Scolding Greece, guess who IMF says needs fiscal stimulus?

This article appeared in today’s Sydney Morning Herald and may be of interest to subscribers. Here is a section

While the Reserve Bank has its foot to the floor with a record-low 2 per cent cash rate to aid an economy headed for a sixth year of sub-trend growth since 2008, the government is tapping the brakes as it tries to bring the budget back into balance by the end of the decade. Trend growth is regarded by analysts as a kind of speed limit -- faster than that and the economy starts stoking inflation.

Australia's over-reliance on monetary policy is spilling into the Sydney and Melbourne property markets, where prices jumped in June in response to a rate cut a month earlier.

"We've got the balance right in relation to fiscal policy," Treasurer Joe Hockey told Bloomberg on Tuesday. "We're on track with a fiscal consolidation of around half a per cent of GDP every year to get back to surplus. But we have the capacity to do what is necessary to keep the Australian economy going through a record run."

This is at odds with calls from institutions at home and abroad for increased government spending on capital projects including public transport and roads to alleviate traffic bottlenecks in the country's largest cities.

"Australia does have fiscal space, we think it would be useful to have higher public investment," said James Daniel, the IMF's mission chief for Australia, on June 24. "That would help in the longer term to increase productivity, and in the shorter term it would help boost demand."

One of the reasons the Australian stock market has such a choppy uptrend compared to the S&P 500 for example is because of the divergence in policy between the government and the central bank. The RBA’s largesse is a tailwind but the fiscal constraint exhibited by the government is a headwind. The result has been an inconsistent uptrend defined by a progression of higher major reaction lows.

The S&P/ASX/200 bounced from the 5400 region this week and will need to sustain a move above the 200-day MA, currently near 5600, to signal more than temporary support has been found.

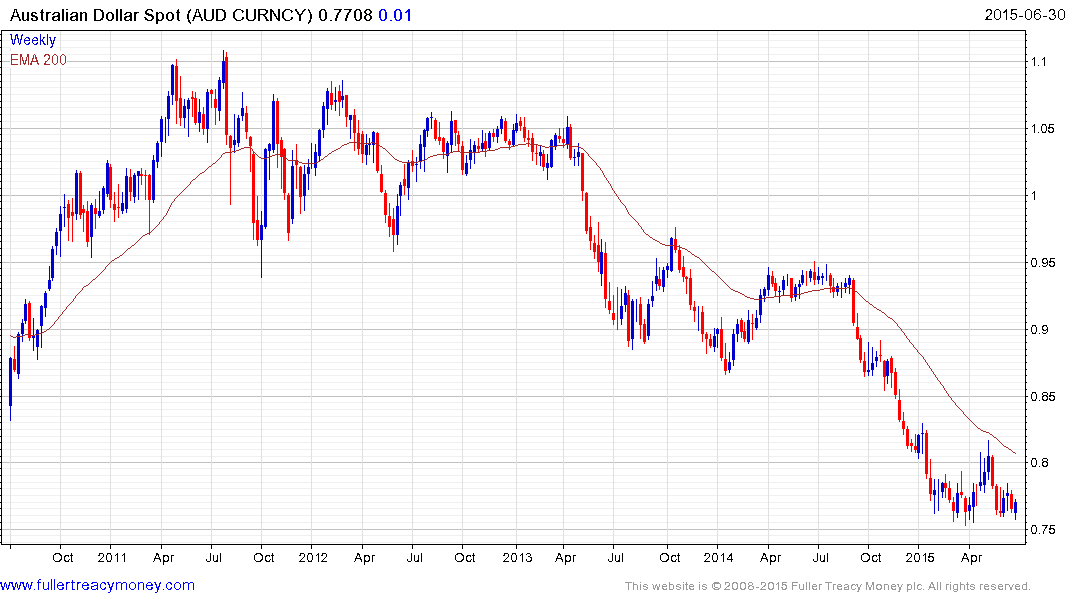

The Australian Dollar remains reasonably steady above 76¢ but a sustained move above the 200-day MA would be required to begin to suggest a return to demand dominance.