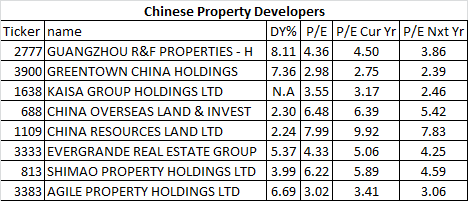

Taking a look at dividend yield in reported FY13 results

Thanks to a subscriber for this report from Deutsche Bank focusing on the Chinese property sector. Here is a section:

Among the key listed Chinese developers that have yet to announce their FY13 results but will be reporting by the end of March, based on the actual 2012 dividends and our forecasted 2013 dividends, we expect high 2013 dividend yields for R&F, Greentown, Agile and Evergrande. Specifically, at the current share price, R&F is trading at a 2012A dividend yield of 7.8% and 2013E dividend yield of 9.1%. Greentown is trading at a 2012A dividend yield of 7.3% and 2013E dividend yield of 8%. Evergrande is trading at a 2012A dividend of 5.3% and 2013E dividend yield of 7.3% while Agile is trading at a 2012A dividend yield of 8.4% and 2013E dividend yield of 8.7%.

Looking at the information on the short interests on Chinese developers, which are estimates based on DataExplorers and the DB Global Prime Finance team, we found that the size of the cumulative short positions on the China property names, including the high-quality state-owned developers like COLI and CR Land, has recently risen quite sharply. For example, the short interests/positions on COLI have increased 9% month-on-month, and based on our estimates, it would take about 8 days to cover the outstanding short positions. As another example, the short interests/positions on CR Land have increased 37% month-on-month, and based on our estimates, it would take about 11 days to cover the outstanding short positions.

The issues China has with overcapacity in the materials sector, a rising tide of defaults in the corporate sector and overbuilding particularly in 2nd and 3rd tier cities are well understood. Considering just how low valuations are, it is reasonable to assume that a good share of the bad news is already in the price.

However, one of the most compelling arguments for remaining on the side-line remains that we just do not know how large the problem is with bad loans and therefore cannot make a judgement on whether attractive valuations can be trusted. The current devaluation of the Yuan suggests efforts are underway to try and enhance the economy’s competitiveness.

Here is table of the valuations of the companies mentioned in the above report.

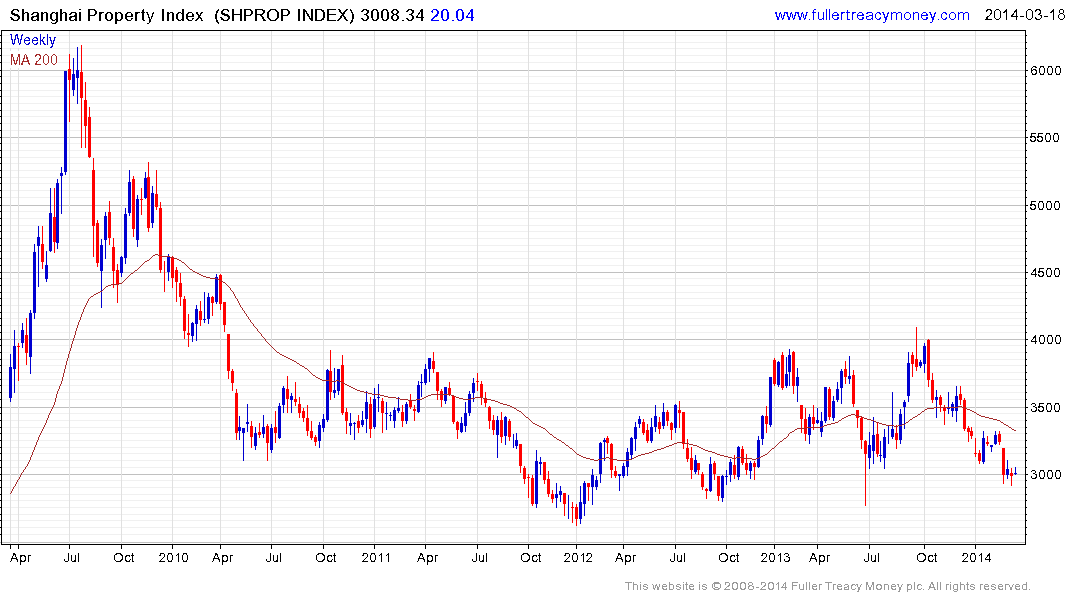

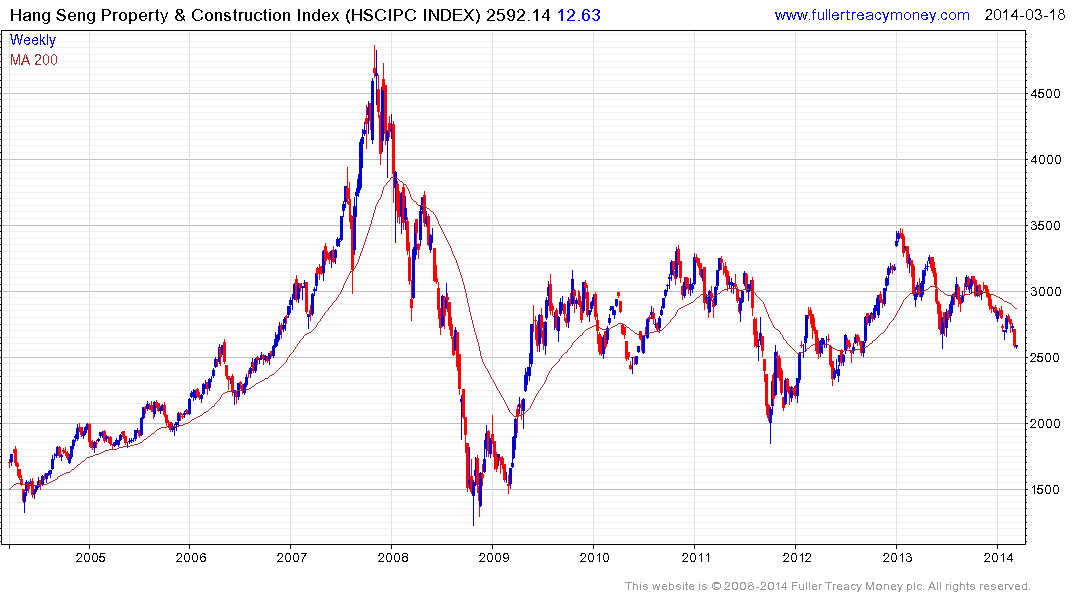

The Shanghai Property Index has been trading between 3000 and 4000 for more than three years and is currently testing the lower boundary. The Hang Seng Property and Construction Index has performed in a more volatile manner but is also testing a previous area of support.

Greentown China Holdings is among the most oversold of the above developers following a steep decline and is currently testing the HK$8.50 area. An upward dynamic would confirm the onset of a short covering rally from this area.

Back to top