Shipping's $500 Billion Profit Can Take on Amazon

This article from Bloomberg may be of interest to subscribers. Here is a section:

Besides splurging on dividends and share repurchases, the once-scarcely profitable container lines are planning to use this once-in-a-lifetime haul for acquisitions and investments. Some aim to turn themselves into end-to-end logistics giants, in the vein of Amazon.com Inc. or FedEx Corp.

In theory, this should make them more resilient when shipping freight rates normalize, which is bound to happen one day. Shipping costs have already come down a bit, but due, in part, to the spread of omicron in China, some industry observers now don’t expect port congestion to ease until next year.

Of course, the big risk is these hungry hippos waste their epic windfall on empire building, and an industry that’s already on the defensive due to its inflation-stoking profiteering may end up stoking an even greater political backlash.

It’s a sign of how the ambitions of the shipping industry have been transformed that a container liner joining forces with an airline no longer seems unusual: Mediterranean Shipping Co. is angling to acquire a controlling stake in Italian flag carrier ITA Airways, while the billionaire principal shareholder of Germany’s Hapag Lloyd, Klaus-Micheal Kuehne, has built a 10% stake in Lufthansa AG. In addition to expanding its own air-cargo fleet, Maersk agreed to acquire air-freight forwarding specialist Senator International in November.

The two things that bring down shipping rates are softer demand from lower economic growth and a surge in supply of new ships. If shipping companies are spending some of their windfall on logistics or airlines, that does nothing to increase the supply of new ships.

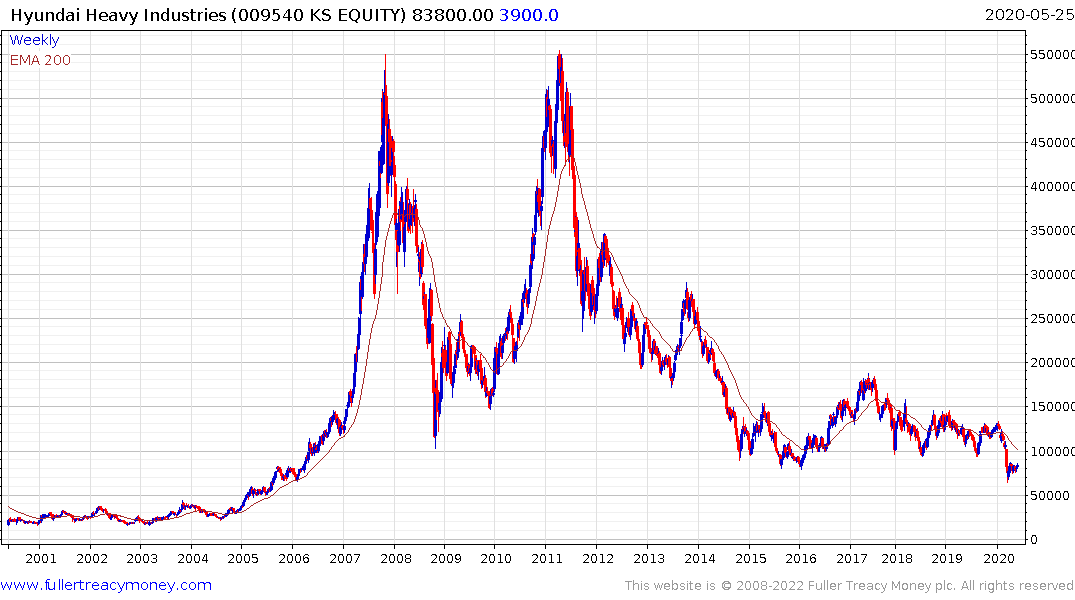

Hyundai Heavy and Samsung heavy are some of the largest ship builders. Their respective share prices don’t indicate ship building has suddenly turned into a highly profitable venture. That’s a sharp contrast with the demand for new ships following the last big boom for shipping rates. It suggests the market is not about to be overcome with new supply.

That suggests the shipping sector will remain leveraged to global growth. Container rates hit a medium-term peak in September while Dry Bulk rates continue to recover.

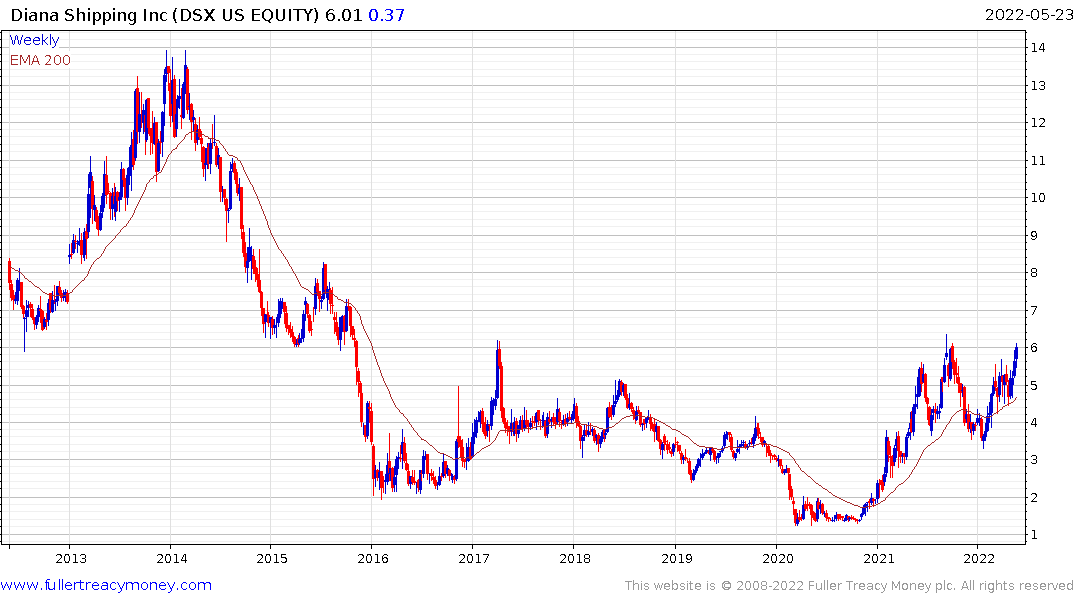

The broad global shipping sector remains on a recovery trajectory. Diana Shipping (dry bulk) is at the upper side of a first step above the base. Textainer (containers) is bouncing from a short-term oversold condition. Teekay Tankers (crude oil carriers) is extending the breakout from its two-year range.