China's Productivity Growth is the Worst Since the Asia Crisis

This article from Bloomberg News may be of interest to subscribers. Here is a section:

Labor productivity in the world's second-largest economy increased 6.6 percent last year to $7,318 per person, National Bureau of Statistics and International Labour Organization data show. The level, calculated as average inflation-adjusted gross domestic product per employed person per year, measures the efficiency of workers economy-wide.

China kicked off a big surge in efficiency in the early 2000s after entering the World Trade Organization, implementing aggressive reforms to streamline state corporations and allowing more of a private real estate market. But even after those gains it still lags far behind more productive economies in Europe, Japan and the U.S.

With a shrinking working-age population already hurting economic growth, China must boost the value created by each worker if it is to join the ranks of the world's wealthy economies. The hope is that upgraded machinery, services sector advances and a shift up the value chain will help make workers more efficient--and maybe even shorten the badminton lunches.

At over $7000 per person China is squarely in the middle income bracket of global economies. However that figure is distorted by the inequality evident within a population of over 1 billion where extraordinary wealth contrasts with profound poverty in the hinterland. If China is going to march towards continued standard of living improvements then productivity growth will need to continue and that will be contingent on government appetite for economic reform.

Efforts so far have focused on both fiscal and monetary accommodation, which has depressed the Yuan but supported the stock market following last year’s surge and crash. The banking sector is back trading above the trend mean since surging in July but will need to hold the move during the current consolidation if potential for continued higher to lateral ranging is to be given the benefit of the doubt. As the primary agent of government intervention the banking sector is a reasonably useful barometer of commitment to support the market.

The CSI300 (P/E 15.41, DY 2.15%) firmed today from the region of the trend mean and a sustained move below it would be required to question potential for additional upside.

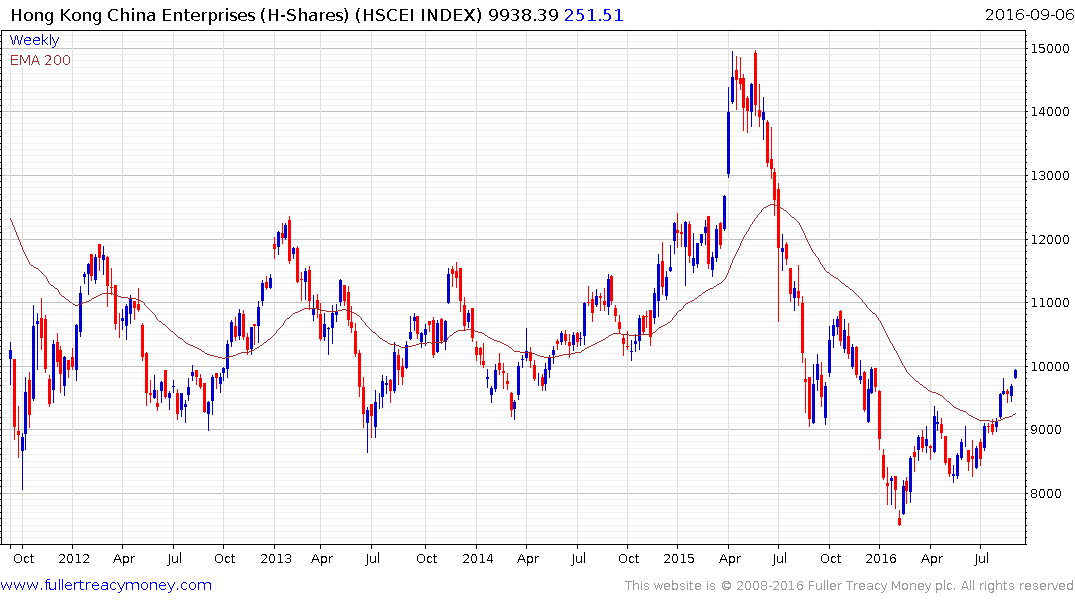

The Hang Seng China Enterprises (P/E 8.52, DY 3.71%) Index continues to outperform and was given an additional tailwind by underwhelming US earnings growth figures which pushed out expectations for a rate hike. A clear downward dynamic would be required to question momentum beyond a brief pause.