Pencils down

Thanks to a subscriber for this edition of Jim Grant’s free letter. Here is a section:

Arm’s prospective transition to the public realm is no small development, as Wall Street impatiently awaits the return of capital markets activity. Conventional IPO fundraising (i.e., excluding special purpose acquisition companies) stands at $10.2 billion in the year-to-date per Dealogic, double the full-year tally logged last year but a fraction of the $39.7 billion and $105.5 billion outputs seen during 2020 and 2021, respectively. “Recent summer weakness is clearly pushing [SoftBank] to list Arm sooner rather than later,” Susannah Streeter, head of money and markets at Hargreaves Lansdown, tells Reuters.

On the bright side for SoftBank and its teeming roster of 28 investment banks leading the offering, recent events in the IPO market suggest that risk appetite remains robust despite the August selloff. Last Tuesday, shares in Sacks Parente Golf, Inc. vaulted 624% in their Nasdaq debut, briefly conferring a $400 million market cap on the micro-cap manufacturer of putting equipment, which lost $3.5 million on $190,000 in net revenues a year ago.

Noting that the Sacks Parente priced its offering at $4 per share, the bottom of its indicated $4 to $5 per share range, while reducing the allotment to 3 million shares from 4.4 million, Renaissance Capital senior strategist Matt Kennedy marveled to Bloomberg that “in a typical IPO, it would be bizarre for a company to price at the low end of its range and then pop 600%. . . There’s still a sub-segment of the IPO market where the casino is open.” Sacks Parente’s hot streak soon abated however, as the stock finished today south of $3, completing a round trip and then some.

Then there’s VinFast Auto Ltd., which also began trading on the Nasdaq last Tuesday via a merger with blank-check firm Black Spade Acquisition Co. The Vietnam-based electric vehicle maker has since enjoyed a hotter ignition, with shares ripping higher by 109% today, building on a 280% rally in its first trading day one week ago. VinFast, which remains under 99% control by its founder Pham Nhat Vuong and which posted a $599 million net loss in the first quarter on $84 million in sales, ended the day with a market cap of roughly $85 billion, nearly equivalent to that of Ford and General Motors combined.

The water’s warm, Masa and Co."

The trend of rising rates damped down speculative activity in the IPO market in 2022. Now, as expectations that central bank hiking cycles are nearing an end enthusiasm is rising once more. The scale of the moves in the IPO market is much more concentrated at present, which is a reflection both of the smaller number of new listings and tightening liquidity.

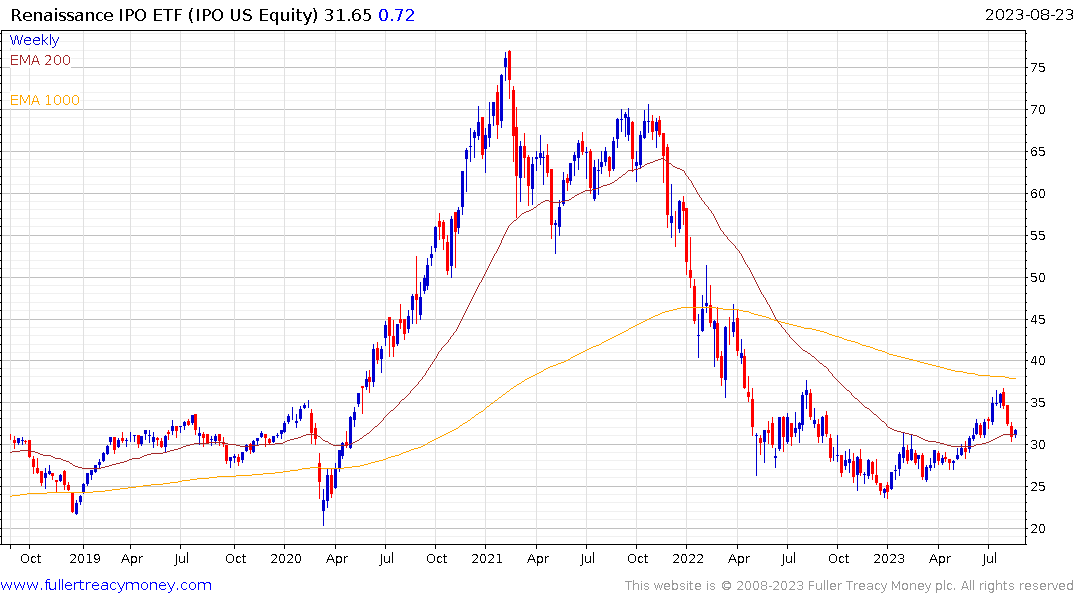

The Renaissance IPO ETF has returned to test the region of the 200-day MA and the upper side of the underlying range. It steadied today but will need to hold the $30 level if recovery potential is to be given the benefit of the doubt. The Ark Innovation ETF has exactly the same pattern.

With a market cap of $84 billion, versus $84 million in sales, Vinfast highlights an entertaining sense of symmetry when one is willing to look past the ludicrous valuation.

With a market cap of $84 billion, versus $84 million in sales, Vinfast highlights an entertaining sense of symmetry when one is willing to look past the ludicrous valuation.

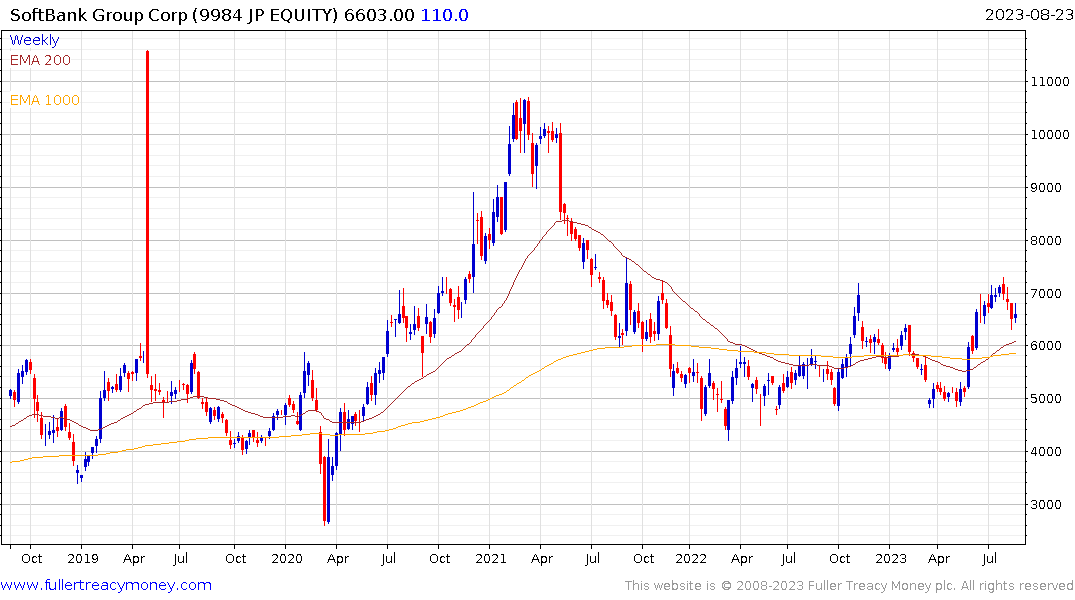

ARM was fully valued when it was purchased by Softbank/Vision Fund. Offloading the position to the stock market now is a brazen effort to get some of their money back. Softbank’s shares popped on the upside in November last year on the expectation it would benefit from selling part of its holding in Alibaba. The share then retreated to the lower side of the range near ¥5000. It retested that peak a couple of weeks ago and will need to hold the current level if recovery is to be given the benefit of the doubt.

ARM was fully valued when it was purchased by Softbank/Vision Fund. Offloading the position to the stock market now is a brazen effort to get some of their money back. Softbank’s shares popped on the upside in November last year on the expectation it would benefit from selling part of its holding in Alibaba. The share then retreated to the lower side of the range near ¥5000. It retested that peak a couple of weeks ago and will need to hold the current level if recovery is to be given the benefit of the doubt.