Email of the day on defence spending versus commitments to future liabilities

The percentage of U.S. defence spending on guns is being smothered by the spending on liabilities. The promises made to a lionized volunteer force whose drafted predecessors only two generations ago was spat upon is forming a reckoning that is only now beginning to come into focus. Do you think the stalling of GD’s price is the market realizing this fact? As a Chicagoan I can clearly see what the clash of these trends brings and it isn’t pretty.

Thank you for raising a question of interest to subscribers. By and large the defence sector exhibits some of the most consistent chart patterns around not least among the very large contractors. General Dynamics is something of a laggard and has work to do if it is to repair its overall trend but it is not yet trending lower.

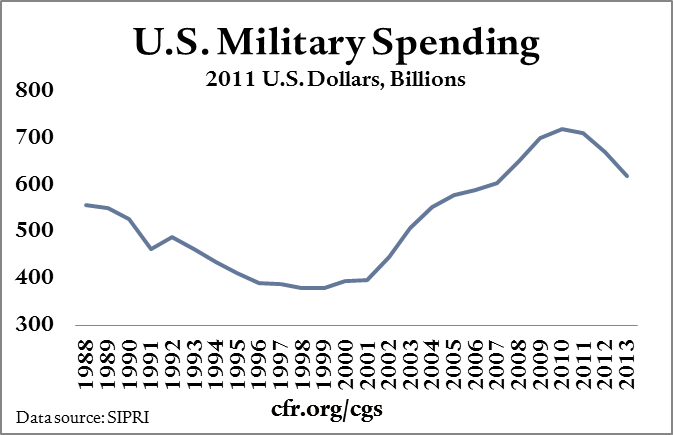

The commitments made to veterans of past wars represents a significant unfunded liability for the Federal Government. With more 5 million people receiving healthcare at little to no cost it is reasonable to expect progressively more to be spent on this group as they age and as costs per enrolee inflate. The Congressional Budget Office estimates this cost will be between $69 and $85 billion compared to the total military budget of around $600 billion. The bigger issue for companies like general Dynamics is that total military spending is trending lower as operations in Afghanistan and Iraq wind down.

The issues relating to the unfunded liabilities of Social Security and Medicare have yet to be tackled and if the tone of the debates during the current Presidential cycle are anything to go by the answer is higher taxes. Something I have seen very little commentary on is the cost of servicing the national debt if the Fed continues to raise interest rates. That alone means taxes would have to rise. Right now the most likely target appears to be from estate taxes; suggesting it is an advantageous time to think about trusts.

Servicing the national debt has to be on the mind of Fed officials suggesting they have no other choice than to be cautious about raising rates aggressively.

Back to top