Micro E-mini S&P 500 Futures Surpass 1 Billion Contracts Traded

This news release from the CME may be of interest. Here it is in full:

"At just over three years old, our Micro E-mini S&P 500 futures have become some of the most actively traded and deeply liquid equity index products at CME Group, averaging more than 1.1 million contracts traded per day," said Paul Woolman, Global Head of Equity Index Products at CME Group. "At one-tenth the size of their benchmark E-mini counterpart, these micro-sized futures allow market participants to hedge or trade with enhanced flexibility around major market-moving events by executing trading strategies more nimbly and scaling index exposure up or down."

"The S&P 500 is widely regarded as the best single gauge of the U.S. equity market and serves as the foundation for a wide range of liquid investment vehicles around the world," said Bruce Schachne, Chief Commercial Officer at S&P Dow Jones Indices. "S&P DJI extends its sincere congratulations to CME Group for reaching another significant market milestone, the first to cross this threshold within its complex. We are proud of the growth that we've seen within our indices business and look forward to continuing to provide leading index solutions across varying geographies and asset classes."

This is a substantial milestone. It reflects significant growth in risk appetite as the margins demanded for a position were decreased. That’s doubly true as demand for options of the stock market has ballooned since the advent of extraordinary monetary and fiscal accommodation.

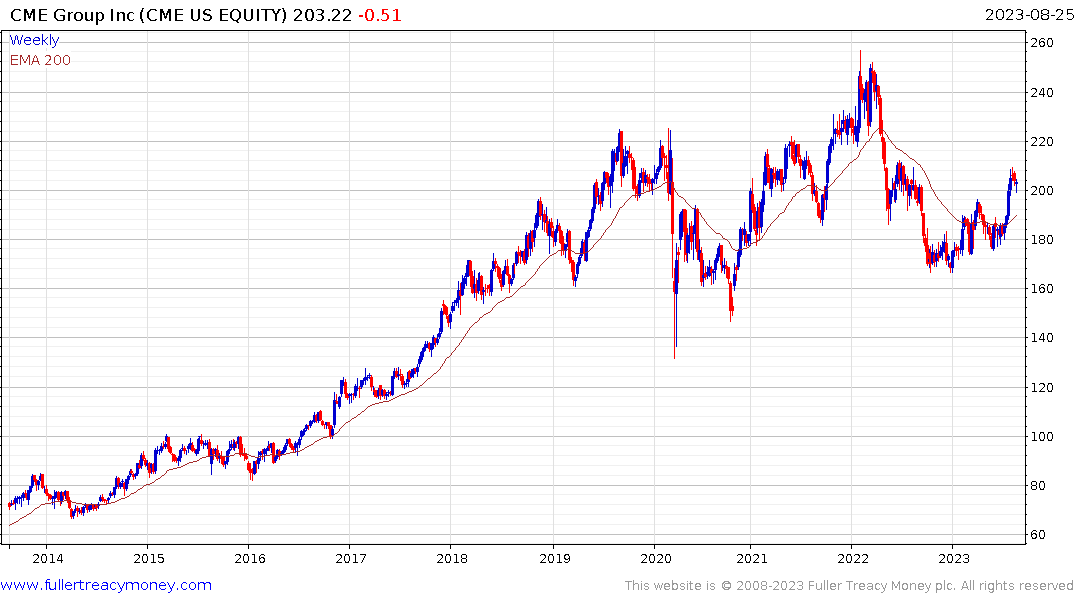

The share is currently firming from the $200 level. It failed to hold the move above that level in 2022 but found support at the lower side of the range in October and continues to recover.

The share is currently firming from the $200 level. It failed to hold the move above that level in 2022 but found support at the lower side of the range in October and continues to recover.

CBOE Holdings broke out to new all-time highs in July which completed a five-year range.

CBOE Holdings broke out to new all-time highs in July which completed a five-year range.

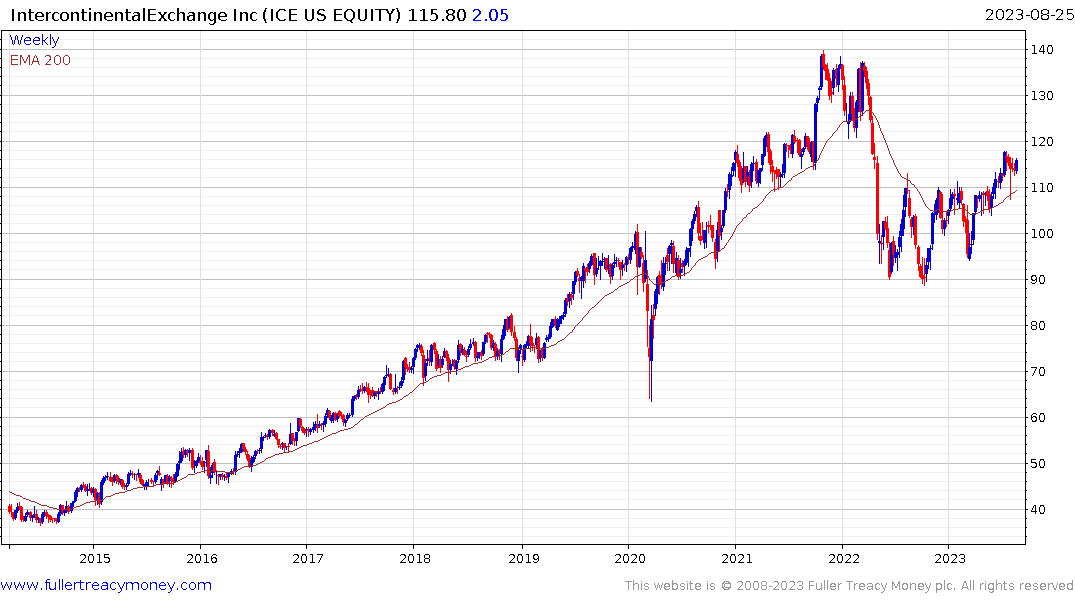

Intercontinental Exchange is firming from the region of the 200-day MA.

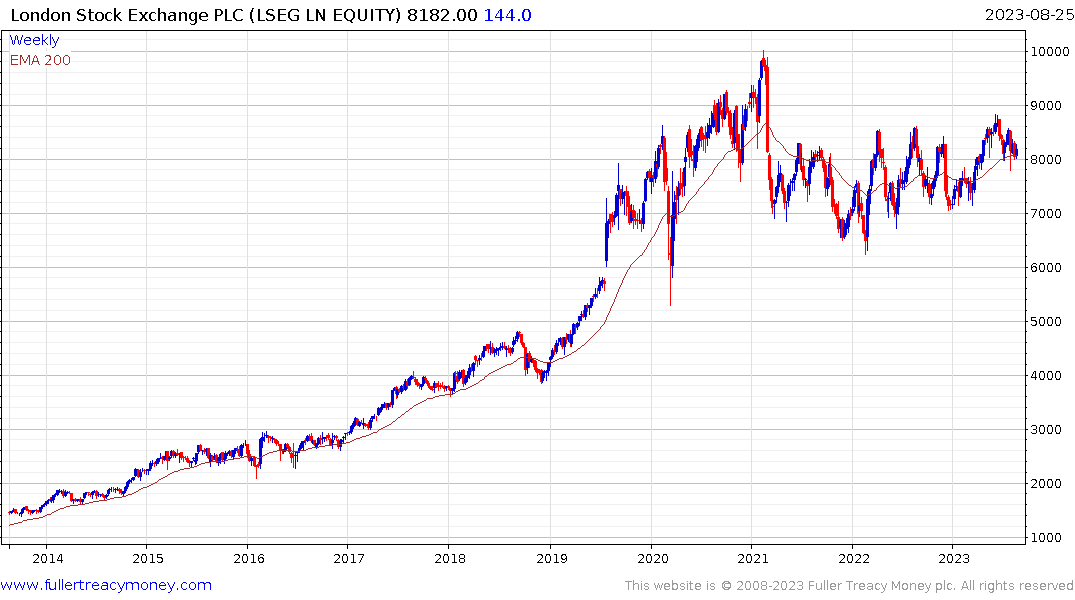

So is the London Stock Exchange. These are among the best performing exchanges. Most others are still trending lower.