How Should China Respond to Changing U.S. Attitudes?

This article by Fu Ying, vice chairperson of the Foreign Affairs Committee of China's National People's Congress, and of the Academic Committee of China's Institute of International Strategy at the Chinese Academy of Social Sciences may be of interest to subscribers not least because it appeared on Bloomberg and appears to speak directly to investors. Here is a section:

In fact, changes in U.S.-China relations may help to push China’s own desired reforms. Some requests raised by U.S. companies, such as increased market access, dovetail with recommendations from China’s leaders. The government is, in fact, opening up: Eight out of the 11 market-opening measures announced by President Xi Jinping in April have been put in place, covering banking, securities, insurance, credit rating, credit investigation and payment, and so on. The government is also working harder to improve the business environment and strengthen intellectual property protections for both Chinese and foreign enterprises. Chinese reformers can turn outside pressure to their advantage, using it to bust through internal

resistance to necessary changes.

But make no mistake: The Chinese people will stand firm against U.S. bullying over trade. There is talk about China’s economy “sliding down” as a result of the trade war. Some expect China to succumb soon. I can tell you that this is wishful thinking.Yes, China is in the process of deleveraging, which is uncomfortable and painful. But it is a price worth paying for sustaining healthy development. It’s worth remembering that China adopted a stimulus program to help overcome the global recession triggered by the 2008 financial tsunami in the U.S. And it’s worth noting that the trade war may slow the necessary process of deleveraging.

China is now the self-appointed champion of free markets and international trade not least because is has most to lose from any change to the global market equilibrium. The opening up of protected sectors within the Chinese economy are focused on the most heavily overleveraged sectors, where a desire from fresh capital and risk sharing is a priority. There is no sign that the higher growth areas of the economy are suddenly going to become open for foreign investment or that China’s domestic champions are ready for international competition in their home market.

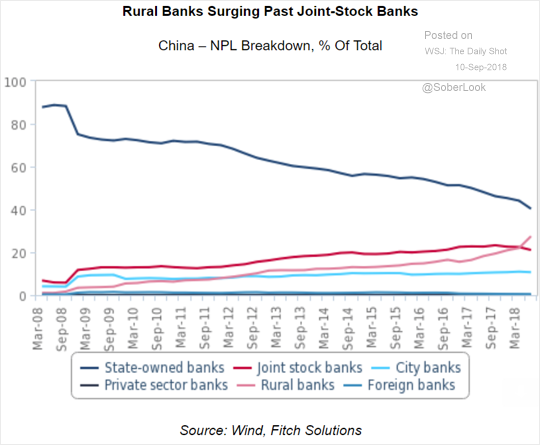

The deleveraging process currently underway in China is taking a toll on the currency, stock market and government bonds are rising. The unlisted regional banking sector, which is much more heavily leveraged than the large state-owned sector, has seen its nonperforming loans accelerated since defaults were permitted approximately 18 months ago.

Historically rallies in Chinese stocks have been state sponsored and downward pressure is likely to persist until the Xi administration deems it necessary to support the market again.

For decades the USA played along to get along while China engaged in industrial espionage, protectionism and artificial supports for its industries in order to capture market share. Now that the laissez faire stance is being challenged, it is truly a looming question what exactly China is going to do about it without hurting itself.

Back to top