NVidia to fall nearly 20% on increasing competition from AMD, high valuation, analyst says

This article by Tae Kim for CNBC may be of interest to subscribers. Here is a section:

Instinet lowered its rating on NVidia to reduce from buy, saying the company's earnings will come in below expectations this year due to a more difficult gaming graphics market.

"We believe consensus is underappreciating a slowdown in gaming and the potential negative impact to the multiple," analyst Romit Shah wrote in a note to clients Wednesday. "We recommend investors take profits."

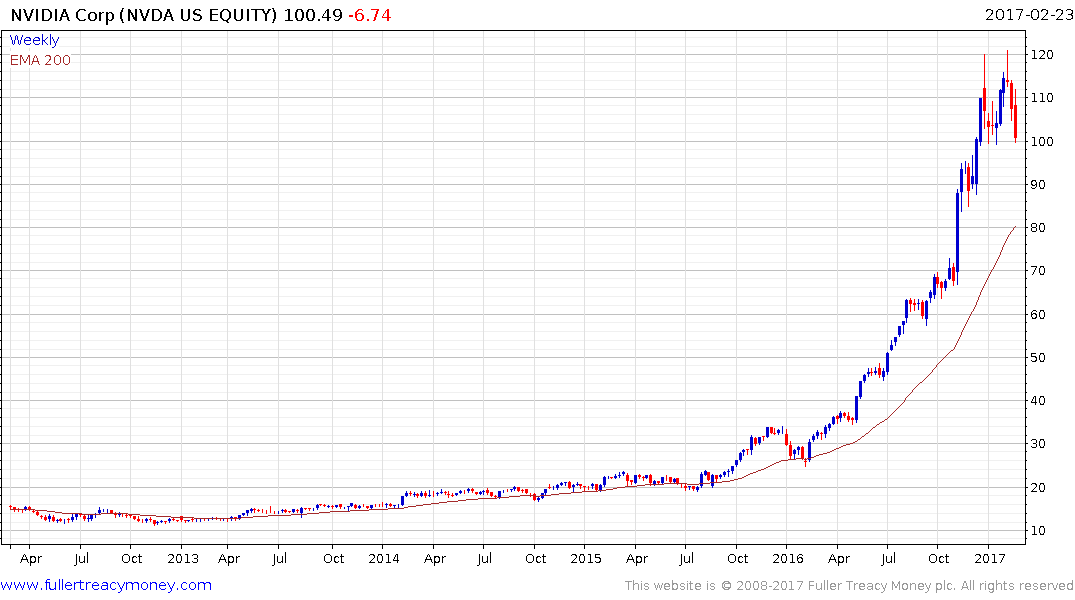

NVidia shares are up 251 percent in the past 12 months due to better-than-expected sales results from its graphics card segment.

Acceleration is a trend ending and NVidia definitely accelerated last year so reversion towards the mean, at least, is a distinct possibility.

The challenge in a new year is that the best performing stock over the previous 12 months can no longer be considered a rational deep value proposition and growth estimates will have already been priced in. At the end of December many US based investors begin to think about taking profits and offsetting losses against winners to minimise tax liability which saps demand. At the beginning of the year with cash in hand they then begin to think about what is likely to do best in the following 12 months and the previous best performers will face stiff competition from previous laggards.

NVidia was the best performer last year and is among the three worst performers this year. It has posted two downside key days reversals from the $120 level since late December and dropped today to retest the $100. An adage from The Chart Seminar is that volatile ranging following an impressive advance is seldom a reliable continuation pattern and NVidia currently is susceptible to completing a Type-1 top with right hand extension.

In the interests of full disclosure my short position moved into the money today.