Powell's Speech Title Mirrors 1998 Paper Reflecting Same

This article by Matthew Boesler for Bloomberg may be of interest to subscribers. Here is a section:

That means sometime next year, they will raise rates above their estimates of the so-called neutral interest rate which neither boosts nor restricts economic growth -- most Fed officials believe it’s somewhere between 2.5 and 3 percent. That makes sense because, according to their models, unemployment is below their estimate of the so-called natural rate of unemployment which would keep inflation stable. In June, they believed that rate was 4.5 percent.

But the problem facing Fed officials is that even though unemployment is at the lowest levels in nearly 20 years, inflation isn’t showing many signs of a pickup.

One of the most common explanations is that policy makers’ views of the natural rate of unemployment may be too high. The error bands around those estimates are “two percentage points on either side,” Chicago Fed President Charles Evans said Aug. 9.

The big question for central bankers is not so much about headline inflation being a concern right now, but just how much of a distorting influence has quantitative easing had on asset prices, valuation models, risk metrics and the reliability of lead indicators.

We can only make decisions on information we have to hand and central bankers are no different. They know that extraordinary monetary policy has had a distorting influence but it will only be in hindsight that the exact size and implications of the move will eventually be measured. Until then everything is conjecture.

The bond market tells us what people are doing with their money. The 10-year yield has been locked in a tight range between approximately 2.85% and 3% for the last few months. During that time, it has unwound the overextension relative to the trend mean. A break below the trend mean would signal investors are more worried about deflation than inflation while a break on the upside would likely coincide with concern about the scale of issuance required to pay for fiscal stimulus.

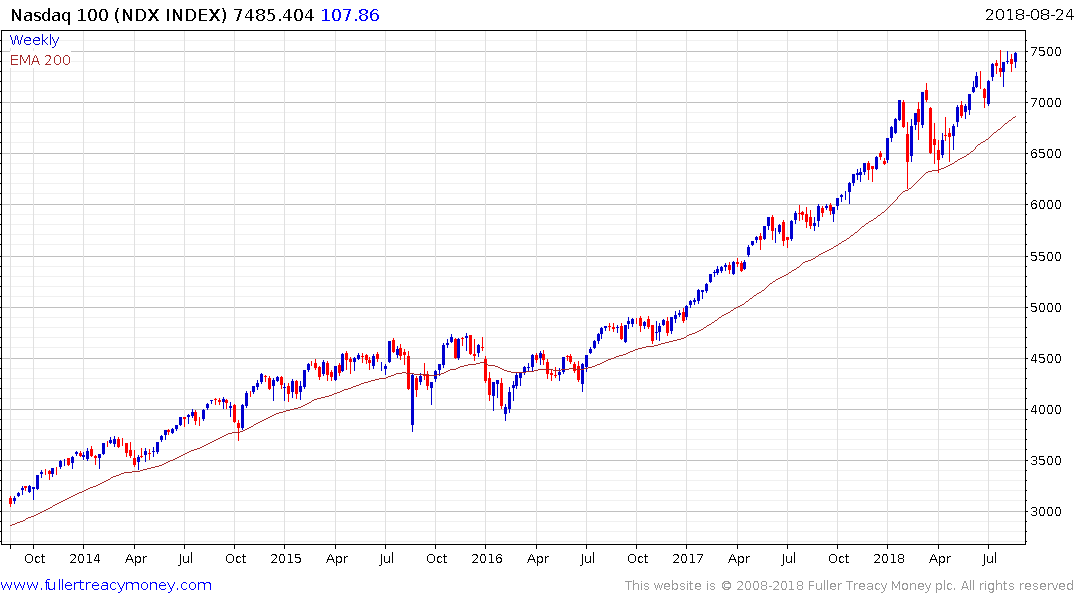

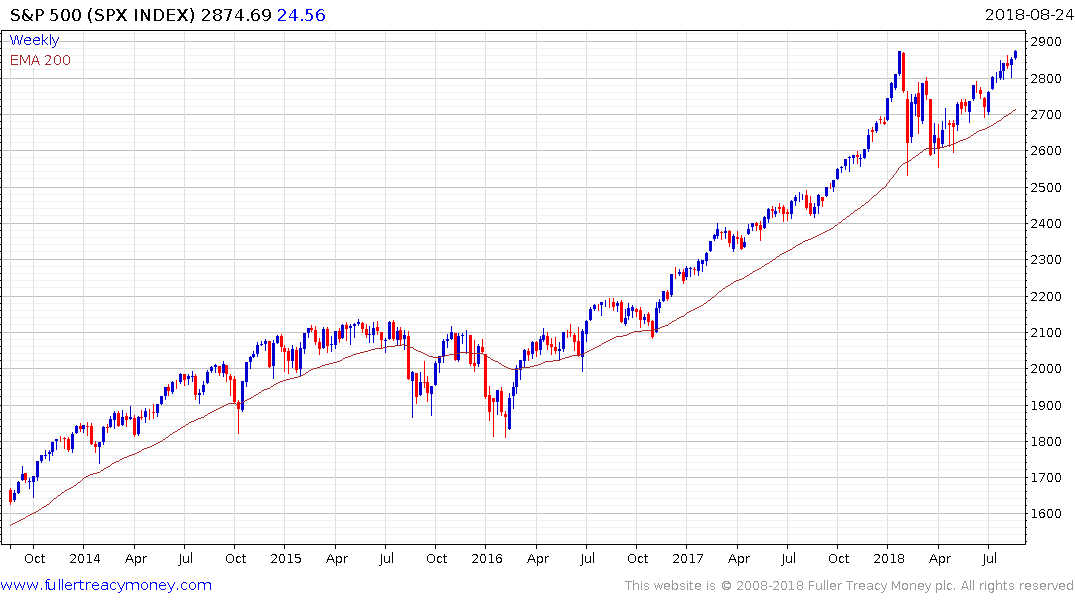

Perhaps the biggest parallel with the last 1990s is that large cap technology shares represent significant weightings in the primary Wall Street indices and are also among the best performers. If the Federal Reserve has no intention of accelerating interest rate hikes that’s good news for stocks and the S&P500 hit a fresh all-time today.

Meanwhile the Russell 2000 continues to lead and extended its breakout today.