US Set to Block Russian Debt Payments, Raising Default Odds

This article from Bloomberg may be of interest to subscribers. Here is a section:

Russia has started the process of paying holders of two foreign-currency bonds before a key carveout in restrictions expires next week.

The money isn’t due for another week, but the settlement date for both payments is two days after a temporary exemption for US bondholders to receive Russian bond funds is set to end.

That loophole has allowed the government to get payments through the plumbing of the international financial system to US investors, staving off a foreign default. But Treasury Secretary Janet Yellen characterized the carve-out as “time-limited” last week.

Payments of $71.25 million on a note maturing 2026, and 26.5 million euros ($28 million) on debt due 2036, were transferred to the National Settlement Depository, or NSD, Russia’s Finance Ministry said Friday. It added that its obligations on the debt have been met “in full.”

Previous fund transfers have been delayed or blocked by financial institutions amid the sweeping international sanctions imposed on Russia since its invasion of Ukraine. About $650 million of payments were made just days before a grace period was due to expire earlier this month.

Russia Dodges Default for Now as Investors Get Dollar Funds

From the NSD, the payments go to international clearinghouses, which distribute the funds to the various custodian banks where foreign bondholders have their accounts.

If that all goes smoothly, attention will turn to almost $400 million of coupons due toward the end of June.

Without the Treasury loophole for US investors, and no alternative options arranged, the question will be whether bondholders elsewhere can still receive the funds.

The first two coupons due June 23 have clauses that allow payment in euros, pounds sterling or Swiss francs. Their terms also stipulate that the funds will land with the local paying agent, the NSD.

One day later, $159 million comes due that can only be paid in dollars, via a unit of JPMorgan as foreign paying agent.

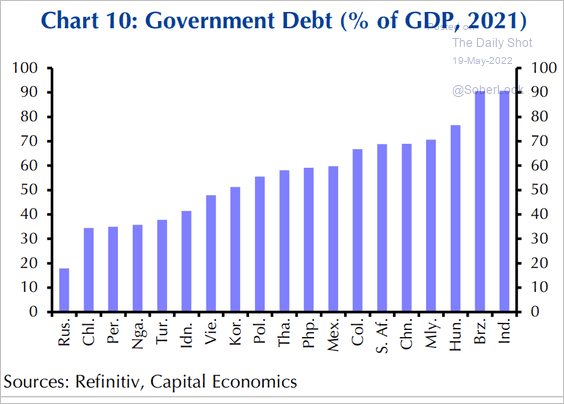

Engineering a Russian debt default is obviously part of the economic warfare the West has launched in response to the invasion of Ukraine. The impact of those measures is significantly reduced by the fact Russia has one of the lowest debt to GDP ratios in the world.

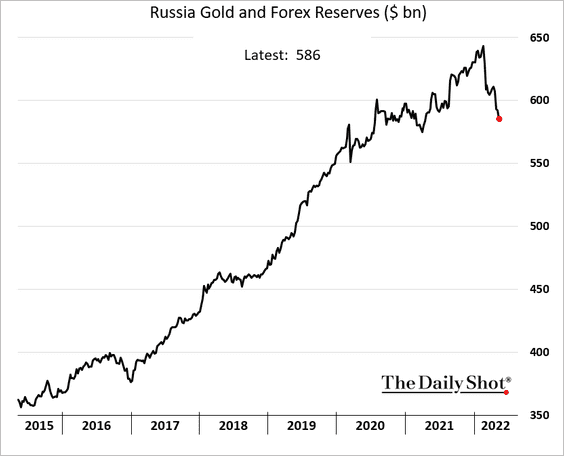

How much access Russia has to its foreign exchange reserves is debatable, but the total is beginning to be drawn down as debt payments mount and the demand for payment in Rubles reduces fresh inflows.

The Ruble is not behaving like there is an impending debt crisis. It has recouped more than the initial decline versus the Euro and is in the process of breaking a long-term downtrend.

The Dollar denominated RTS Index has bounced from the lower side of its range and is performing better than a broad swathe of the speculative technology sector.

I’m no fan of authoritarian regimes, but the above charts suggest Russia is not in nearly as dire a state as western media lead us to believe. The simple truth is the price of everything it exports is high, and its customers don’t have ready supplies from other sources.