Pulses, Indian Beef. Bullish Corn

Thanks to a subscriber for this report by Ned Schmidt which may be of interest. Here is a section:

Ten years ago India was not a topic of a lot of interest. This month we find ourselves again talking about India twice, on pulses and beef. And when we look at corn we have some optimism to offer up.

Pulses are basically dry beans, lentils, and peas. Few of us ever thought about them being grown in North America. U.S. and Canada have become major growers, exporting to India and other nations from the Middle East to India. Bottom graph is of U.S. acreage planted in pulses. While expansion has been irregular, roughly 1.5 million acres have been added in last fifteen years. Canada is a major source of pulses. Roughly 65% of world’s lentils are grown in that nation. Acreage dedicated to these crops is probably approaching 10 million acres. Apparently Canada is an ideal place to grow them, and then send them to India, et al

India is becoming a major customer for world’s food system. Second, world will grow what customers want. Farmers are looking to produce alternative crops in search for profits. The “corn vs. soybean” farmer, while essential, may increasingly become “outdated”.

Here is a link to the full report.

India is one of the fastest growing economies in the world which is lifting millions of people out of abject poverty. The first thing people do when they go from $1 to $2 a day is eat more food and buy soap. That helps them to continue earning more money and puts many people and their children on the road to a more secure standard of living. It is reasonable to expect India’s demand for food will continue to increase as it progresses economically.

Corn has found support in the region of $3 on a number of occasions in the last decade and bounced from that area again in September. It is currently firming from the region of the trend mean and a sustained move below it would be required to question medium-term scope for additional upside.

Soybeans has been a laggard and broke down to a new reaction lows last week. It firmed today, but a sustained move back above 1000¢ would be required to check the downward bias.

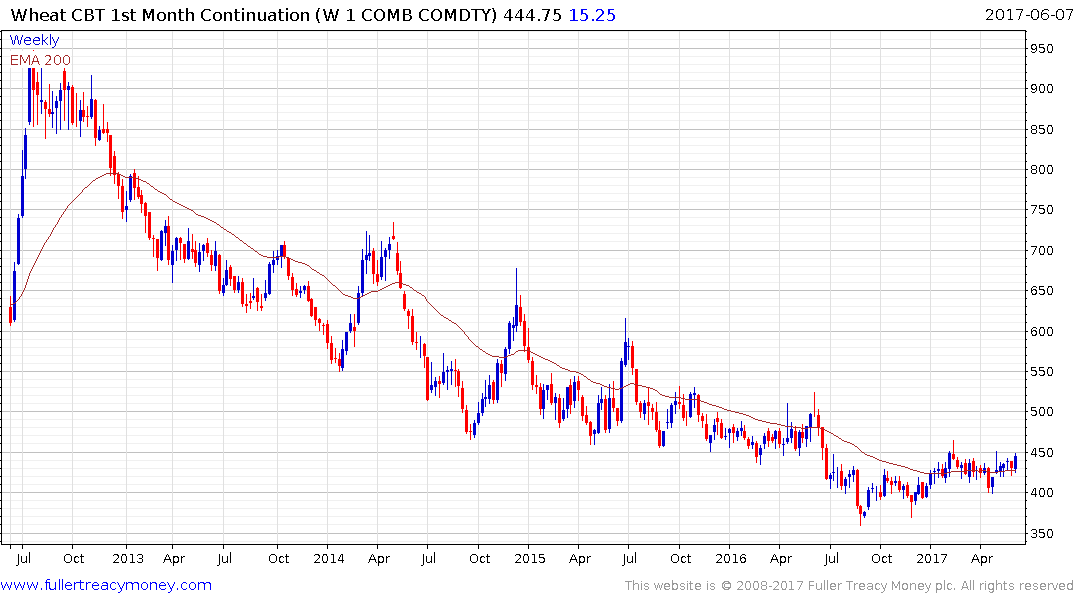

Wheat has held a mild upward bias since September and is currently firming from the region of the trend mean.

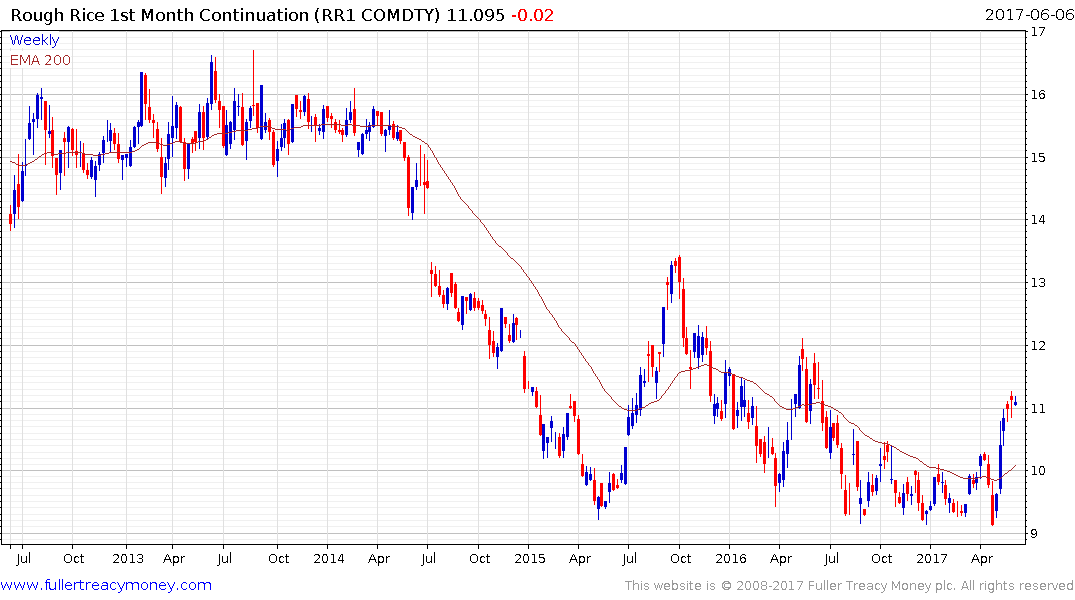

Rough Rice rallied in April to break above the trend mean and continues to extend the rebound. It will need to find support above, or in the region of, the trend mean on the first significant setback to confirm a return to medium-term demand dominance.