Most Crowded Trade in Bonds Is a Powder Keg Ready to Blow

This article by Brian Chappatta and Anchalee Worrachate for Bloomberg may be of interest to subscribers. Here is a section:

“Rates are rising from a very, very low base, which means there’s lots of downside and very little upside” for bond prices, said Kathleen Gaffney, a Boston-based money manager at Eaton Vance Corp., which oversees $343 billion. She runs this year’s top-performing U.S. aggregate bond fund and has reduced duration and boosted cash. “If you don’t know how to time it, and I certainly don’t, you just want to get out of the way.”

The lengthiest maturities have dominated the decades-long bull market in bonds, precisely because of their higher duration. Investing in 30-year Treasuries since the turn of the century has produced a 7.8 percent annualized return, compared with 4.3 percent for the S&P 500 index. Yet that run has faltered: U.S. long bonds are on pace for their worst month since June 2015, losing 3.2 percent as yields have climbed about 0.2 percentage point.

I’ve written quite a bit about the sensitivity of bond prices to interest rates but this is the first article I’ve seen that specifically talks about the duration of the market and how that represents a risk for investors as interest rates begin to rise. What I have not yet seen is a discussion of convexity which is the influence interest rates have on the relationship between price and yield. Nevertheless it is inevitable that this will become a greater consideration as interest rates rise further.

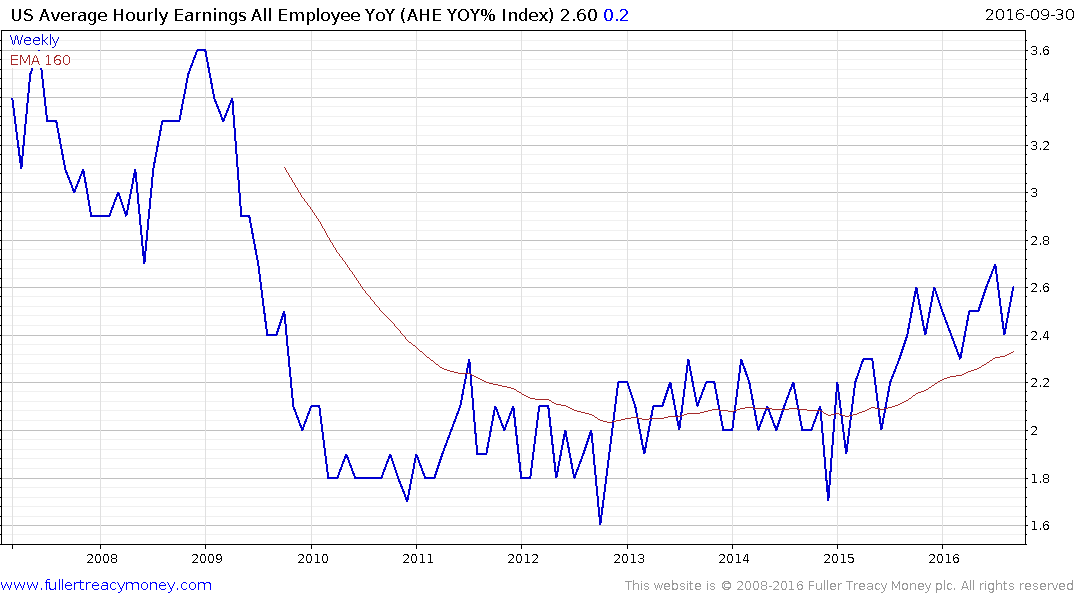

The chart of US wage growth has first step above the base characteristics. If it hits a new high on the next release (November 4th) then the Fed will be much more likely to raise rates in December.

US 10-year yields found support today in the region of the trend mean and a clear downward dynamic would be required to question potential for additional upside.