Review of Bank relative performance

There has been a great deal of stress in the European banking sector, the UK is still mired in an increasingly emotional discussion about the fate of London’s financial centre and the introduction of a major change to US money market funds has just occurred. With so much going on I thought it might be instructive to review the relative performance of banking sectors to their respective markets.

Despite the fact banks have become the sector everyone loves to hate, and not without some justification considering the shenanigans that have gone on, it is important to remember that banks are liquidity providers. Considering their influence on the commercial and retail sector, the ability of banks to profit from their activities and their willingness to lend are important factors in sustaining the flow of liquidity that helps to fuel bull markets. There is no denying that over the last decade central banks have taken on many of the responsibilities for liquidity provision that have previously been outsourced to banks. However the financial sector still retains an important position in every economy, so their shares are worth keeping an eye on for signs of underperformance.

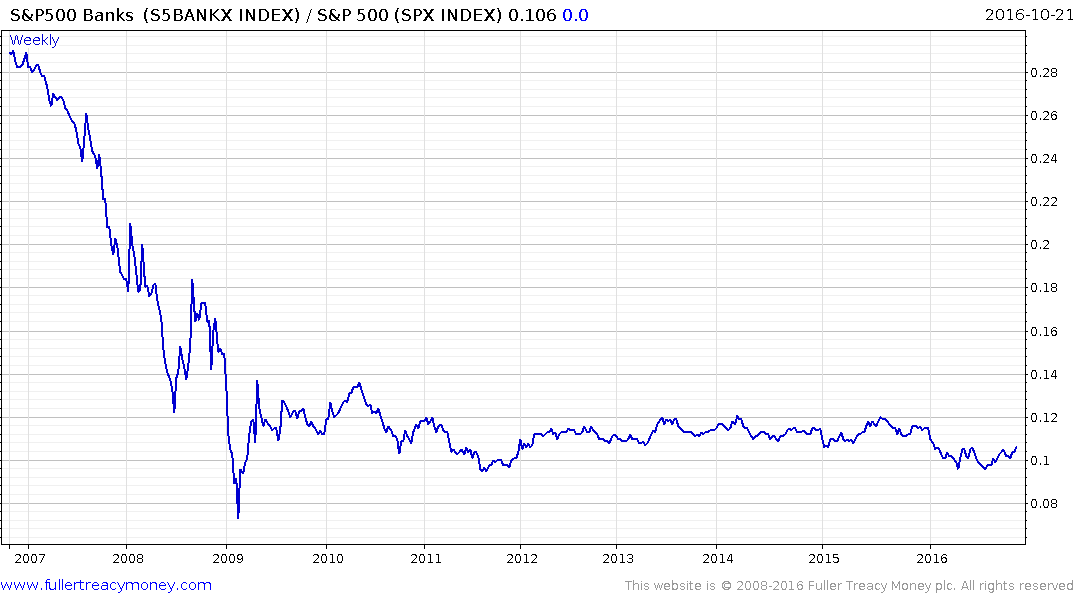

The S&P500 Banks Index / S&P 500 Index ratio has been relatively stable for most of this year, despite some notable banking scandals, and is now testing the upper side of its range. A breakout to new 12-month highs would signal a return to outperformance beyond the short term.

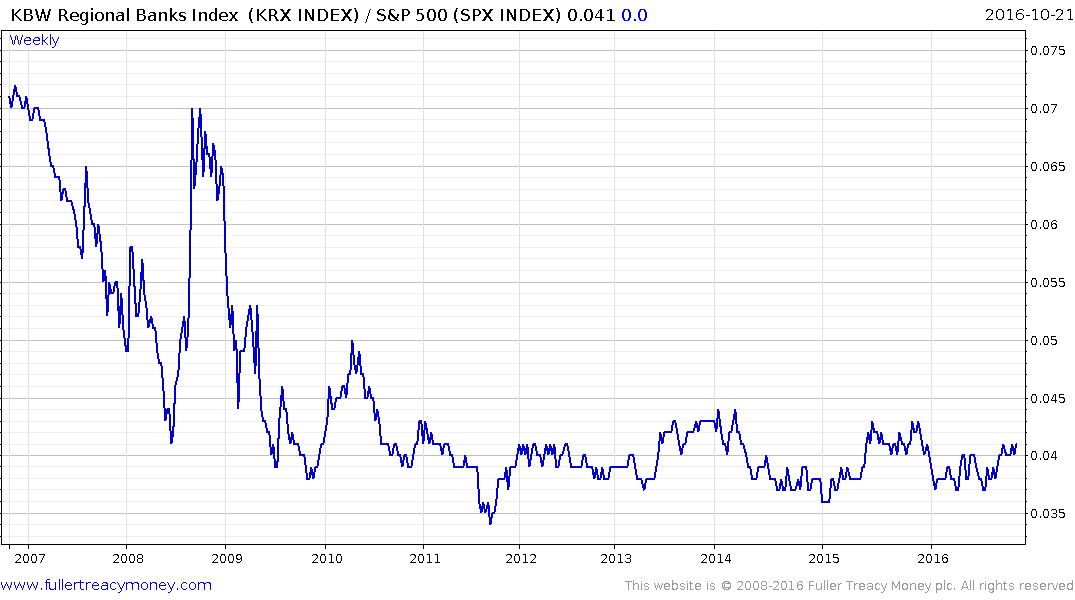

The KBW regional Banks Index / S&P500 Index ratio moved to a new high for the year a month ago and is now pressuring the upper side of its short-term range suggesting additional higher to lateral ranging within the five-year congestion area is looking more likely than not.

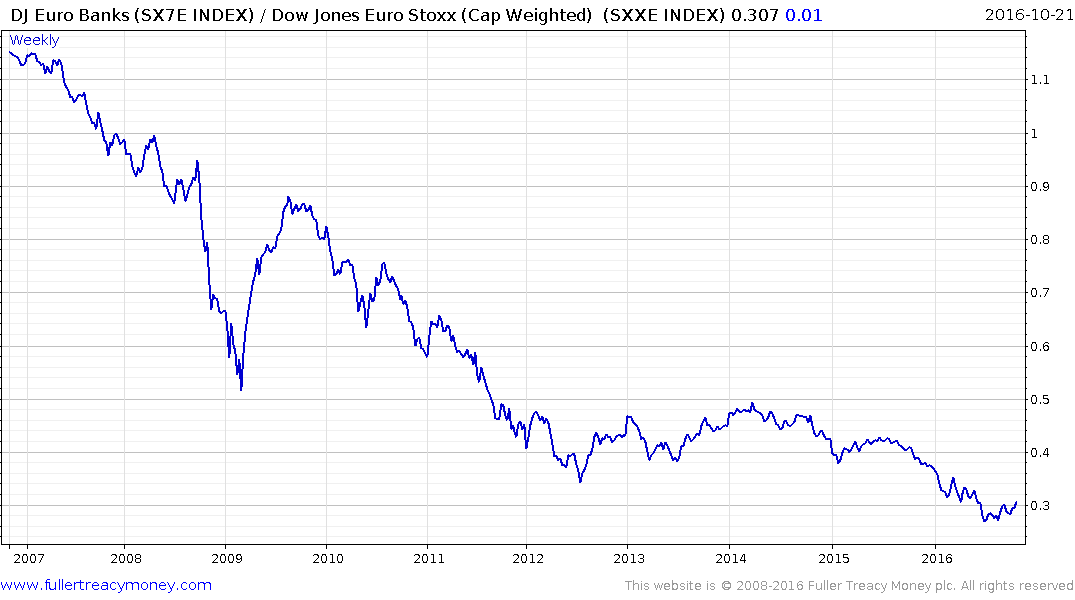

The Dow Jones Euro STOXX Banks Index / Dow Jones Euro Stoxx Index ratio trended consistently lower for more than two years but has stabilised over the last couple of months as a mean reversionary rally has taken hold. A sustained move above 0.35 will be required to break the medium-term progression of lower rally highs.

The FTSE-350 Banks Index / FTSE-350 Index ratio trended lower for three years before breaking down to new reaction lows in late 2015. It has stabilised over the last few months and a sustained move above 1 would signal return to demand dominance beyond short-term steadying.

The Swiss Banks Index / Swiss Market index has also at least stabilised but needs to hold the short-term progression of higher reaction lows if potential for additional outperformance is to be given the benefit of the doubt.

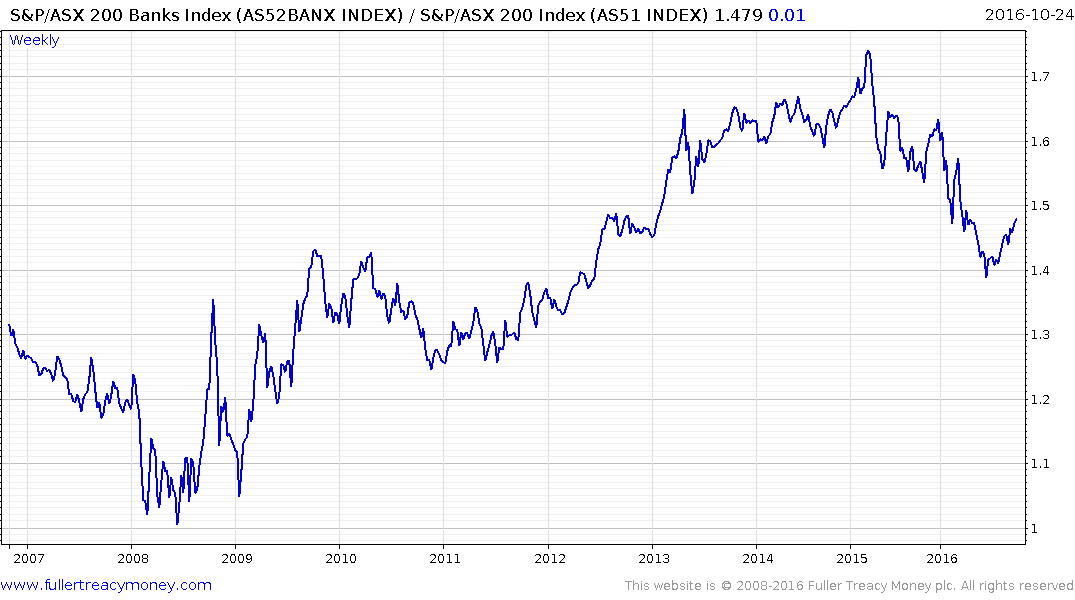

The S&P/ASX200 Banks Index / S&P/ASX200 Index ratio trended lower for 18-month and broke its medium-term uptrend in the process. The ratio is currently engaged in a reversionary rally but will need to sustain a move above 1.5 to signal a return to outperformance beyond the short term.

The S&P/TSX Financials Index / S&P/TSX Index ratio has been trending highs since 2011 and the medium-term progression of higher reaction lows will need to hold if Canadian Banks are to continue to outperform the wider market.

The Topix Banks Index / Topix Index staged an impressive relative rally mid-year but needs to hold above 0.1 during the current consolidation to signal a return to demand dominance beyond the short-term.

The FTSE/Xinhua A600 Banks Index / CSI 300 Index ratio has been mostly rangebound this year not least because the sector represents such a large weighting in the wider index.

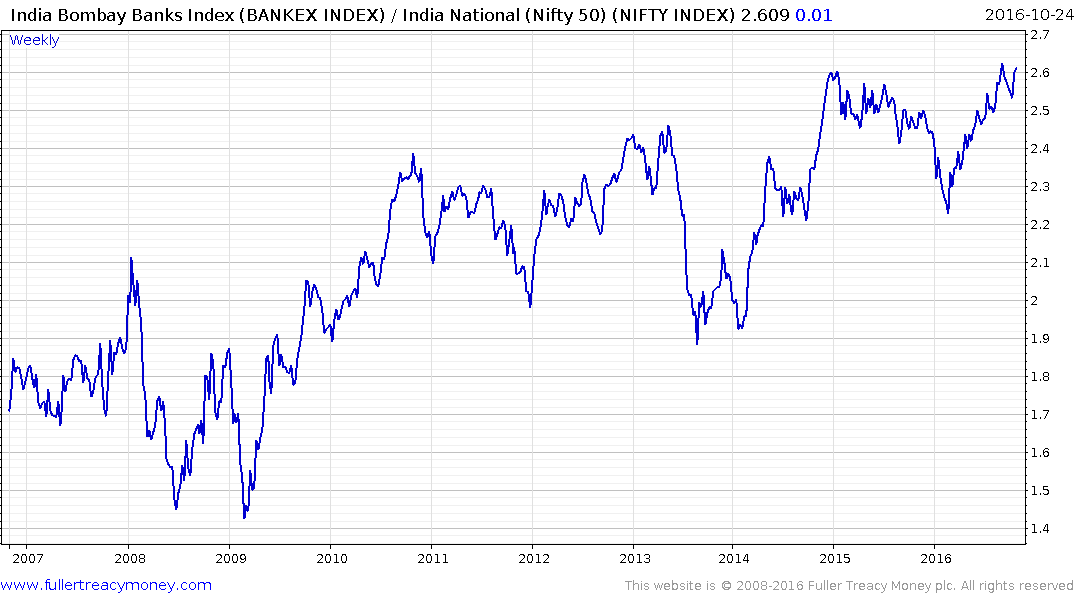

The Bombay Banks Index / Nifty 50 Index ratio is testing its highs and a sustained move below 2.52 would be required to question potential for additional outperformance. Considering how reliable a lead indicator for the wider market the Bombay Banks Index has been this is an encouraging performance.

Taken in aggregate the majority of the world’s major banking sectors have at least stabilised and India’s in particular continues to exhibit impressive relative strength. A number are engaged in reversionary rallies and the next few months will be pivotal in whether they can break medium-term downtrends. Importantly none are making new relative lows suggesting that a period of relative calm is reasonably well supported. That is particularly relative for Europe and Japan where their broad indices are testing the upper side of their yearlong respective ranges.

Back to top