Email of the day on global food shortages

The media highlight the possibility / likelihood of a worldwide food shortage - could you please cover this subject and share with us your conclusion and how a smart investor could potentially take advantage of such regrettable drama for large parts of the world population.

Thank you for this question which I’m sure is of interest to the Collective. The last time we had a food shortage scare was in 2007/08 when fertilizer shares were accelerating to records, commodity prices were strong, and the rising prosperity of the global consumer was driving calorie consumption for billions of people.

This was a classic demand growth bull market, and the fear was supply would not be able to keep up with such rapacious appetites. Prices collapsed during the credit crisis and a food crisis was averted because demand growth forecasts were cut back, and leverage was snuffed out of the system.

On this occasion, there are legitimate concerns about supply without the outsized predictions for demand growth we had in 2007. The global population is still growing so that is predictable demand growth factor and is largely irrelevant to the price structure at present.

The primary challenge is with climate conditions delaying planting and war knocking out supply. This is highlighting the low inventory levels which have been a constant factor in the agriculture commodity sector for years. The full effect that conditions is now being felt.

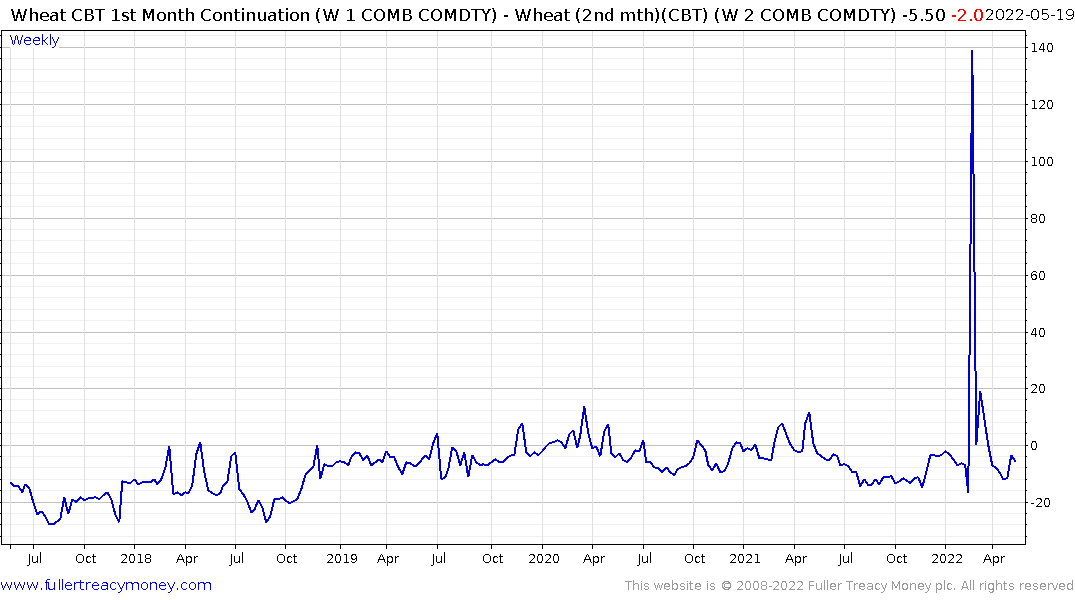

The backwardation in wheat prices has now turned into a contango so we are already seeing demand destruction from high prices. Nothing has happened to endanger Russia’s wheat harvest and Ukraine’s issues are primarily about transporting grain rather than growing conditions. Canada on the other hand is having a lot of difficult planting because of high moisture conditions.

Corteva produces both seeds and fertilisers and remains in a consistent uptrend.

Corteva produces both seeds and fertilisers and remains in a consistent uptrend.

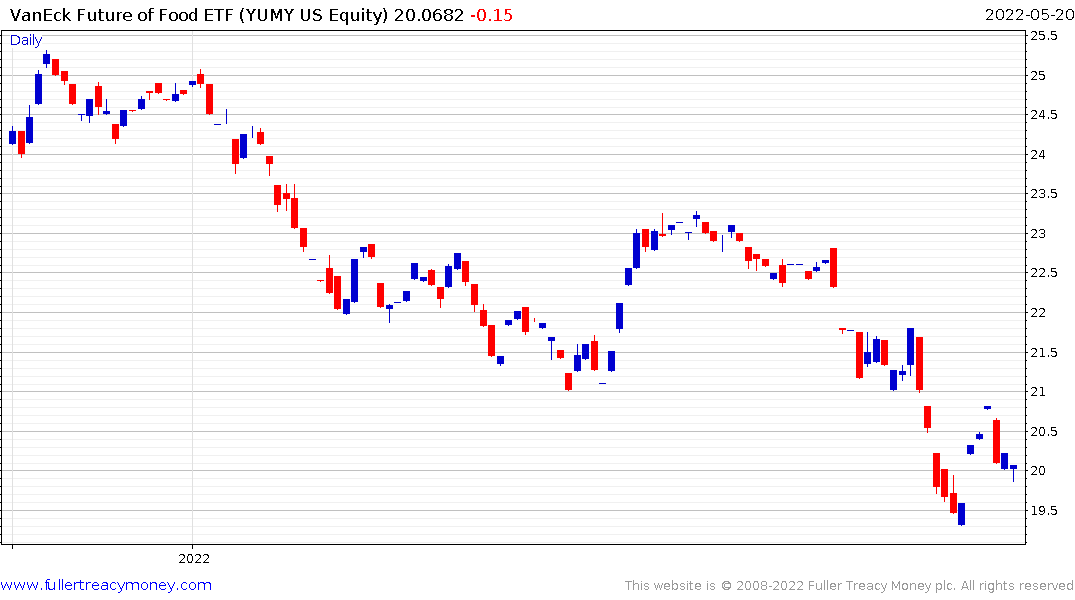

The new VanEck Future of Food ETF (YUMY) appears to be attempting to put in a higher reaction lows.

The new VanEck Future of Food ETF (YUMY) appears to be attempting to put in a higher reaction lows.

Bayer is building support in the region of the 200-day MA.

Mosaic and Nutrien are currently unwinding their respective overextensions relative to their 200-day MAs.

Rather than focus on the lamentable conditions of the food supply sector, which will be corrected eventually, I think the primary reason to look at agriculture investment is as a hedge against volatile climate conditions. Brazil is looking at frost again. Droughts in the US Midwest, excessive rain in eastern Canada, the threat of an active hurricane season, the continued La Nina and any other unpredictable factors have the capacity to support agriculture prices.

Back to top