Renewed Love for Gold into Early 2017

Thanks to a subscriber for this report from RBC, dated February 13th, which may be of interest. Here is a section:

Through the first month of 2017, global commodity AUM flows have shifted course as funds have returned to precious metals and out of energy. This was a reversal in pattern from that seen through Q4/16, which saw total outflows of $20.5B in precious metals holdings and inflows of $8.4B into energy. This corresponded to a 0.7% increase in TSX weighting for precious metals to 7.3% and a 1.3% decline in energy in January. However, despite the promising start to the year for precious metals, total commodity AUM still sits 13% below the $123B seen in September 2016 and the current TSX weighting of 7.75% still sits 1.9% below the high of 9.6% seen in July 2016.

This month, we have seen an acceleration of inflows into physical gold ETFs, which we view as a positive sign fundamentally, and believe that we will continue to see inflows due to geopolitical concerns, persistence of low real rates globally, and growing US inflation expectations. We would recommend that investors focus on companies with attractive margins, solid balance sheets, organic growth opportunities and a consistent operating strategy.

Here is a link to the full report.

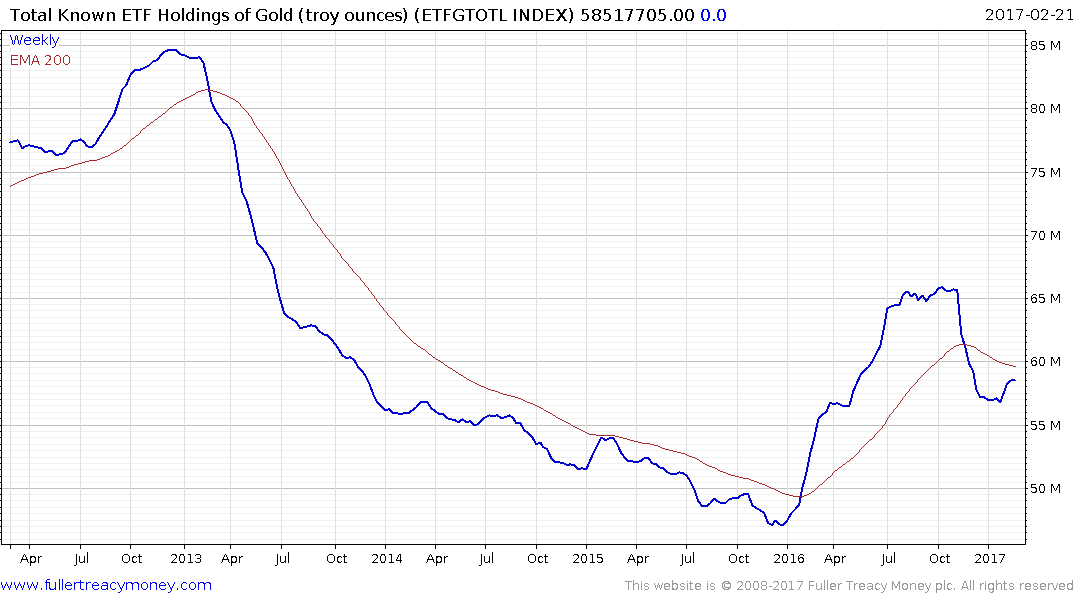

Following an impressive rally in early 2016 Total Known ETF Holdings of Gold followed the trajectory of the gold price and pulled back below the trend mean. A rally back towards 60 million ounces is currently underway and a sustained move above that level would lend credibility to the view that a low of more than temporary significance has been found.

Gold broke out of its short-term range today to hit a new recovery high and, just as importantly, is now pushing successfully above the trend mean.

.png)

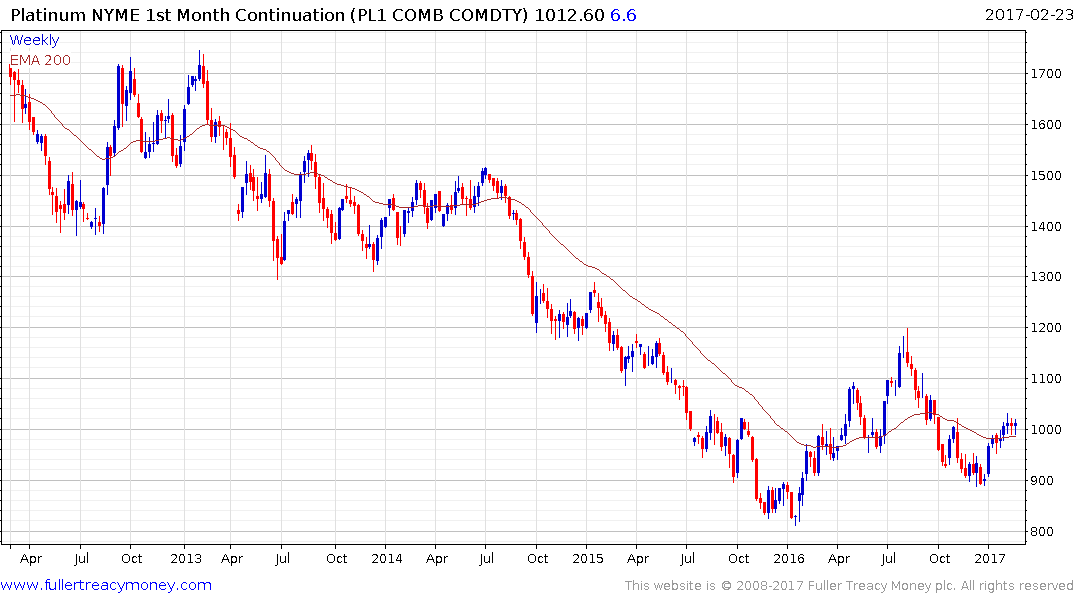

It is being led higher by silver platinum and gold shares all of which offer leverage to gold prices.

Addressing the medium-term outlook, gold experienced a clear Type-2 massive reaction against the prevailing downtrend in early 2016. As is typical with such moves a period of ranging characterised as right hand extension has ensued. The depth of the decline since July was unsettling for the bulls, especially following the six-week decline in the aftermath of the US election result. Nevertheless, veteran investors will likely be inclined to remember that gold is characteristically volatile and is best bought following deep pullbacks.

At this stage, with gold pushing above the trend mean, the potential for an additional rally to challenge the progression of lower rally highs from July, near $1300, is looking more promising. Over the medium-term the question is whether the deep pullback last year will hold up the advance for a lengthier period of ranging or whether gold will successfully move to new recovery highs this year. I suspect the answer to this question will not be confined to an examination of the gold market but will be influenced by commodities, the Dollar, equities, inflation and interest rates more generally. How well gold finds support in the region of the trend mean following any pullback will give us clues as to how dominant medium-term demand is.

With prices now successfully rallying from the above 2016 low there is a strong likelihood that $1000 represents an important medium to long-term area of support.

Back to top