Reflections on the Trump Presidency, One Week after the Election

Thanks to a subscriber for this article by Ray Dalio which appeared on LinkedIn. Here is a section:

Donald Trump is moving forcefully to policies that put the stimulation of traditional domestic manufacturing above all else, that are far more pro-business, that are much more protectionist, etc. We won’t go down the litany of particulars about the directions, as they’re well known, discussed in my last Observations, and well conveyed in the recent big market moves. As a result, whereas the previous period was characterized by 1) increasing globalization, free trade, and global connectedness, 2) relatively innocuous fiscal policies, and 3) sluggish domestic growth, low inflation, and falling bond yields, the new period is more likely to be characterized by 1) decreasing globalization, free trade, and global connectedness, 2) aggressively stimulative fiscal policies, and 3) increased US growth, higher inflation, and rising bond yields. Of course, there will be other big shifts as well, such as pertaining to business profitability, environmental protection, foreign policies/alliances, etc. Once again, we won’t go into the whole litany of them, as they’re well known. However, the main point we’re trying to convey is that there is a good chance that we are at one of those major reversals that last a decade (like the 1970-71 shift from the 1960s period of non-inflationary growth to the 1970s decade of stagflation, or the 1980s shift to disinflationary strong growth). To be clear, we are not saying that the future will be like any of these mentioned prior periods; we are just saying that there’s a good chance that the economy/market will shift from what we have gotten used to and what we will experience over the next many years will be very different from that.

The conclusion everyone has come to as a result of last week’s US Presidential Election is that a lot has changed and that portfolios needs to be structured somewhat differently. Janet Yellen today said that rates hikes are appropriate “relatively soon” is a reflection first and foremost of the central bank’s desire to put some distance between policy and the zero bound if for no other reason than to have fuel to cut the next time there is a crisis.

What we can also foretell is that there will be a crisis at some point in future. Embarking on a large fiscal stimulus when the country is at full employment is inflationary and wage growth is already suggesting that once inflation takes off it might be hard to contain. Large deficits will need to be paid down at some point and that is likely to be in a currency with reduced purchasing power.

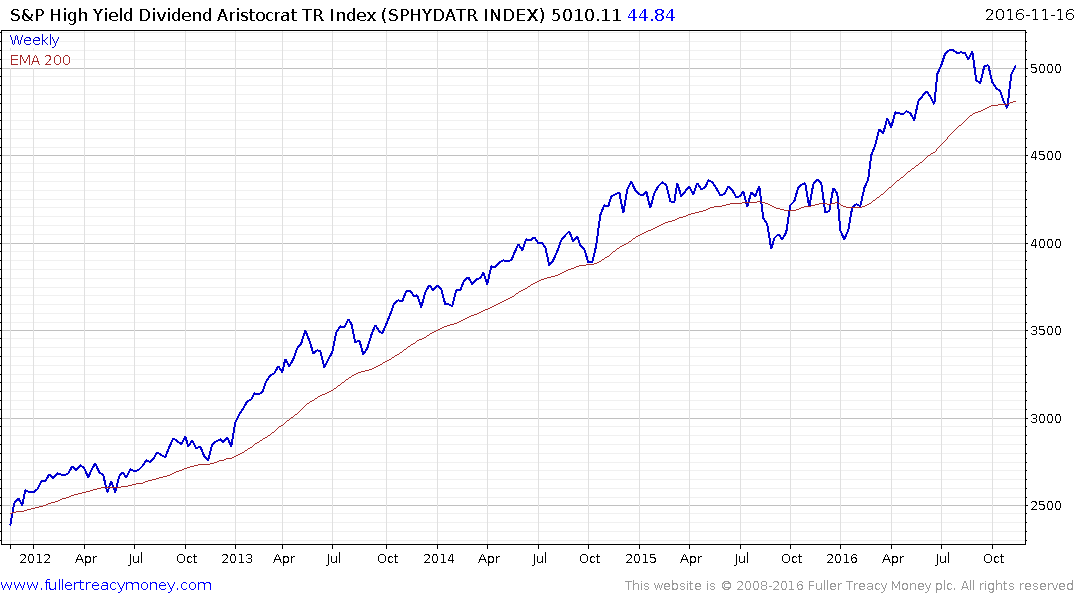

The S&P High Yield Dividend Aristocrat Total Return Index remains in a reasonably consistent medium-term uptrend and bounced emphatically over the last two weeks from the region of the trend mean. A sustained move below it would be required to question medium-term scope for additional upside. Historically equities and property have tended to be reasonably sound hedges against inflation.