European Equity Strategy Outlook for 2016 in 10 charts

Thanks to a subscriber for this report from Morgan Stanley which may be of interest to subscribers. Here is a section on the UK equity market:

Relative performance and valuation of FTSE100 versus Mid250 is very depressed relative to history.

FTSE100’s earnings revisions ratio is no longer inferior to that of the Mid250 for the first time in nearly 3 years.

UK mid-caps are very well owned and vulnerable to a slowing domestic economy and an increase in ‘Brexit’ fears.

All of the UK delegates at last week’s Chart Seminar in London were asking about the potential fall out for the economy resulting from next year’s referendum on EU membership. I’m not convinced it will have any meaningful medium-term effect on the ability of UK businesses to conduct trade across the channel but that does not mean the subject will not have an influence on sentiment.

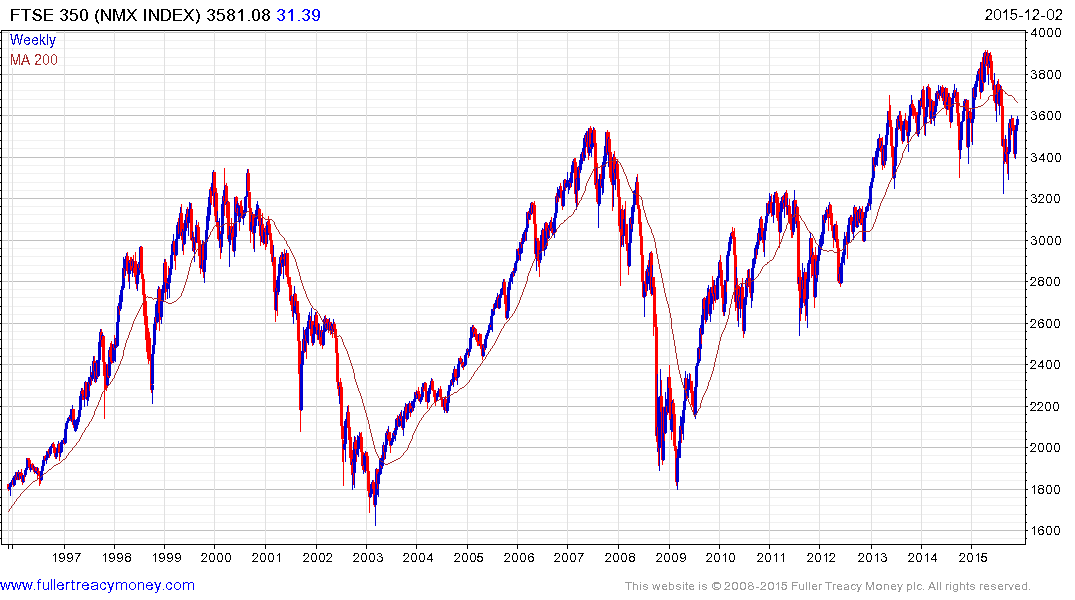

The FTSE-350 has outperformed the FTSE-100 by a considerable margin over the last five years. The Index has been ranging above the 2007 peak since last year and is currently rebounding from a test of the lower boundary. A sustained move below 3375 would be required to question the medium-term view that this large range is nothing more than a first step above the long-term congestion area.

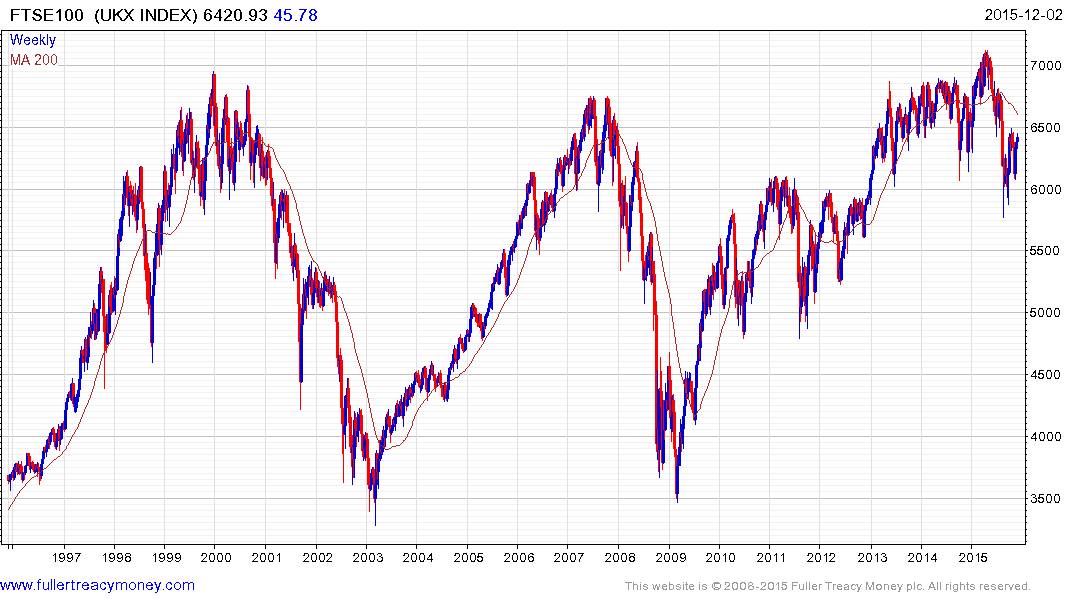

By way of contrast the FTSE-100 has been ranging below 7000 since 1999. If the experience of the S&P 500, DAX and FTSE-350 are any guide then the FTSE-100 is more likely to break upwards than downwards. However in order for that to happen, the outlook for global growth, upon which the majority of its large cap constituents depend, will have to improve.

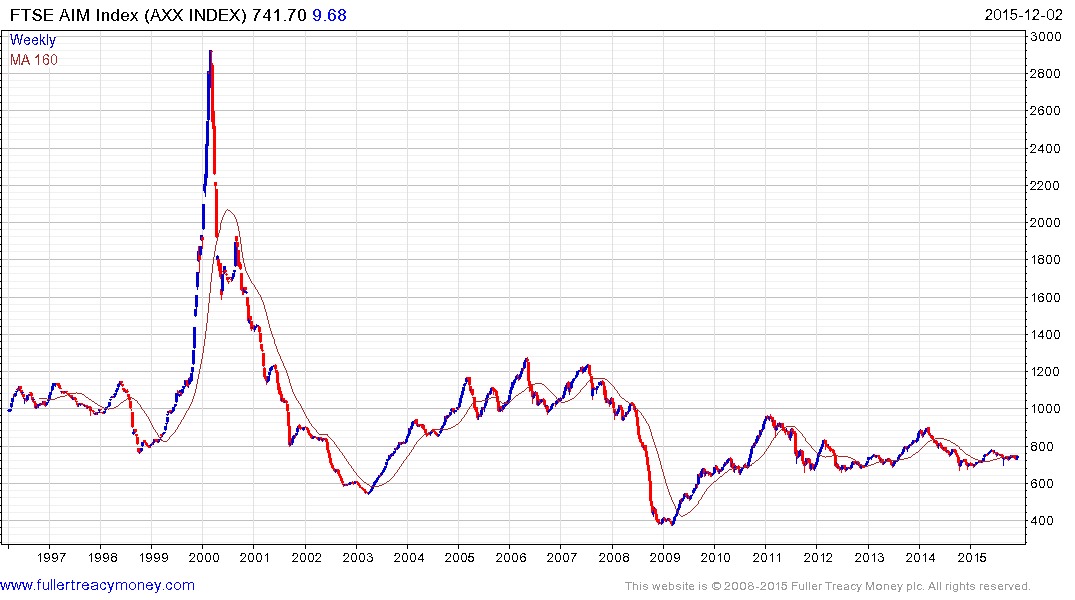

The AIM Index of small caps has been ranging, in a volatile manner, mostly above 650 since 2011 and has held a progression of higher reaction lows for much of this year. A sustained move below 715 would be required to question current scope for additional upside.