Nvidia Stock Soars Past $500 After Chipmaker Demolishes Q2 Estimates

This article from Benzinga may be of interest. Here is a section:

Nvidia Corp. (NASDAQ:NVDA) strong positioning in artificial intelligence technology is taking the chipmaker into the stratosphere Wednesday.

Santa Clara, California-based Nvidia’s second-quarter non-GAAP earnings per share rose 422% year-over-year from 51 cents to $2.70. Sequentially, the measure improved 148% from the previous quarter’s $1.09 per share.

Analysts, on average, expected the bottom-line result to come in at $1.91.

The earnings growth reflected strong revenue, which climbed 101% year-over-year and 88% sequentially to $13.51 billion. The topline came ahead of the consensus estimate of $10.3 billion and the company’s guidance of $11 billion plus or minus 2%.

Wall Street began its rebound in early trading as the bond market rallied in response to downgraded expectations of job growth. The tech sector in particular firmed, as optimism around Nvidia’s earnings built. Following the strong results and upgraded guidance, the share jumped above $500 in after hours trading. The 10% advance was exactly what the options market had priced in before the announcement.

These results cement Nvidia as the go-to artificial intelligence share. It is viewed as the single best way to invest in the sector and that will remain the case until sales begin to underwhelm. Several of the company’s customers are designing their own chips, but that is a medium-term threat.

These results cement Nvidia as the go-to artificial intelligence share. It is viewed as the single best way to invest in the sector and that will remain the case until sales begin to underwhelm. Several of the company’s customers are designing their own chips, but that is a medium-term threat.

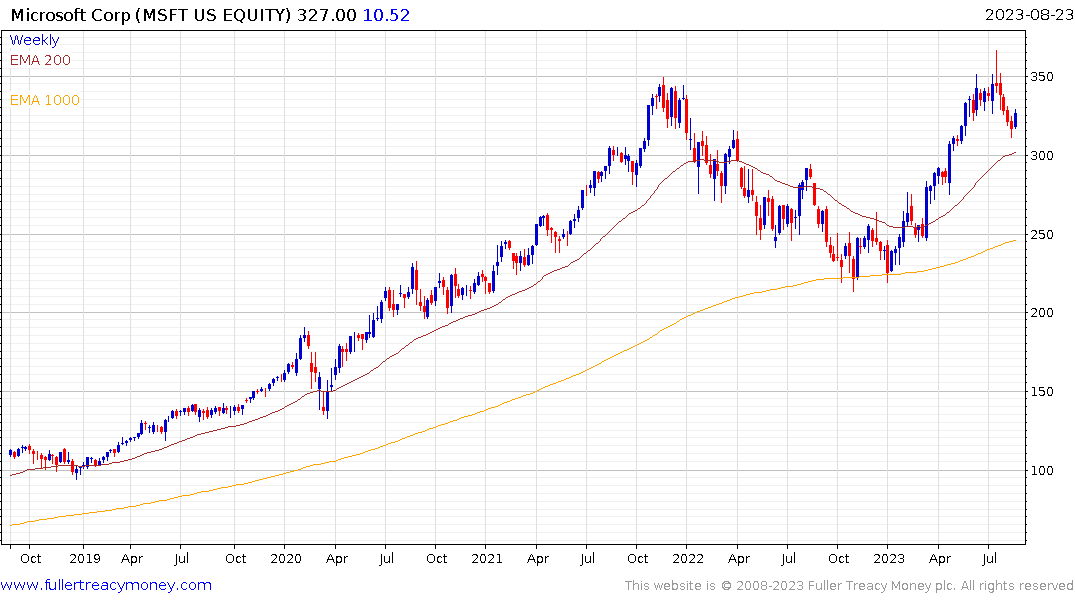

Microsoft continues to firm from above the 200-day MA and has also been supported by its eager embrace of the artificial intelligence theme.

Microsoft continues to firm from above the 200-day MA and has also been supported by its eager embrace of the artificial intelligence theme.

Ahead of the earnings announcement, the FANGMANT/NYSE Total Market Cap ratio was back testing the upper side of its short-term range and continues to hold the breakout from the 2020-22 range. It is reasonable to conclude this bull market will not be over until those eight companies lose their ability to outperform so robustly.

Ahead of the earnings announcement, the FANGMANT/NYSE Total Market Cap ratio was back testing the upper side of its short-term range and continues to hold the breakout from the 2020-22 range. It is reasonable to conclude this bull market will not be over until those eight companies lose their ability to outperform so robustly.