Do U Dare to Dream?

Thanks to a subscriber for this report focusing on uranium, from BMO, which may be of interest to subscribers. Here is a section:

Playing Into a Number of Pertinent Thematics: The global push for energy independence following Russia’s invasion of Ukraine has provided a tailwind for uranium expectations, as nuclear build-outs are back in vogue. The role of uranium, and wider nuclear technology, in a low-carbon global economy is becoming ever clearer and is driving significant research and development into the next generation of technologies, just as happened with solar power around 2010. Given this pathway, we believe the uranium price will ultimately have to rise to necessary levels to stimulate the increased production required to match growing demand needs; hence, we have increased out L/T price to US$58/lb, from US$50/lb. Furthermore, government strategy in the U.S., potential Chinese exports of the Hualong reactor technology and development of small modular reactors (SMRs) all have potential to see demand surprise on the upside relative to our base case.

Here is a link to the full report. .

Sprott’s decision to enter the uranium market as a major buyer resulted in a major breakout in September 2021. The price quickly jumped from $11 to $20. Since then it has returned to unwind most of that advance.

The challenge for uranium is it takes a long time to build new reactors. The best-case scenario is existing reactors will have their lives extended while new technologies for modular designs will be rapidly scaled up.

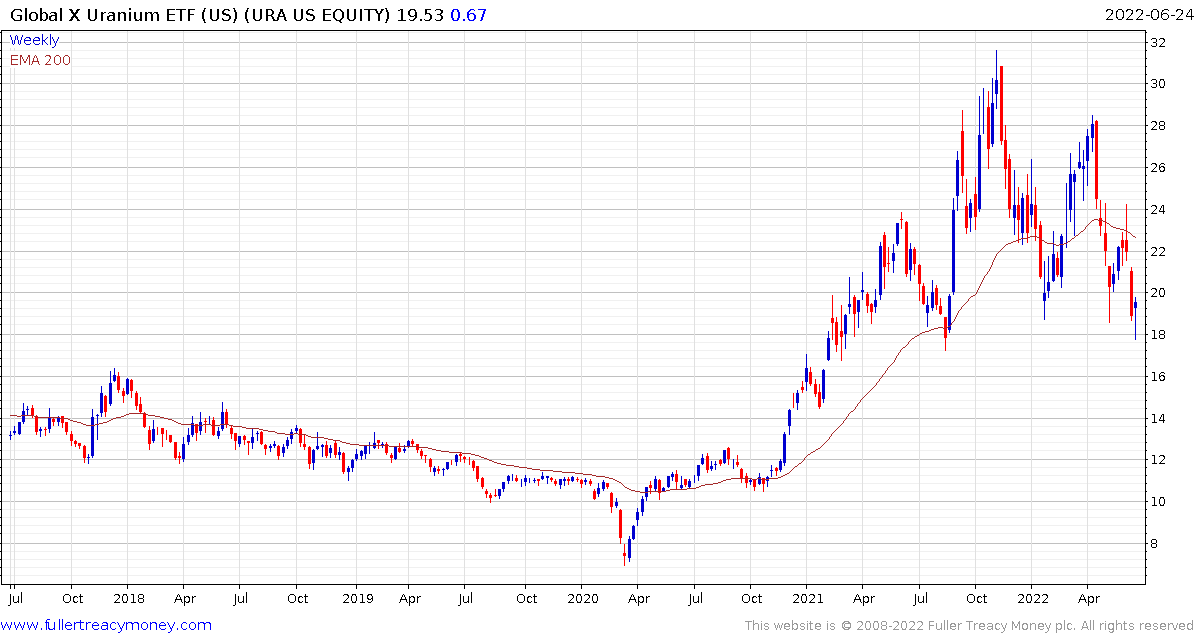

The Global X Uranium Miners ETF is also back at the lower side of its first step above the base and testing the region of the 1000-day MA.

This article from Bloomberg highlights how urgent the need for additional electricity generating capacity is for Europe. Here is a section:

We’re reaching the point of ‘no idea is too crazy’: keeping nuclear power plants running, wholesale energy price caps, suspension of markets, removal of CO2 costs and limits, burning more coal, re-starting domestic gas production even if that triggers local earthquakes in the Netherlands. Everything has to be backed up with multi-billion-euro loans from governments to key sectors.

The problem isn’t just the current eye-watering prices for power and gas. The forward contracts for 2023, 2024 and even 2025, which are used to lock in energy costs, are getting more expensive by the day. “This may be a sustained price rise, rather than something that disappears quickly,” Jonathan Brearley, the head of the UK energy regulator Ofgem, said earlier this month.

The months-long crisis that many industrialists penciled into their plans has morphed into a years-long problem. The prospect of bleeding cash for a few months, perhaps half a year, or even a year, was one thing; losing money indefinitely is another thing entirely.

At the G7 there are thousands of people marching in favour of doing more to reduce carbon emissions. Practicality is likely to trump idealism. European natural gas prices remain at multiples of where they traded ahead of the Russian invasion of Ukraine. The threat of Russia cutting off supplies entirely is non-trivial. In fact, it has to be the base case if Russia wants to exert sufficient pressure on the European economy to force negotiations on their terms.

At present the global industrial sector continues to exhibit a great deal of commonality because of threat of a global slowdown. However, there is clearly more risk to Arcelor Mittal’s business than Cleveland Cliffs which bought its US operations a few years ago