Gold Standard Ventures Is Uncovering Bonanza Grade in Nevada's Carlin Trend

Thanks to a subscriber for this interview from The Gold Report which may be of interest. Here is a section:

TGR: You have released test results on Dark Star that Bob Moriarty called "obscene" in a good way. What's your strategy for moving that discovery forward?

JA: The Dark Star project is something that we're very excited about. To hit 150-plus meters of 1.5 grams per ton oxide in the Carlin Trend has historically meant you were in a large, robust system. This is our second blind discovery on the project. This just goes to show that our exploration team is very good. This was a systematic, methodical model-driven exploration process. Our strategy is to hit this whole corridor, which from north to south is about 10 miles long. On the southern end is Dark Star, and on the northern end is Newmont Mining Corp.'s (NEM:NYSE) producing Emigrant mine. We think there is a lot of exploration potential along the structural corridor. A lot of that has been made possible because of the consolidation work that Gold Standard has been able to do.

TGR: As you mentioned, you have some majors as operating neighbors. Are there some models in Nevada that investors are using to compare your possible future prospects?

JA: For Pinion, I think the closest model is Emigrant, a producing mine that belongs to Newmont. It was built in 2012. It's a run-of-mine, heap-leach operation. It has similar grade and characteristics. I think the market wants to see what the metallurgy will look like at Pinion because that is key to the economic model for a heap-leach project. We're doing a lot of that work in that area right now and should have a much better picture in January/February of 2016.

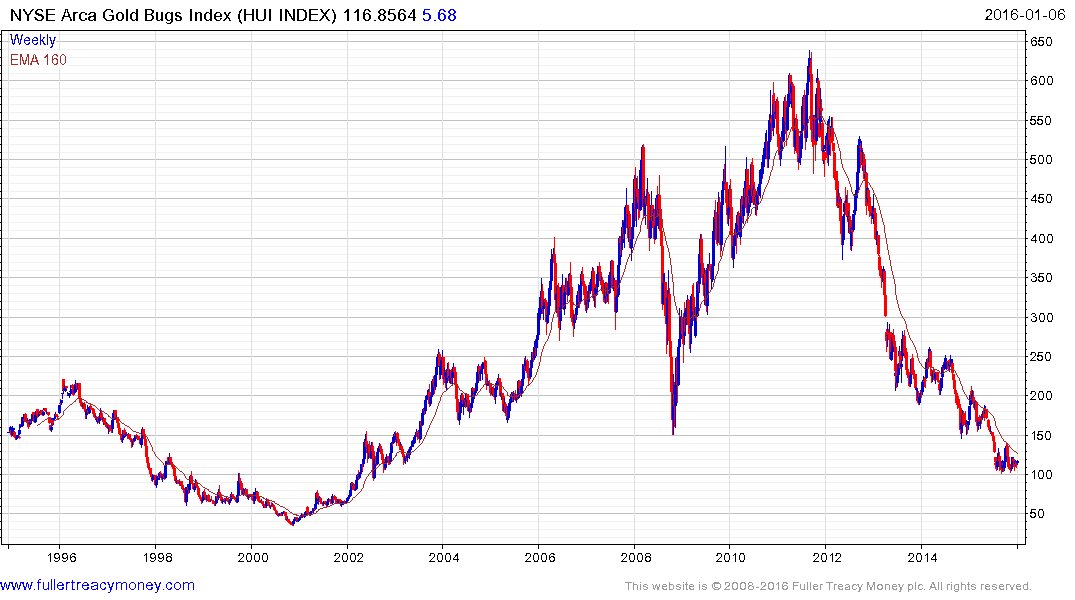

Gold shares are trading at their lowest level relative to the gold price in at least 25 years.

.png)

In absolute terms the NYSE Arca Gold Miners Index is not quite as low as it was in 2000 but it has definitely already fallen a long way.

The focus today is the lowest all-in cost of production because there is no room for anyone talking about production that breaks even at today’s levels not least because there is so much uncertainty in the commodity space particularly against a background of such a strong Dollar.

Gold remains steady above $1050 and has attracted interest this week with the uptick in geopolitical pressure. It will need to sustain a move above $1150 to break the medium-term downtrend. However as long as prices hold above $1000 the outlook for select gold miners may be more favourable that it has been over the last couple of years. Relative performance against the current background is generally an indication that a company’s fundamentals are better than those of competitors.

Gold Standard Ventures does not yet have earning but has rallied impressively over the last two months to close in on the C$1 area. Some consolidation is possible but a sustained move below the 200-day MA would be required to question potential for additional upside.

NovaGold is a high probability explorer engaged in a joint venture with Barrick to develop a promising mine in Alaska but does not yet have any earnings. The share is currently trading near the upper side of a three-year base and a sustained move below the trend mean would be required to question potential for a successful breakout.

Canadian listed Claude Resources (Est P/E 6.05 DY N/A) has been ranging with a mild upward bias, in what appears to be a first step above its base. It hit a new three-year high today and a sustained move below the trend would be required to question medium-term upside potential.

Seabridge Gold is a development stage miner. The share failed to sustain the break to new lows in July and has since rallied back to test the upper side of the base formation and posted new two-year highs today.

UK listed Centamin Gold (Est P/E 14.21, DY 2.92%) has been trading in a triangular pattern for 18 months and is now rallying back to test the most recent lower rally high. A sustained break above 70p would signal a return to demand dominance beyond the short term.

Highland Gold Mining hit an important low in early 2015 and has since held a progression of higher reaction lows. It found near-term support in the region of the 200-day MA from late November and a sustained move below 50p would be required to question potential for additional upside.

US listed Harmony Gold posted a loss for 2015 and does not pay a dividend. The share found support near 50¢ in November and rallied today to push back above the 200-day MA for the first time in a year. A clear downward dynamic would be required to check momentum.

Australian listed Evolution Mining (Est P/E 7.3, DY 1.43%) has held a progression of higher reaction lows for more than a year and has returned this week to test the region of the trend mean.