Powell Remarks Friday at Jackson Hole Full Text

This speech by Jay Powell may be of interest to subscribers. Here is the conclusion:

As is often the case, we are navigating by the stars under cloudy skies. In such circumstances, risk-management considerations are critical. At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks. Based on this assessment, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.

Restoring price stability is essential to achieving both sides of our dual mandate. We will need price stability to achieve a sustained period of strong labor market conditions that benefit all.

The 2% target is still official. Judging by the response of the market to Powell’s statement today, traders are beginning to give that statement some additional weight. Larry Summers’ remark on Twitter this morning helps to put the dilemma into fresh perspective.

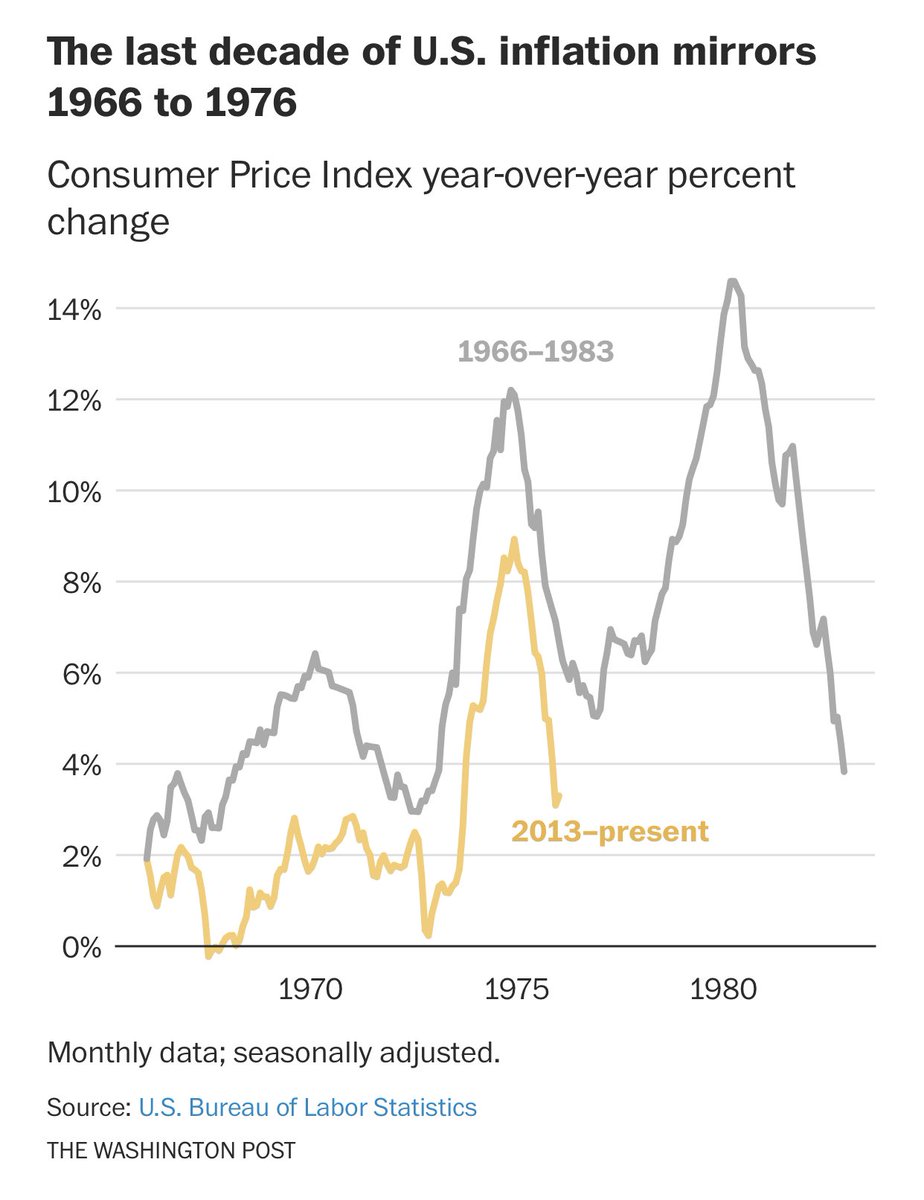

“It is sobering to recall that the shape of the past decade’s inflation curve almost perfectly shadows its path from 1966 to 1976 before it accelerated in the late 1970s.”

“It is sobering to recall that the shape of the past decade’s inflation curve almost perfectly shadows its path from 1966 to 1976 before it accelerated in the late 1970s.”

US unemployment trended higher all the way through the 1970s and did not peak until the early 1980s. That is not only sobering but also highlights how much of a lagging indicator unemployment is.

US unemployment trended higher all the way through the 1970s and did not peak until the early 1980s. That is not only sobering but also highlights how much of a lagging indicator unemployment is.

What I find even more compelling is how the trajectory of social and political discourse over the last decade has mirrored that of the late 1960s and early 1970s.

The expense of war is now becoming a political football as Ukraine’s summer offensive fails to break through Russia’s defences. The death toll to NATO is negligible compared with the body bags coming home from Vietnam, but the willingness of governments to expand deficits is similar. Meanwhile the magnitude of today’s deficits would make 1960s monetarists blush.

The civil rights movement is only mirrored in this cycle by the social change accelerated by the pandemic. Rising political polarisation and populism are similar even if the wealth gap is wider.

The big difference on this occasion is the magnitude of debt. In 1970 the debt burden was less than 40% of GDP. Today it is closer to 120%.

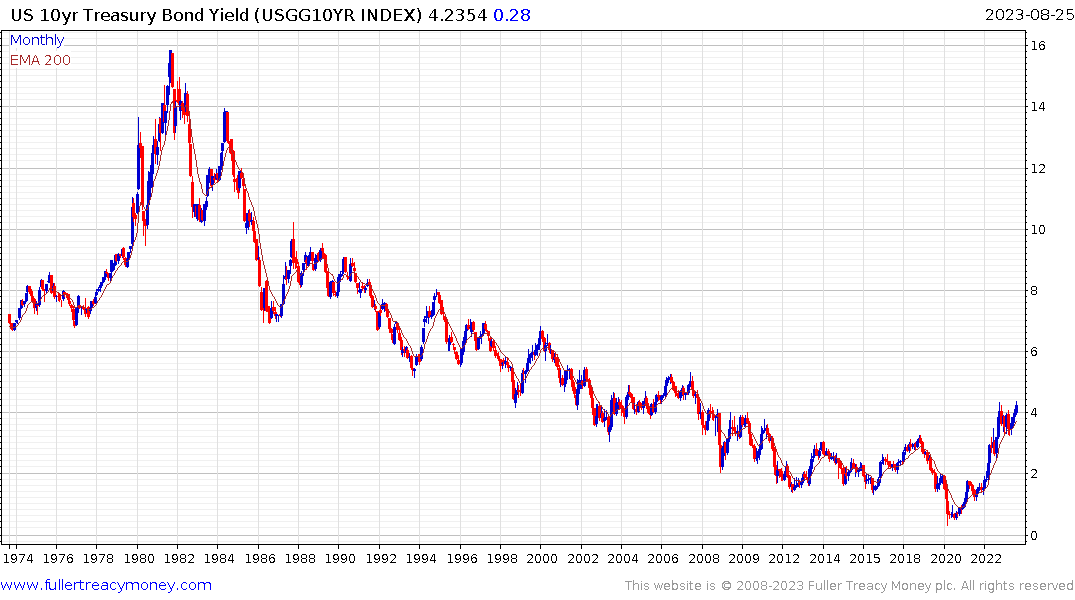

The major inflationary event of the 1970s was the oil shock. To ensure a similar event is avoided on this occasion, the Fed has to raise rates enough to both combat inflation and create sufficient demand for Treasuries. That means taking policy into restrictive territory until deflationary forces are overwhelming.

Student debt repayments begin again in October, consumer savings are expected to be fully eroded in Q3 and average credit card balances are breaking out (in nominal terms). That suggests the consumer will be experiencing stress for the remainder of the year.

The quandary of the markets today is that monetary conditions are tightening, and yields are close to historic peaks, but the stock market remains quite steady. The only way to rationalise that performance is by following the money. When the US government is running an 8% deficit at full employment, that has been sufficiently stimulative to defray the risk of deeper pullbacks.

Back to top