In Gold we Trust 2015

Thanks to a subscriber for this detailed heavyweight report from Ronald Peter Stoeferle at Incrementum AG which may be of interest. Here is section:

Let us draw a comparison: if you were sitting in a rowboat in stormy seas, would you say that the lighthouse is moving from side to side and up and down? Or would you employ a rubber band as a tape measure? Certainly not, and for good reasons, as the lighthouse and steel are stable, and waves and rubber bands are not. The relationship between gold and paper currencies is roughly analogous.

This is not to say that the exchange value of gold would be perfectly stable. It would change over time, depending on the growth in the supply of gold, the change in the demand to hold cash balances, and the growth in goods and services on the market. However, given its much lower as well as easily foreseeable annual supply growth rate, it would be far more stable than paper currencies.

Ludwig von Mises always argued that money is a good like any other. It differentiates itself by one important characteristic: Money is the generally accepted medium of exchange, because it is the most marketable good. According to Mises, money's function as a medium of exchange is thus the central one, while its store of value and unit of account functions are merely subordinate functions (they are derived from, or implied by the central function). This also implies that a rising money supply must lower the exchange value of money.35

In 1913, the population of the US was 97 million. The monetary aggregate M3 at the time amounted to approx. USD 20 billion, i.e., USD 210 per capita. Currently the population of the US is 318.9 million, while the monetary aggregate M3 has increased to USD. 17.8 trillion. This translates into a money stock of USD 55,817 per capita.

Here is a link to the full report.

Many of the arguments that speak to gold’s appeal as a financial resource resemble the arguments for the existence of Platonic ideals. Gold will hold its purchasing power over the long haul, gold does not represent a debt or reliance on cash flows, gold is immutable, has historic appeal, was the original money and cannot simply be printed or lent into existence. All of this is true.

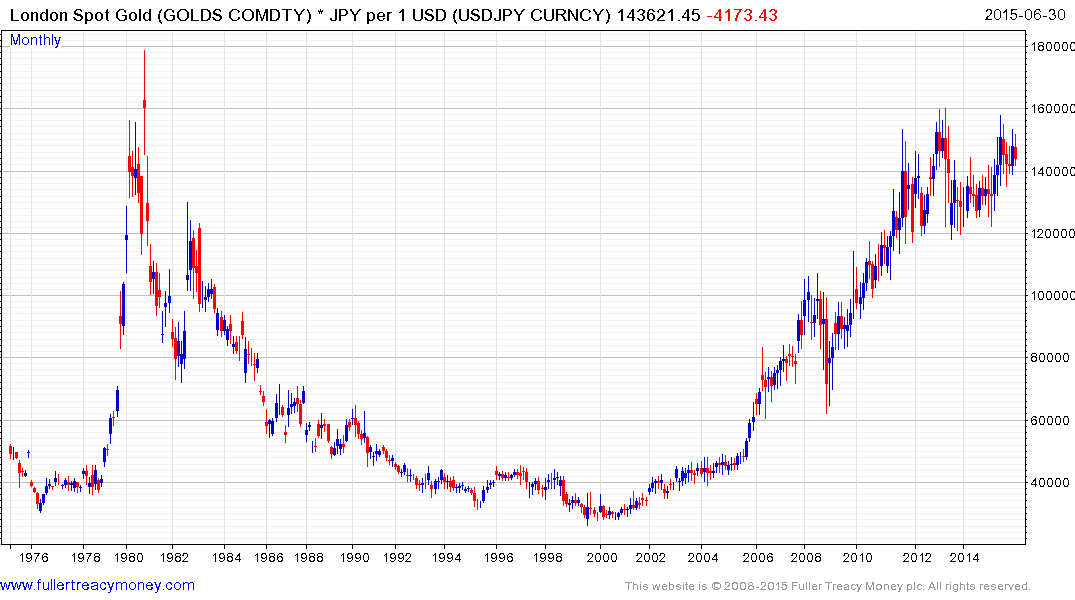

However as with so much in life we do not live in the black and white of idealistic arguments but in the grey of compromise. Gold has been remonetised in the eyes of investors and experienced an impressive decade-long bull market when it was appreciating in just about every currency. Since 2011 it has no longer been the best performing currency. Due to its relative stability, profligacy of the BoJ and ECB and the weakness of commodity currencies it has performed best when redenominated to currencies other than the US Dollar.

For example contrast these charts of Gold in Japanese Yen, Euro, Australian Dollar and US Dollars.

.png)

.png)

.png)

The US Dollar has broken a long-term downtrend so it is more difficult for gold to outperform against it. A sustained move above the $1200 area will be required to begin to suggest a return to gold dominance.

Elsewhere in the precious metals sector palladium has developed a short-term oversold condition following a steep seven-week decline and found at least short-term support today.

Back to top