Payrolls Surge as U.S. Hiring Broad-Based for Second Month

This article by Michelle Jamrisko for Bloomberg may be of interest to subscribers. Here is a section:

Payrolls climbed by 255,000 last month, exceeding all forecasts in a Bloomberg survey of 89 economists, following a 292,000 gain in June that was a bit larger than previously estimated, a Labor Department report showed Friday. The jobless rate held at 4.9 percent as many of the people streaming into the labor force found jobs.

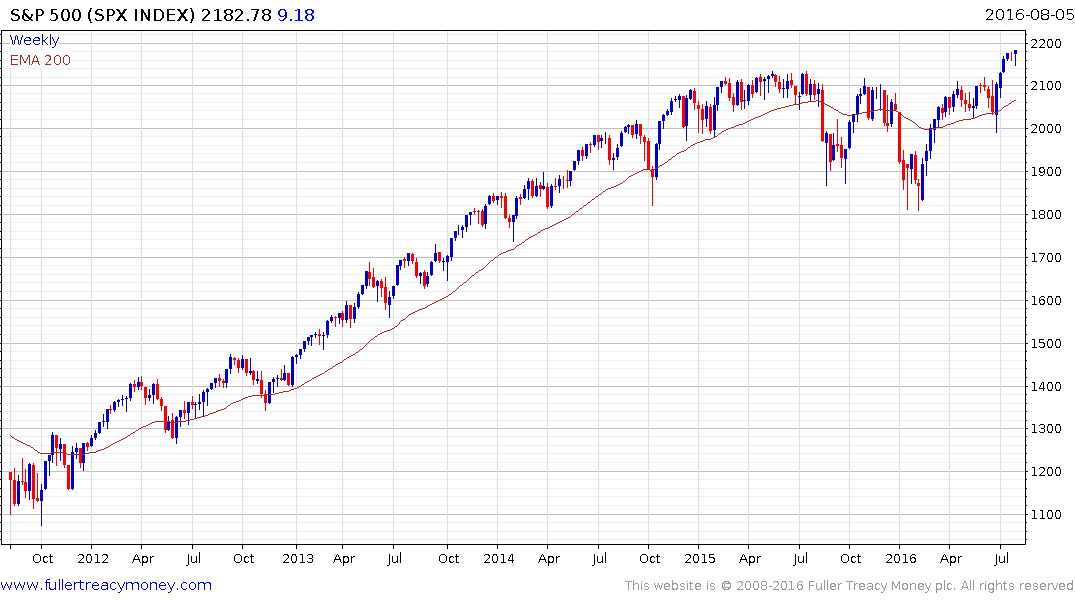

The rate of hiring is more than enough to whittle away at the jobless rate over time and gradually eliminate labor-market slack, a goal of Federal Reserve officials who’ve kept interest rates low to spur growth. The strong employment readings, which propelled stocks toward a record, also come as the U.S. heads toward the presidential election, which could give Democrat Hillary Clinton a positive talking point.

“Labor demand is holding up pretty well,” said Jesse Edgerton, an economist at JPMorgan Chase & Co. in New York. “The labor market is firming up. Wages are starting to pick up. It’s a positive for consumer spending. This will reinforce the Fed’s view that improvement in the labor market is likely to continue.”

By taking swift action to force banks to write down non-performing loans, foreclose on underwater properties and raise capital requirements the USA ensured that the banking sector returned to some sense of normality within a few years of the financial crisis. By concurrently flooding the market with liquidity the Fed delivered higher asset prices which has helped banks rebuild their balance sheets. Very low interest rates and tight lending conditions might not be the best recipe for growth in bank profitability, but US banks are no longer the epicentre of risk in the global financial sector. That mantle has passed to the Eurozone banking sector.

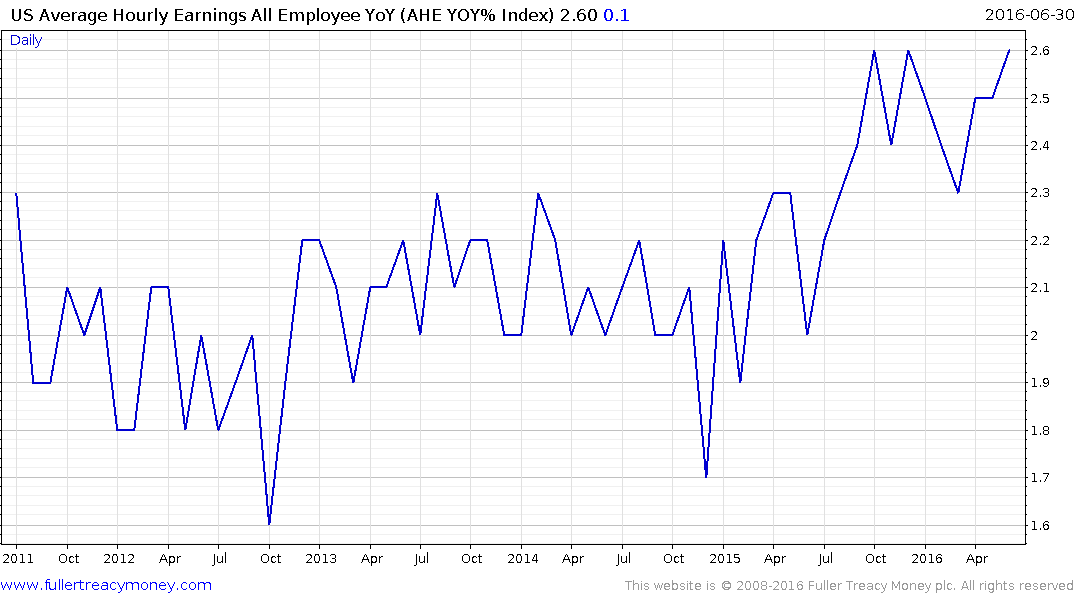

Rising interest rates holds out the prospect of an easier path to better profitability for the banking sector and today’s jobs and earnings growth data give a boost to the possibility the USA will not follow its global counterparts into a negative interest rate environment. The Fed raised rates last year following a breakout in the hourly earnings figures and it would be reasonable to expect that is wage demand accelerate further they will feel compelled to raise rates again.

The KBW Regional Banks Index has lagged the breakout in the wider market but continues to firm the region of the trend mean.

US Treasury yields bucked the international trend and rose today to post a first higher reaction low from the early July nadir. Potential for a reversionary rally continues to look more likely than not, but a sustained move above the trend mean, currently near 1.8% would be required to signal more than temporary supply dominance.

The Dollar Index has held a progression of higher reaction lows since posting a failed downside break below 92.5 in early May. A sustained move below 95 would now be required to question potential for higher to lateral ranging. A sustained move above 100 would likely signal a return to medium-term Dollar dominance.

The S&P 500 completed a short-term range to post new highs today, reasserting the upward bias to trading.

The Nasdaq-100 broke out today to complete an 18-month range.

The Dow Jones Industrials Average found at least near-term support near 18,500 this week as it continues to hold the breakout.

The Russell 2000 has rebounded impressively from the January low and is now pulling away from the 1200 level, which has previously been an area of resistance.

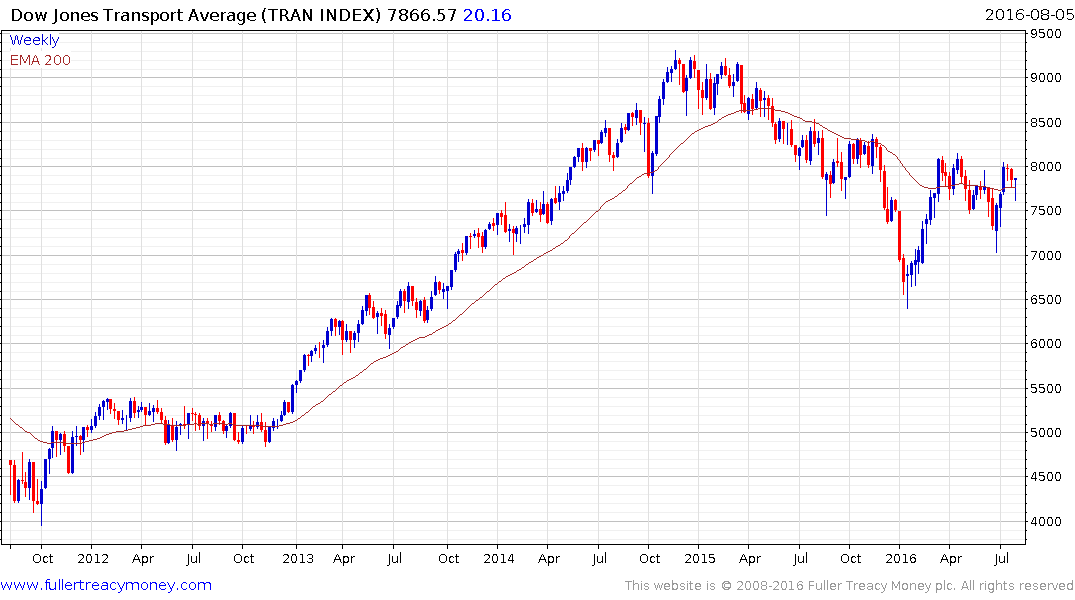

The Dow Jones Transportation Average needs to sustain a move above 8000 to begin to signal a return to medium-term demand dominance.

Back to top