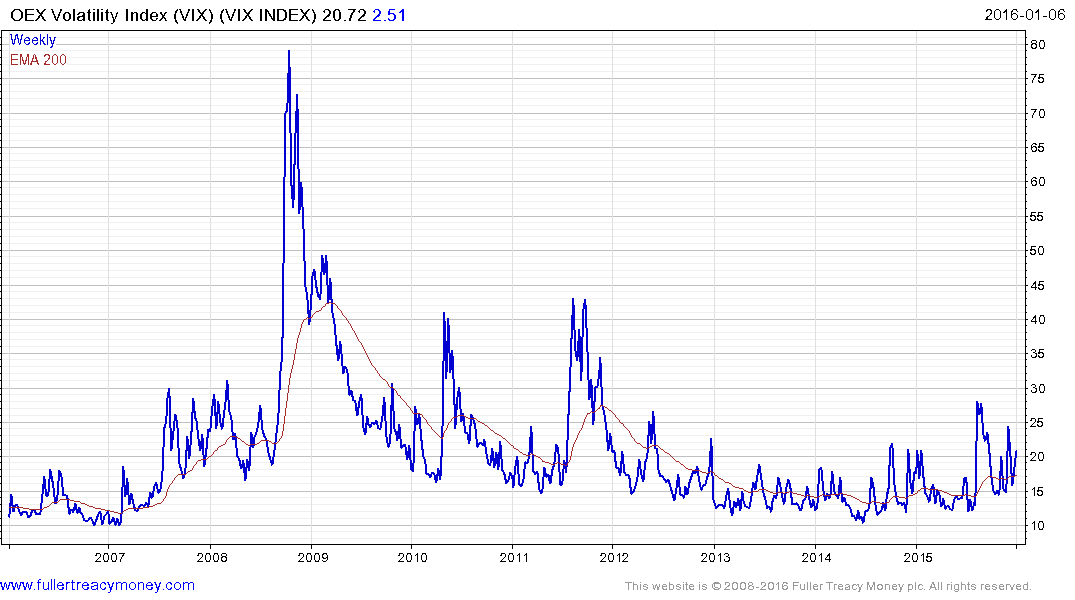

While the above chart of the VIX is itself volatile the fact the moving average has now turned upwards is evidence of heighten volatility overall and is an additional consideration for automated trading systems that have to reduce the size of positons as a result.

Share buybacks remain a powerful tailwind for the market as long as the weighted average cost of capital remains positive for higher rated corporations. However their influence is dependent on the capital allocated to purchases continuing to rise and that is questionable in the current environment.

The S&P 500 encountered resistance below its May peak in November and dropped below the psychological 2000 today. A short-term oversold condition is now evident but a clear upward dynamic will be required to check momentum.

The Nasdaq 100 is back testing the region of the trend mean and will need to hold this area if potential for continued higher to lateral ranging is to be given the benefit of the doubt.

The Russell 2000 has been ranging for two years and is back testing the lower side of what appears to be a developing Type-3 top formation. It will need to rally smartly from current levels to signal demand coming back in at current levels.

The relative performance of the Nasdaq is being driven by a relatively small number of very large cap stocks while the Russell is probably more reflective of what is going on in the wider market. Widening breadth will be required if the wider market is to rally meaningfully this year and right now there is little evidence of that as heightened geopolitical risk is priced in.

Back to top