Pound Falls Against Dollar Amid Slowdown in Key U.K. Industries

This article by Lukanyo Mnyanda for Bloomberg may be of interest to subscribers. Here is a section:

“Sterling is behaving somewhere in the middle, between the euro on the one hand and the dollar on the other,” said Ulrich Leuchtmann, head of foreign-exchange strategy at Commerzbank AG in Frankfurt. “Most of the market participants are expecting that we don’t get a very quick interest-rate normalization from the Bank of England. Short-term risks dominate.”

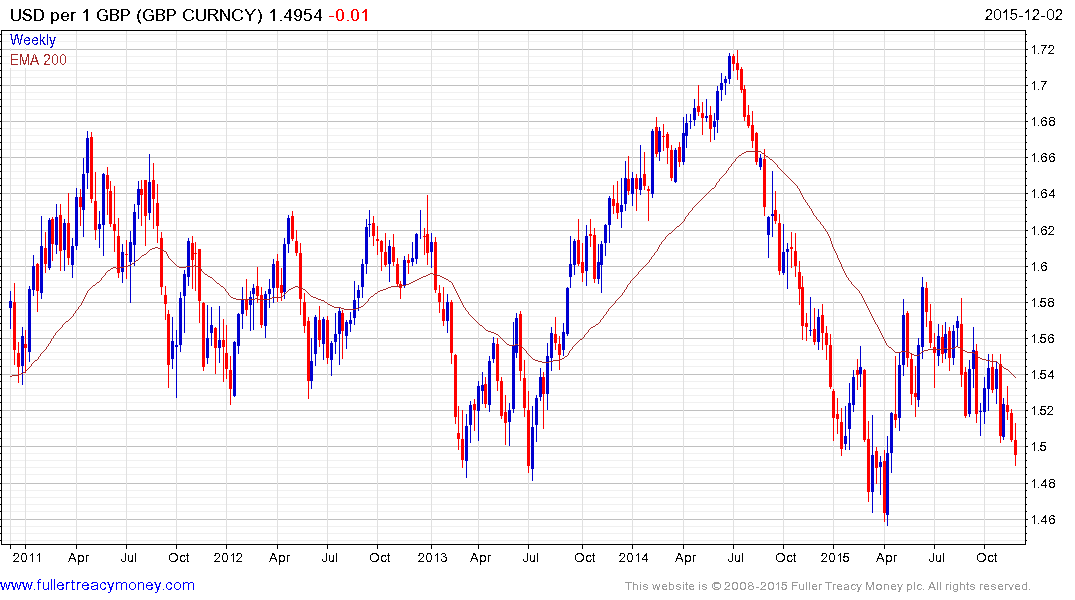

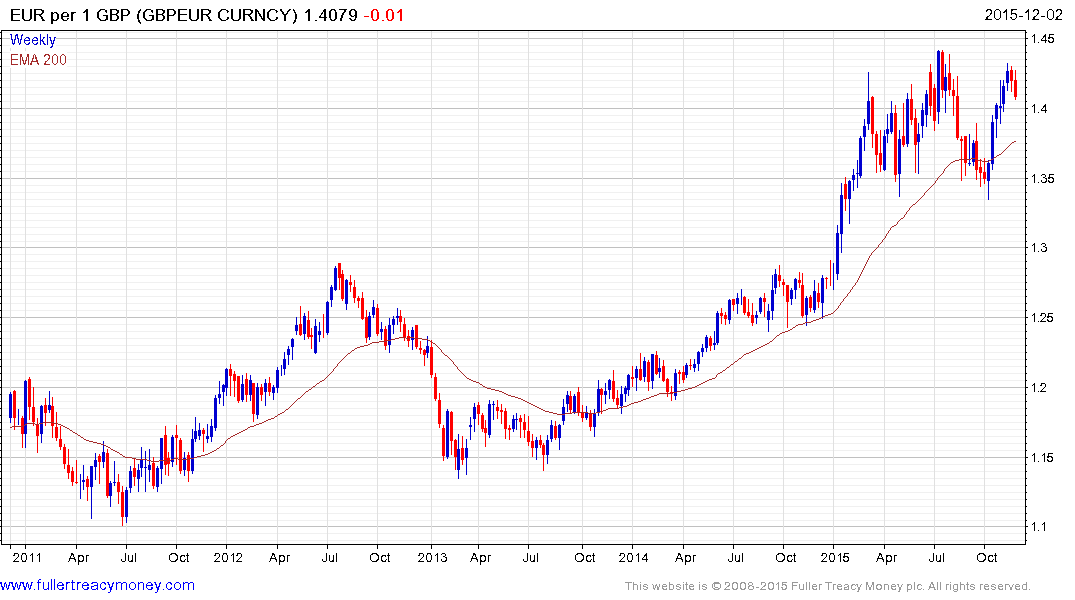

The pound dropped as much as 0.6 percent to $1.4993, the lowest level since April 23, and was at $1.5003 as of 2:05 p.m. London time. It weakened 0.1 percent to 70.57 pence per euro, having tumbled as much as 0.3 percent before the inflation report.

By retaining its own currency the UK was able to sidestep many of the issues that have affected so many of its Eurozone neighbours. However that does not completely insulate the economy from a slowdown among its largest trading partners. Continued stress in the Eurozone and its requirement for additional monetary support suggest the Bank of England may not be so quick to follow the Fed’s lead in raising rates. The Fed’s wish to wait and see before deciding on a second hike is likely to also influence that decision.

The Pound dropped through the psychological $1.50 area today, extending a five-month decline. A clear countermanding upward dynamic would be required to question potential for additional lower to lateral ranging.

Against the Euro, the Pound has encountered at least short-term resistance in the region of the upper side of what is now an almost yearlong range. A sustained move above €1.42 would be required to question potential for additional consolidation of the rally from the October retest of the region of the trend mean.

The Dollar Index has been ranging below 100 for much of the last nine months but hit its highest level since 2003 during today's intraday rally. A short-term overbought condition is evident and this is potenital for some consolidation in this area but a clear downward dynamic would be required to question potential for additional upside.

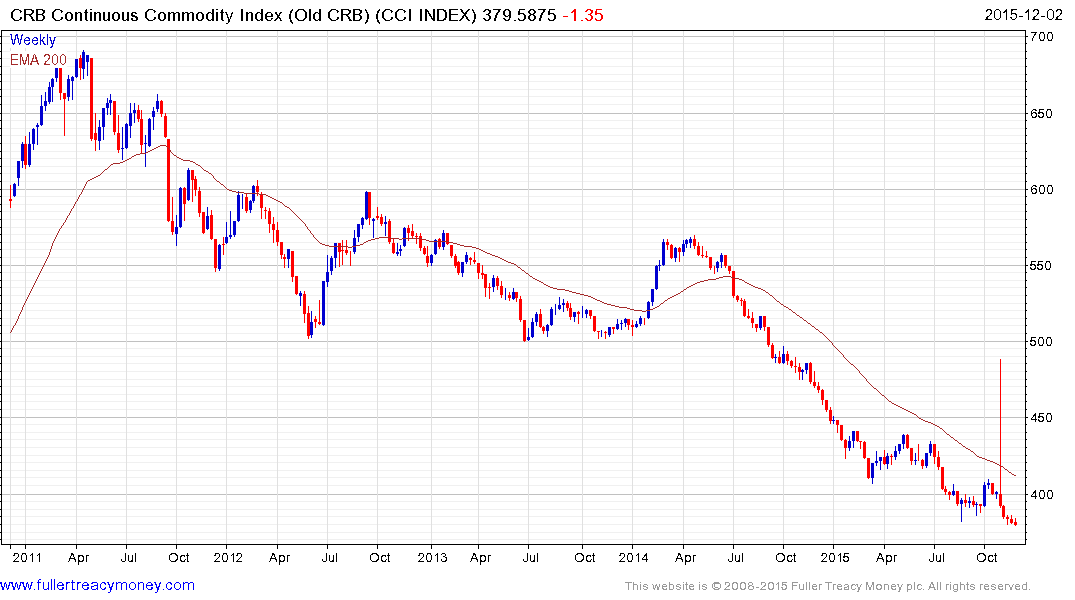

The Continuous Commodity Index is going the other direction as it tests the lower side of a three-month range and remains in a reasonably consistent medium-term downtrend overall.