Riverfront The Weekly View

This note by Chris Konstantious may be of interest to subscribers. Here is a section:

However, currency markets attempt to discount future changes in fundamentals at least as much as the current state of fundamentals; in this regard, it’s possible that the U.S. economy is about as strong as it can get in this cycle, a these we touched on last week’s Weekly View (9.3.18, “Consumer Confidence – As Good As It Gets?”). Inflation is one item that could eventually cause issues for the dollar; with U.S. core-CPI running at nearly 2.4% and headline inflation at 2.9%, the market may start to price in a weakening of the relative real rate attractiveness for the U.S. going forward, damaging dollar sentiment.

In addition, political uncertainty may be increasing in the U.S. It’s our belief that headline political risk factors are more priced into currencies likely the pound with Brexit concerns and the euro with Italian political issues, as well as many emerging market currencies, than with the dollar. An increase in political uncertainty in the U.S. is not outside the realm of possibility, given controversies constantly swirling around the current Administration.

Then there’s the longer-term matter of the U.S.’s twin deficits; with the U/S. running a large budget deficit as well as a current account deficit, and a potential trillion dollar hole in the budget deficit by 2020 (see our Strategic View on 2.27.18 for more on this topic), it’s possible that in the future the market may not still be willing to give the U.S. the ‘benefit of the doubt’ as it relates to the ability to run more fiscally balanced budgets going forward. The historical playbook in FX suggests that most nations’ currencies eventually must pay the price for extended fiscal profligacy.

Here is a link to the note.

Here is a section from it:

However, currency markets attempt to discount future changes in fundamentals at least as much as the current state of fundamentals; in this regard, it’s possible that the U.S. economy is about as strong as it can get in this cycle, a these we touched on last week’s Weekly View (9.3.18, “Consumer Confidence – As Good As It Gets?”). Inflation is one item that could eventually cause issues for the dollar; with U.S. core-CPI running at nearly 2.4% and headline inflation at 2.9%, the market may start to price in a weakening of the relative real rate attractiveness for the U.S. going forward, damaging dollar sentiment.

In addition, political uncertainty may be increasing in the U.S. It’s our belief that headline political risk factors are more priced into currencies likely the pound with Brexit concerns and the euro with Italian political issues, as well as many emerging market currencies, than with the dollar. An increase in political uncertainty in the U.S. is not outside the realm of possibility, given controversies constantly swirling around the current Administration.

Then there’s the longer-term matter of the U.S.’s twin deficits; with the U/S. running a large budget deficit as well as a current account deficit, and a potential trillion dollar hole in the budget deficit by 2020 (see our Strategic View on 2.27.18 for more on this topic), it’s possible that in the future the market may not still be willing to give the U.S. the ‘benefit of the doubt’ as it relates to the ability to run more fiscally balanced budgets going forward. The historical playbook in FX suggests that most nations’ currencies eventually must pay the price for extended fiscal profligacy.

The USA has transitioned from monetary to fiscal stimulus which is not something other countries have been willing to do. Additionally, the change to the tax code which favoured companies by lowering tax rates and reducing the penalty to bring cash home has resulted in fresh demand for the Dollar while also reducing demand for other countries’ currencies because of the fall off in corporate debt issuance.

The tax cut for consumers has also helped to bolster the domestic economy and growth has been picking up. I agree this so called ‘sugar high’ is not going to last forever and the 2-year yield suggest the bond market is reluctant to look at interest rates hikes beyond the first quarter. However, we have to also consider when the ECB is going to raise interest rates. Considering the exposure the region has to Italy, Turkey and China it could be longer than many expect.

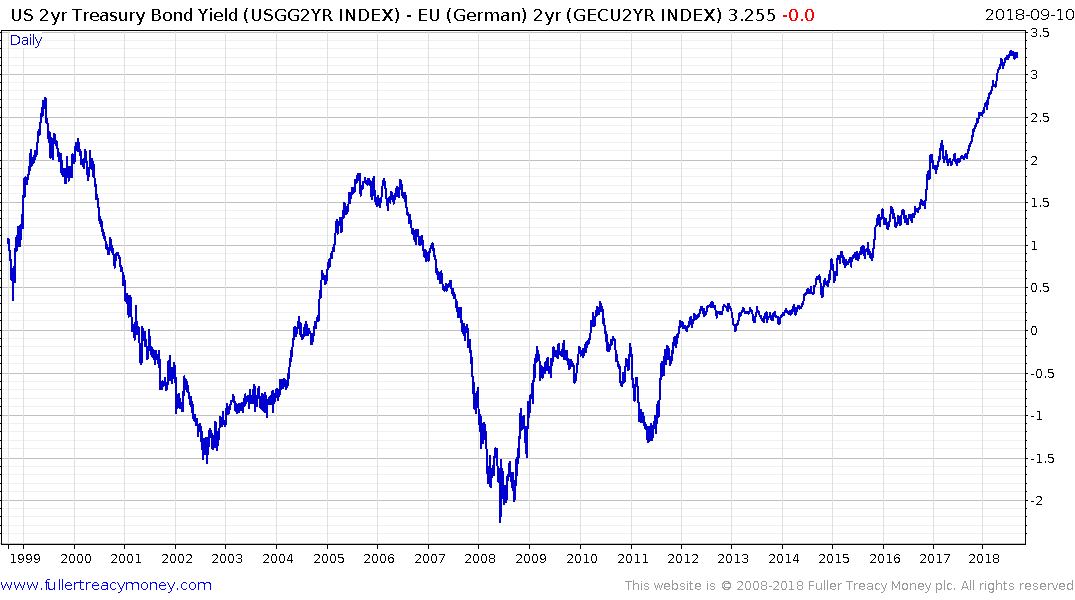

German 2-year yields are still at a negative 53 basis points in absolute terms.

When we look at the spread between the two rates is still trending higher in a consistent manner and is at the highest level in 20 years. As long as the spread is trending higher it will represent a headwind to the Euro.

Meanwhile the Euro will need to sustain a move back above the trend mean to question its downward bias.