Eoin's personal portfolio: profit taken in commodity long and stock market long

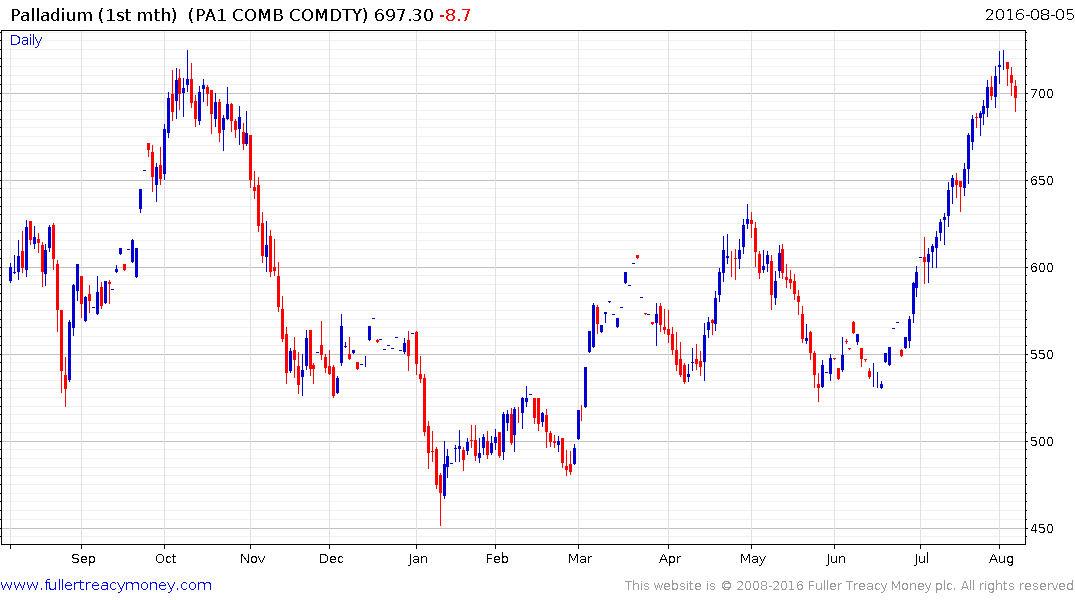

I had placed a stop on my palladium position as it moved through $700 and this was triggered today selling the September contract at $698 against my purchase on June 3rd at $540.47 including spread-bet dealing costs.

Palladium has trended higher in a particularly consistent manner since late June but today’s pullback has broken that short-term progression of higher reaction lows and confirms at least near-term resistance in the region of the October 2015 high. Some consolidation and potentially a reversion towards the mean are looking increasingly likely.

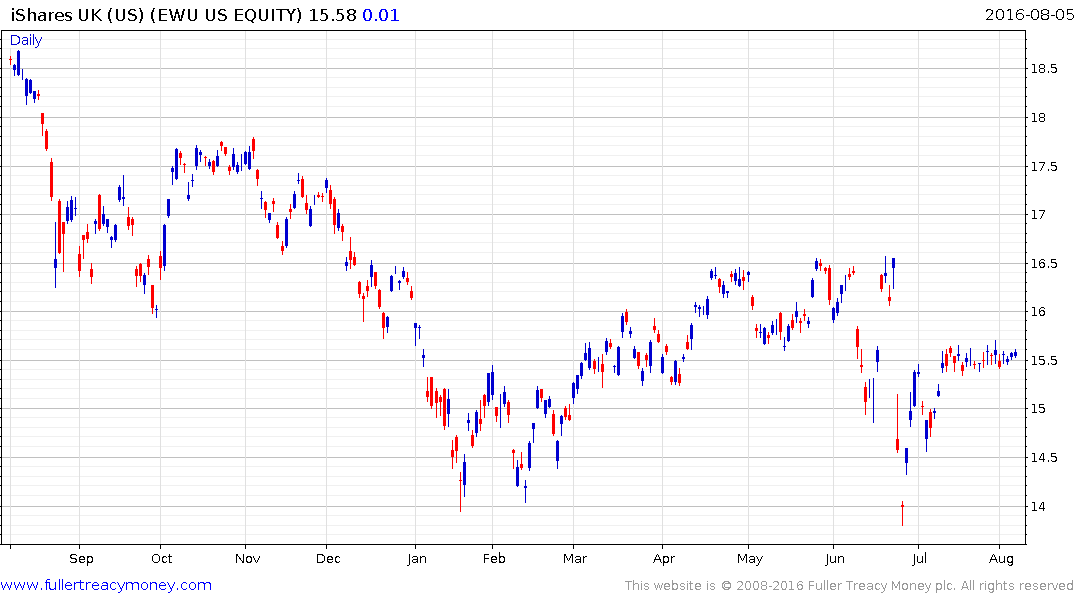

I also took the profit on my iShares MSCI UK ETF which has been inert since mid-July not least because much of the bounce in UK equities has been contingent on the weakness of the Pound and with yesterday’s broad spectrum QE announcement that is likely to remain the case. My September contract was sold at $15.57 against my purchase at $15.05 on June 24th.

Back to top