Email of the day on residential healthcare properties

Do the healthcare indices only cover the pharmaceutical companies or are healthcare homes also included? Are the profits of these homes also threatened?

Thank you for this email which raises an important question. The residential healthcare sector stands to benefit from the increased demand for their services resulting from the aging Baby Boomer generation which is increasingly moving into the stage of life where unassisted living is more challenging.

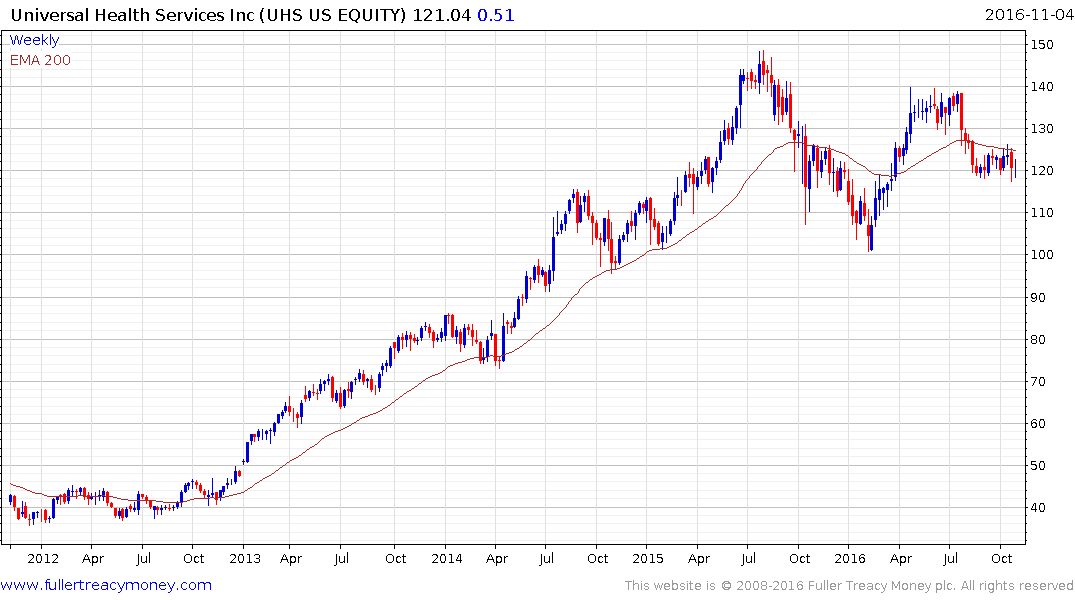

However many constituents of the sector have sold off rather heavily recently. I suspect this has very little to do with the travails experienced by the pharmaceuticals sector and more to do with the fact that as a bond proxy with generally competitive yields they are no longer cheap. Therefore some are experiencing price compression to maintain that relative position as investors expect rates to rise.

I copied the healthcare REITs section of my Favourites into the Eoin’s Favourite section of the Chart Library so it will be easier to monitor the respective shares.

Universal Health Realty is a reasonable example. It yields 4.69%, which on first blush looks attractive, but when compared to the 6-8% it averaged between 2002 and 2010 it’s not particularly impressive. Yield compression has been a significant factor in supporting the prices of a wide spectrum of investments with long records of dividend increases. This was justified by the low yields on government securities and the virtual certainty of continued monetary accommodation. As the macro environment evolves the potential for yields to increase, and spreads to widen, though falling prices is non-trivial.

This is particularly true of highly leveraged instruments whose yields were flattered by low interest rates. Mortgage REITs also fall into this category especially those which have been unable to sustain their dividends.

Back to top