Demographically challenged

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

A deep dive into demographics suggests a dire outlook for property prices

Following an in-depth demographic study for Hong Kong, we have turned more negative on housing demand. Taking into account weaker demand and rising supply (we published a FITT report on supply in Sept-16) we have cut our medium-term (2018E-21E) residential price forecasts significantly. We now expect vacancy to surge to 9% (4% now) and ASP to slide 48% by 2026 from current levels. We reiterate our view that developers will be forced to change their business model from land-banking to asset turnover. Hence, we overhaul our valuation methodology from discount-to-NAV to SOTP, using P/E to value development businesses. We downgrade HLD, Kerry and NWD to Hold.Several negative demographic trends

In this report, we identify several notable demographic trends in Hong Kong, with the most significant being: 1) natural population growth has already peaked and is likely to turn negative by around 2027; 2) reduced immigration; 3) the quick shrinkage of the 25-44 years age group to 26% of the total population by 2025, from 38% in 1995 (vs. 29% now); 4) the rise in people aged over 60 years to 30% of the total population, from the current 22%. Hong Kong already has the second-highest over-60 population in Asia, as a percentage of total population, behind Japan.Aging population constrains financing, translating into lower affordability

In our view, housing affordability will be severely affected by an aging population. We believe affordability (debt servicing) is a function of property prices, mortgage rates, loan tenures and income. As the population ages, fewer households will be able stretch their mortgages to the maximum tenure of 30 years. On our new estimates, we expect only 11.5% of total households will be able to afford an average private housing unit by 2019. Moreover, by factoring in upcoming rate hikes, we expect overall affordability to worsen and ASP to decline by 48% over 2017-26 to restore the supply/demand equilibrium.A new valuation methodology for property development – P/E approach

With improving supply and a bleak outlook for the physical market, we expect land-banking to fade as a business strategy, and we anticipate a growing focus on asset turnover. As a result, we believe a discount-to-NAV valuation methodology will become less relevant in valuing the developers, and we advocate adopting a P/E approach for the development businesses. For the investment properties owned by the HK Property companies, we continue to estimate NAVs based on cap rates. We then apply a discount to the investment property NAV of 34% (the average discount over the past 25 years).

Here is a link to the full report.

Hong Kong has long defied sceptics in its ability to innovate and adapt to changing market structures. However that has not freed it from the cyclicality of the property market which has always been prone to boom and bust. With a pegged currency and interest rates that are beginning to rise from a very low base, the threat to property prices, which are at elevated levels, is growing.

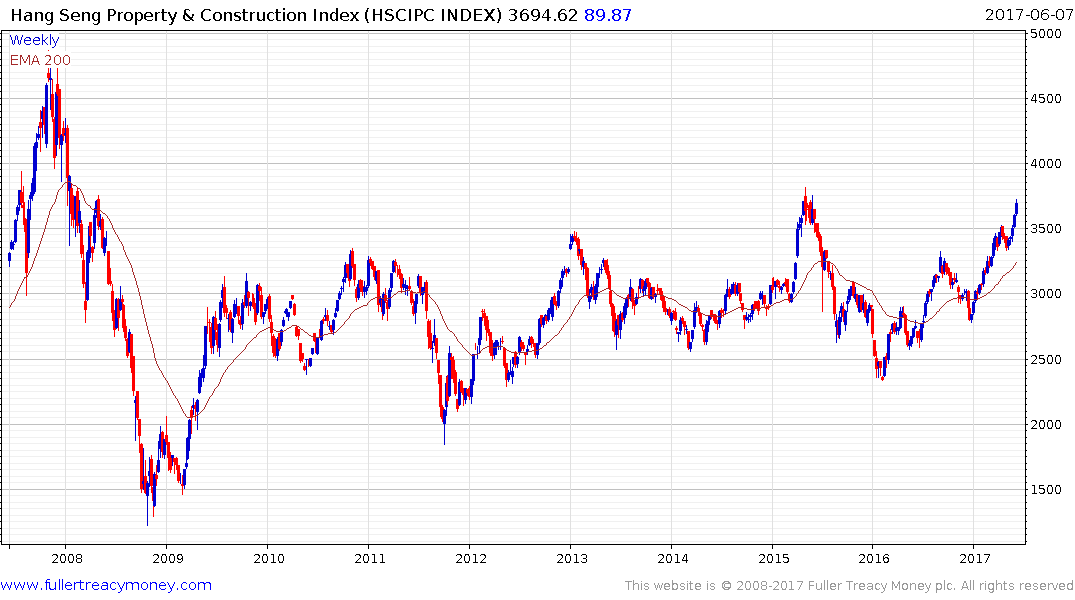

That remains a medium-term concern but right now the Hang Seng Property and Construction Index has rallied impressively over the last four weeks to test the 2015 highs. If it can hold the move above 3500, we can conclude the long eight-year range has been completed.

Despite the caveat of an aging domestic population there are a significant number of mainland Chinese who would welcome the opportunity to own property in Hong Kong and that may act as a cushion to prices on pullbacks

The China Enterprises Index (H-Shares) of Hong Kong listed Chinese shares continues to hold a consistent progression of relatively similar sized ranges one above another. A sustained move below 10,000 would be required to question medium-term potential for additional higher to lateral ranging.