Room to Grow

Thanks to a subscriber for this report from Goldman Sachs which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

Historically, there have been three recession triggers in the US. None are being set off at this time:

1. Aggressive tightening of monetary policy by the Federal Reserve

– Tightening monetary policy contributed to nine of the 11 recessions in the post-WWII period.

2. Economic and financial market imbalances

– Real estate imbalances and excessive valuations and leverage contributed to the three recessions since 1990.

3. Significant domestic and non-US exogenous shocks

– The Arab oil embargo in 1973 and the Iran-Iraq War in 1980 each led to supply shocks and a near-tripling of oil prices, triggering recessions.

In the three longest expansions preceding the current one, the expansion was extended when the Federal Reserve reversed course and lowered the federal funds rate. We believe the Federal Reserve’s mid-cycle adjustment to its tightening cycle in 2019 will extend the life of this expansion for at least another year and possibly beyond 2020.

It is fair to conclude from the valuations on stock markets that after a decade on the upside we are late in the cycle but that does not mean we are at the end. The number of loss-making companies listing on the stock market is similar to what was seen in 1999 and there has certainly been some malinvestment in the private sector, not least by Softbank.

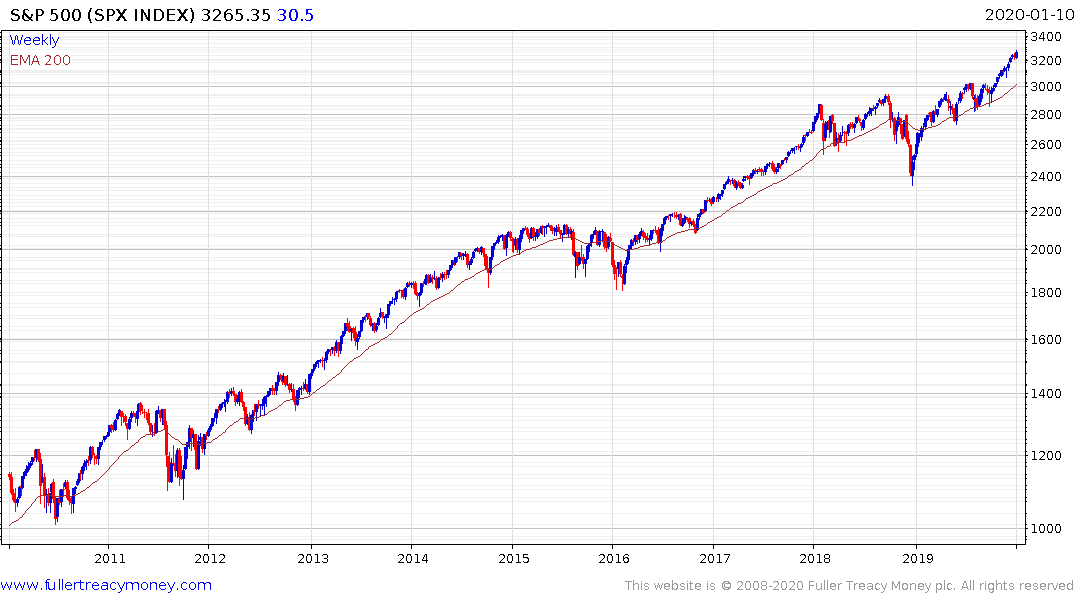

The stock market itself is one of the best lead indicators we have and when long-term base formations or lengthy medium-term ranges are being resolved on the upside that is not evidence of topping activity. In fact, the strength of the breakouts, particularly on Wall Street is about the clearest sign bulls might wish for to support the view we are in the midst of an additional leg higher in what has been a consistent sequence of 18-24-month ranges followed by persistent breakouts.

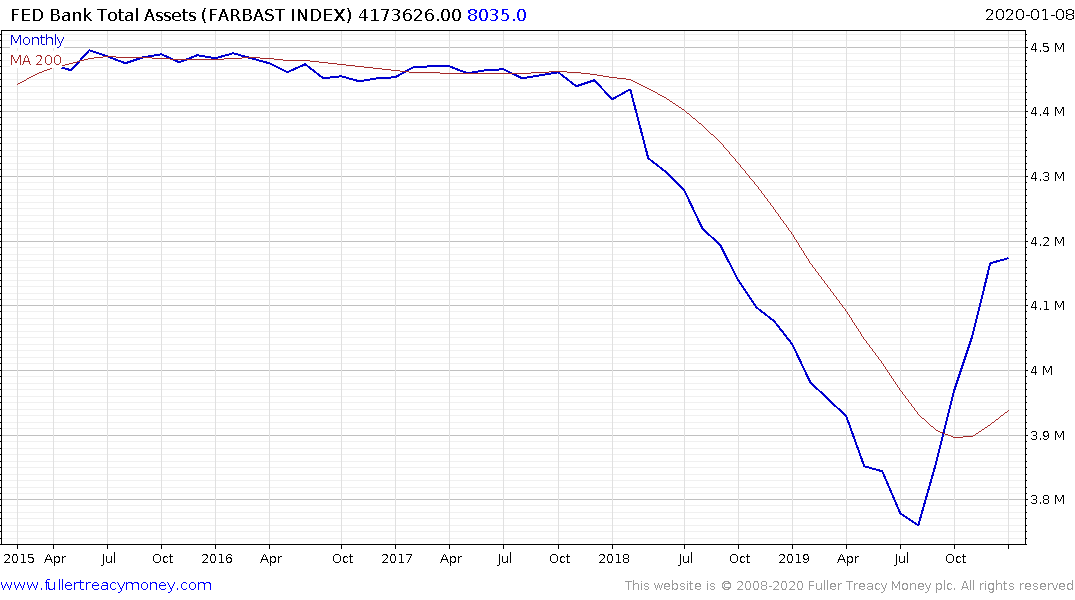

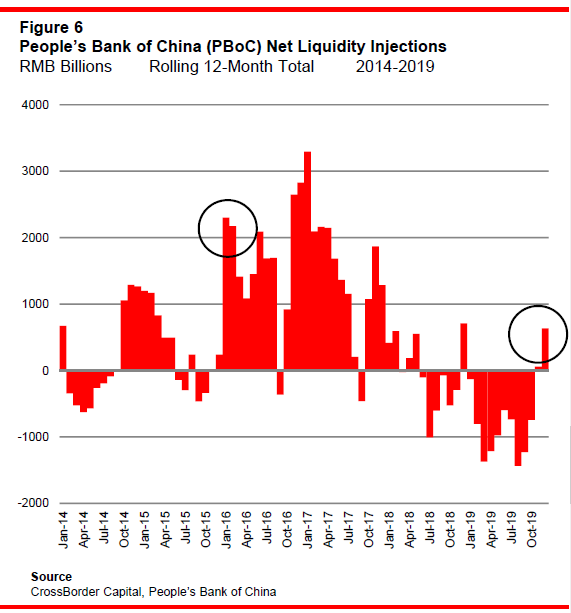

Liquidity remains the fuel driving the bull market so it needs to be monitored. China has been battling the shadow banking sector for nearly three years and that process now appears to be winding down with liquidity increasing once more. The real measure of persistence will be whether this lasts beyond the first quarter when the majority loans are allocated. Concurrently the Federal Reserve has added $400 billion to its balance sheet since October. That is highly stimulative procyclical policy and is supportive of the evolving argument that a bubble is inflating.