PBOC Joins Forces With Powell to Hit the Brakes on Dollar Rally

This article by Katherine Greifeld for Bloomberg may be of interest. Here is a section:

China’s fixing adjustment in tandem with Powell’s dovish tone on price pressures fueled a decline of as much as 0.7 percent for the greenback Friday. The PBOC move to inject stability into the dollar-yuan rate will reverberate across the emerging-market currency landscape, slowing further greenback gains, according to Brad Bechtel, a managing director at Jefferies Group LLC.

“Any dollar-yuan rallies will be a lot less punchy and a lot more gradual, so it will have a dampening effect,” Bechtel said. “It provides stability to the entire Asian-EM complex. It does help cap the rally in the dollar, or at least stall it.”

The yuan has slid more than 6 percent against the greenback since mid-June as the two countries square off in a protracted trade war, helping fuel broad dollar gains and stoking the ire of U.S. President Donald Trump. The PBOC last introduced a counter-cyclical factor to the yuan’s fixing in May 2017, helping spark a 3.5 percent decline in the dollar over the remainder of the year.

Beijing had suspended use of the factor in January, a move interpreted to mean that policy makers had grown more comfortable with the yuan’s trajectory after several months of gains against the dollar.

China’s renminbi has been among the weakest currencies in the world this year and as it approached the region of the lows posted in 2016, the question many Chinese people have been asking is do they need to move money abroad?

For a closed system like China, big questions about the sustainability of debt, nonperforming loans, a large deposit base and the role of the government in lending can all be managed if money is held within the country. Capital flight is greatest threat to that status quo which is why the government so actively tries to inhibit the practice of moving money overseas.

That is a major concern even as the country deploys the currency as a policy tool during its trade spat with the USA. The Renminbi bounced today to post a higher reaction low to cap its biggest weekly advance since this year. That suggests a low of at least near-term significance has been reached and holds out the prospect of a reversionary rally back towards the trend mean.

The Dollar’s weakness and the Renminbi’s bounce lent a tailwind to both emerging markets and commodities. Gold has been in need of a bullish catalyst and today represented the biggest rally seek since March. The price is now challenging the four-month progression of lower rally highs but the odds are improving that a reversionary rally is underway.

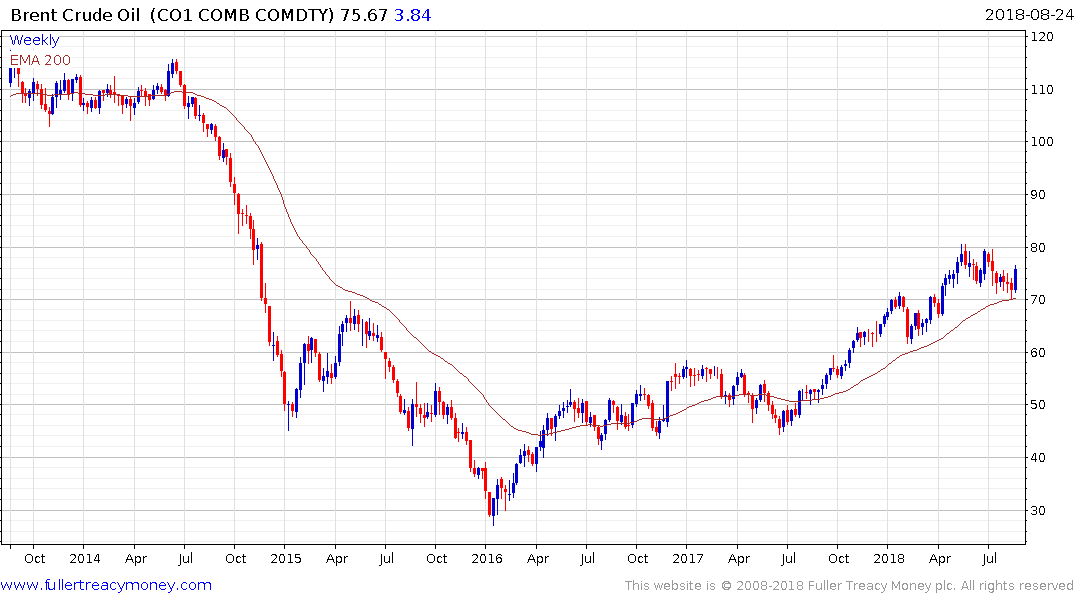

Crude oil continues to firm from the region of the trend mean and remains in a generally consistent medium-term uptrend.

Arabica coffee bounced back above $1 today and potential for a reversionary rally has improved.