Rupee Jumps to 4-Month High as Patel Begins Innings as RBI Chief

This article by Nupur Acharya for Bloomberg may be of interest to subscribers. Here is a section:

Indian sovereign bonds also advanced on Tuesday. Urjit Patel assumed charge as the Reserve Bank of India’s 24th governor on Sept. 4, succeeding Raghuram Rajan. Patel’s first test will come Oct. 4 -- a scheduled monetary policy review -- where investors will gauge if governorship reduces his traditional reticence.

“An interest-rate increase by the Fed is unlikely,” said Rohan Lasrado, Mumbai-based head of foreign-exchange trading at RBL Bank Ltd. “Inflows into stocks remain strong and that’s supporting the rupee.”

The rupee climbed 0.5 percent to 66.5250 a dollar at the close in Mumbai, according to prices from local banks compiled by Bloomberg. It rose to 66.49 earlier, the strongest level since May 9. Tuesday’s gain reduced the currency’s 2016 loss to 0.6 percent, Asia’s worst performance after China’s yuan. RBL Bank expects the rupee to appreciate to 66.40 a dollar in the near term should equity flows sustain their momentum, Lasrado said.

“We don’t expect a change in the RBI’s foreign-exchange management under the new leadership,” he said. “They will love to buy dollars at dips and refrain from intervening should the rupee weaken in line with Asian fundamentals.”

The RBI engaged in a reserve accumulation policy which put pressure on the Rupee between mid-2014 and early this year when the currency tested its spike lows against the US Dollar. However it has stabilised over the last six months with the 6.5% base rate looking increasingly attractive in an environment where so many government bonds are trading on negative yields.

10-year Indian Government Bond yields are testing the 7% area which marked important support in 2013 but a clear upward dynamic would be required to check the medium-term trend of compression.

The Bombay Banks Index posted a large upside weekly key reversal in February and has trended consistently higher since. It hit a new closing high today and, while overextended relative to the trend mean, a break in the progression of higher reaction lows would be required to begin to question potential for additional upside.

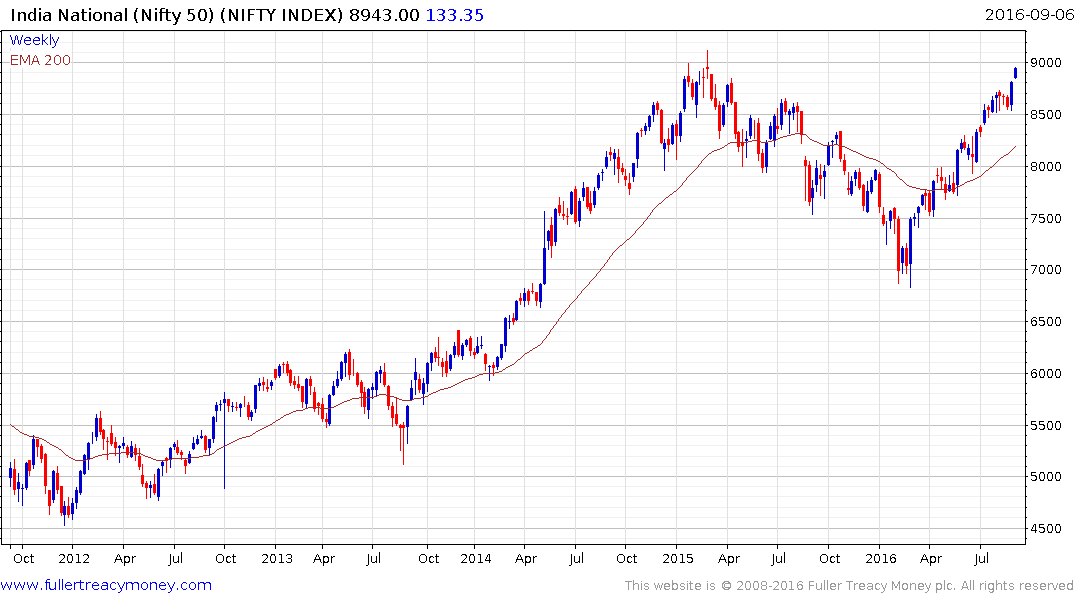

The Nifty 50 is also back testing its highs and a resounding downward dynamic would be required for this area to offer anything other than a temporary area of resistance