Rates Could Soar or Go Negative as Fed Pause Divides Wall Street

This article for by Liz Capo McCormick Bloomberg may be of interest to subscribers. Here is a section:

The message from the Fed, combined with solid U.S. job creation last month and optimism about U.S.-China trade talks, has pushed expectations for the next rate cut well into 2020. Fed fund futures aren’t penciling in a full quarter point cut until about September.

The yield move London-based Panigirtzoglou envisions would mirror what happened when the Fed engineered a similar three-quarter-point cut in a counter cycle maneuver in 1995. JPMorgan’s U.S.-based rates team is more sanguine, lifting its Treasury yield forecasts to 1.65% for year-end 2019 and 1.85% for mid-2020. That would be little changed from around 1.79% Monday.Panigirtzoglou did add some big caveats to his bolder prediction. It assumes that the U.S. macro picture remains consistent with a mid-cycle adjustment, with resilience in employment and consumer confidence, as well as a rebound in manufacturing.

These two views are not mutually exclusive. The outlook for rates is quite capable of fulfilling both scenarios, just not at the same time. Right now, the case for a mid-cycle slowdown, like what was seen in the mid ‘90s, is looking increasingly credible as stock markets push to new highs and cyclicals return to outperformance. The argument for even lower yields is looking like an increasingly distant possibility.

The size of the upward dynamics seen on the 10-year Treasury yield, as it bounces from the psychological 1.5% level suggest a low of at least near-term and potentially medium-term significance. The jump in yields, against a background where anything with bond-like cashflows has surged, suggests clear potential for a rotation out of bond proxies and into beaten down cyclicals and leading growth companies.

McDonalds has now dropped below the trend mean following disappointing earnings and the firing of its CEO. This is not the first time the share has traded below the trend mean but it will need to find support soon if the trend is to remain reasonably consistent.

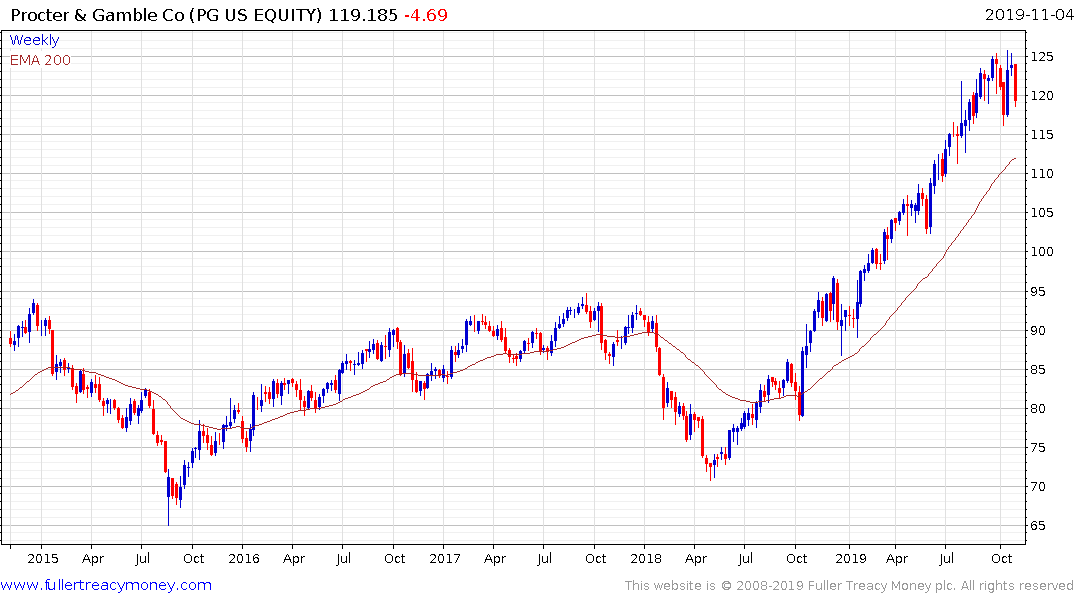

Proctor & Gamble has rallied even more impressively but today’s downward dynamic suggests the impetus behind the rally is waning, even while the sequence of higher reaction lows is still intact.