Oil Market `Fooled' by Freeze Talks Seen Better Off Gauging U.S.

This article by Sharon Cho and Serene Cheong for Bloomberg may be of interest to subscribers. Here is a section:

While global producers are “buying time” and waiting for the focus to shift from the oversupply to rising demand, U.S. producers will “absolutely” be the ones driving the potential rebalancing of the oil market, according to Hansen.

“No doubt, because they have the ability to react much quicker to price changes,” he said, referring to U.S. producers. He warned that a price surge to $55 to $60 a barrel may prompt drillers to pump more. Others including Goldman Sachs Group Inc., UBS Group AG and IHS Energy have also said a recovery in crude may sputter once prices go high enough to keep U.S. oil flowing.

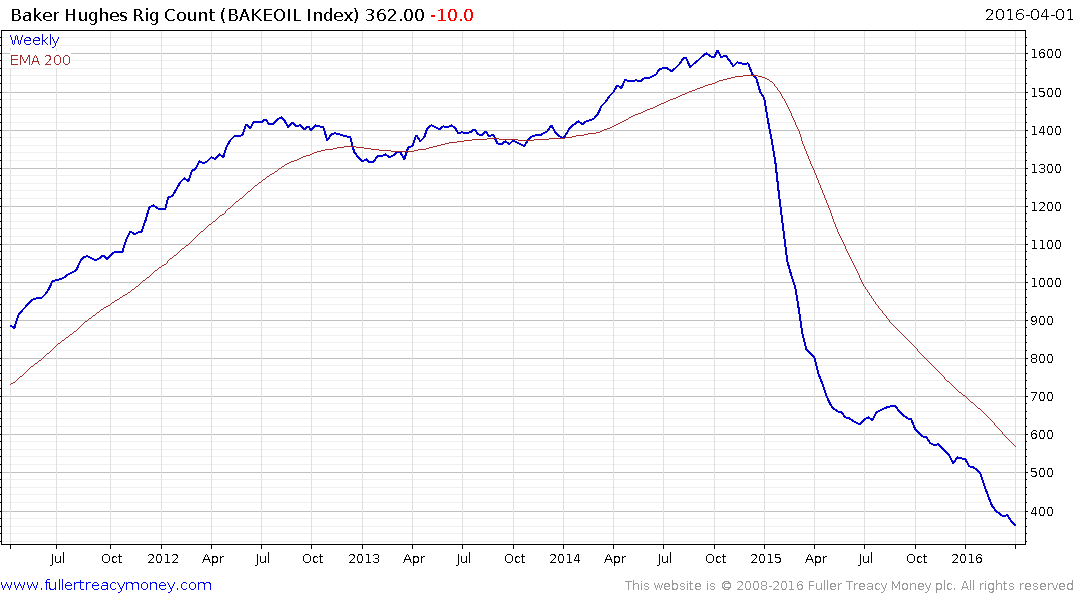

After surging to 9.6 million barrels a day last year, the highest level in more than three decades, daily U.S. production has dropped to about 9 million as of early April. Meanwhile, the number of rigs drilling for oil in the U.S. has dropped to the lowest level since 2009.

Still, the market may reach equilibrium in 2017, according to Hansen. The International Energy Agency has warned that investment cuts taking place now because of the energy downturn increase the possibility of oil-security surprises in the “not-too-distant” future.

The USA is an increasingly important swing producer of crude oil which is not a condition many people predicted before last year. Unconventional oil and gas remain gamechangers for the sector and the increasing potency of the US on energy prices as a supplier rather than just a consumer is a part of that.

The decision by OPEC plus Russia to talk about freezing supply turns focus onto Kuwait bringing stalled production 300,000 barrels back on line and the question of how high prices have to rally for US producers to start drilling again.

The Baker Hughes Rig Count continues to trend lower and the first uptick is likely to act as at least a short-term catalyst for weaker prices. This also highlights just how much pressure the sector is under due to the potential of the US to increase supply as prices rise and the reluctance of other major producers to reduce supply.

Brent has posted a $7 and $5 consolidation since hitting an important low in January. A sustained move below this week’s low near $37.80 would be required to question potential for additional upside.

Back to top