Payrolls in U.S. Rise 161,000 in October as Wages Accelerate

This article by Michelle Jamrisko for Bloomberg may be of interest to subscribers. Here is a section:

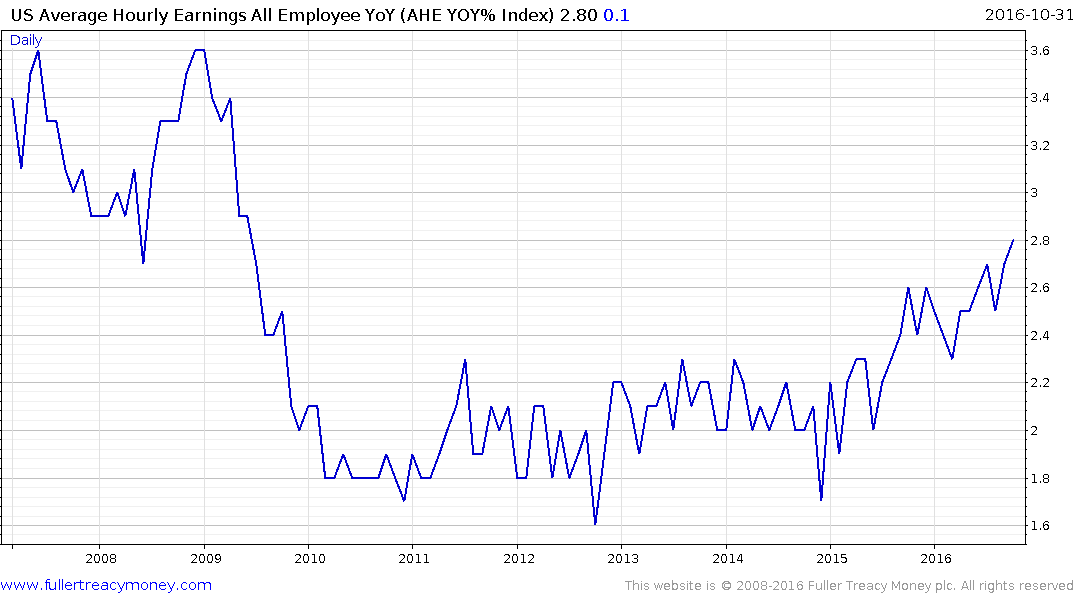

Wage gains picked up, with average hourly earnings rising 0.4 percent from a month earlier to $25.92. The year-over-year increase was 2.8 percent, compared with 2.7 percent in the year ended in September.

Higher wages are starting to encourage more Americans to quit their jobs with the confidence they’ll find other work that pays more. The number of job leavers as a share of unemployed rose to 12.1 percent in October, the highest since February 2007.

The average work week for all workers held at 34.4 hours in October. Among service providers, education and health services led with an increase of 52,000 jobs, followed by professional and business services at 43,000. Retailers pared payrolls by 1,100 on declines at electronics and appliance stores and clothing shops.

Factories reduced payrolls by 9,000 after an 8,000 decline the month before, in line with a report earlier this week that showed manufacturing barely expanded in October while orders moderated. Employment at construction companies rose by 11,000. Governments added 19,000 workers.

Wage growth broke out on these figures. Considering it is almost the one measure of inflation that cannot be hedonically moderated it carries weight in the Fed’s decision on whether to raise rates. In fact all other factors being equal the pop in wage demands is likely the figure that pushes the Fed over the line into definitely raising rates in December. The only thing that could derail such a move would be market tumult following a surprising US election result not least if it is deadlocked.

12-month yields contracted this week on increasing anxiety about the outcome of the election and as investors increased hedge shorts in the stock market. However a sustained move below 55 basis points would be required to begin to question medium-term scope for additional upside.